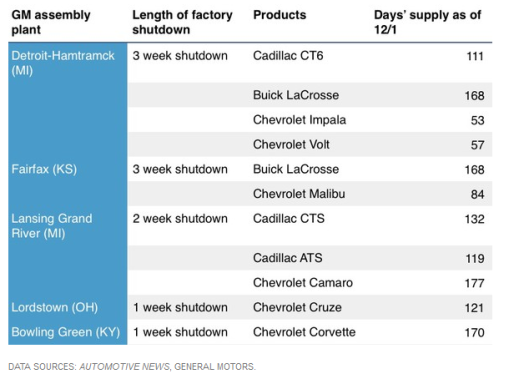

General Motors (NYSE:GM) car inventories are as high as they have been since November 2008. Ideal inventory levels are 60 days but 8 models have over 110 day’s of inventory.

As a result, GM is idling five plants for one to three weeks.

Please consider General Motors Will Idle 5 U.S. Factories Next Month.

General Motors will idle five of its U.S. factories for one to three weeks each in January, as it confronts high inventories that have drawn concern from analysts.

As first reported by Automotive News, GM will idle factories in Michigan, Ohio, Kansas, and Kentucky to reduce inventories. GM had an 86-day supply of new vehicles in the U.S. as of Dec. 1, up from 70 days’ worth a year ago.

A GM spokesperson told Automotive News that the company is aiming to get supplies back down to about 70 days’ worth. For most car models, about 60 days’ supply is generally considered ideal.

GM’s inventories as of Dec. 1 were the highest they’d been in eight years — since November of 2008, in the midst of the economic crisis. The huge inventory was despite generous incentives: GM’s spending on incentives in November was almost $4,900 per vehicle, up about 35% from a year ago. (The overall industry average was up about 19% year over year.)

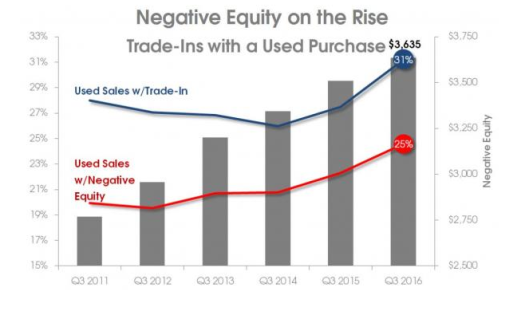

Negative Equity

As incentives increase, residual values of used cars dive.

Zerohedge noted last month that a Record 25% Of Used Car Trade-Ins Are Underwater.

Zerohedge accurately commented

since most people simply roll their negative equity into their new loans, many used car buyers are likely sitting on loans where ~15-20% of their outstanding balance simply reflects their negative equity from their previous car.

Lovely.

And with increased incentives (with even bigger incentives coming), the value of those new cars people just bought are sure to increase that negative equity.

About Those Supply Numbers

By the way, all those day’s supply numbers assume sales will keep up at the current pace.

Why should they? And if they don’t, GM will have to idle plants longer, provide even greater incentives, or both.

Fed Going to Hike Three Times?

Retail sales, led by autos, was point number five in my December 17 article Five Reasons Fed Won’t Hike Even Twice in 2017.