- Stocks extend slump as China fears intensify, yields scale fresh highs

- Dollar on a winning streak as Wall Street heads for third weekly loss

- Markets eye more China rate cuts and Jackson Hole for Fed clues

More pain for risk assets

The rout in global stock markets shows no signs of ending on Friday even as the surge in bond yields has eased off a little. It’s been a torrid week for equities, which have been hammered by a tale of two economies. In China, the alarming headlines about a deteriorating economy just haven’t stopped, while in the United States, evidence is piling that the economy is regaining some momentum at this late stage of the tightening cycle.

With the former fuelling fears of a global contagion and the latter bolstering higher for longer bets for the Fed, the overriding sentiment now is one of heightened uncertainty.

August is proving to be a terrible month for Wall Street, with the recent events pushing up the VIX Volatility Index to the highest in two-and-a-half months. The S&P 500 has slid 5.1% from its late July peak, while the losses of the riskier interest-rate sensitive Nasdaq Composite are approaching 8%. Both are headed for their third straight week of declines.

Yuan steadier, but maybe not for long as rate cut looms

Joining the freefall in stocks is the Chinese yuan, which on Thursday hit its lowest point against the US dollar since November 2022 in both onshore and offshore trading. The People’s Bank of China has reportedly stepped up its intervention this week and the yuan has firmed from just below 7.35 per dollar yesterday to around 7.31 per dollar today.

However, there could be fresh selling pressure for the currency on Monday when the PBOC is expected to cut its one- and five-year loan prime rates.

The incremental rate cuts, which have been accompanied by targeted support measures, have so far failed to ease investor concerns about the growing cracks appearing in the Chinese economy, as the liquidity crunch in the property sector only seems to be getting worse. This liquidity crisis not only risks spilling over to the broader economy, but also triggering a global fallout.

The Australian dollar, often traded as a liquid proxy for China risks, has been feeling the brunt of the negative news feeds, plunging to a nine-month low of $0.6363 on Thursday.

Dollar bulls brace for Jackson Hole

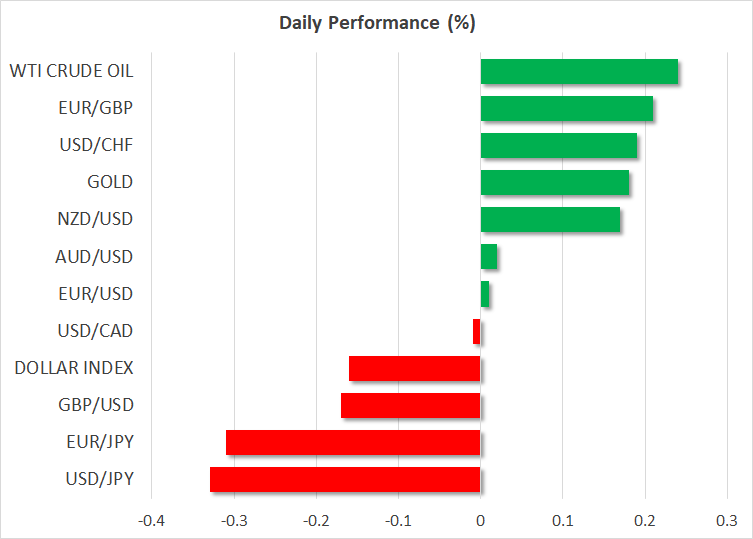

The greenback, meanwhile, was slightly softer on Friday but is on track for a fifth week of gains after climbing to a two-month high against a basket of currencies yesterday. Rising Treasury yields have been behind this latest rebound in the dollar, though some safety flows have boosted it too.

The 10-year Treasury yield surpassed 4.30% yesterday for the first time since October 2022 and is close to reaching levels not seen since 2007. The question is, at what point will the US economy break? This week’s robust retail sales figures as well as some upbeat numbers on housing and jobless claims have led investors to once again scale back their bets that the Fed will aggressively cut interest rates next year.

With the latest FOMC minutes not giving traders much to go on, next week’s Jackson Hole symposium looks set to be the big focal point for the coming days in the hope that Fed Chair Powell’s address on Friday will offer some clarity on the rate path.

Pound and yen slip, Bitcoin crashes

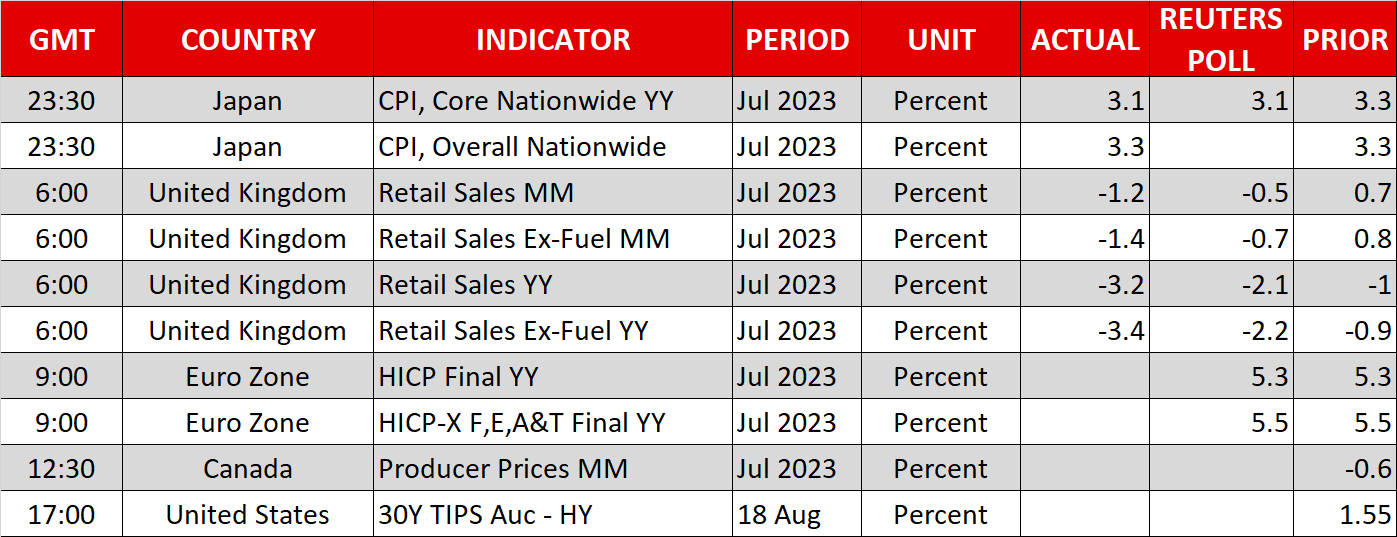

Elsewhere, the pound’s relative outperformance over the past week came to a halt today as a disappointing set of retail sales numbers out of the UK pressured cable. The yen also slipped as Japan’s core CPI rate moderated from 3.3% to 3.1% y/y in July, as expected, easing pressure on the Bank of Japan to speed up its exit from stimulus. The dollar has been testing the 146 yen handle this week but has pulled back to around 145.50 today amid the ongoing threat of intervention by Japanese authorities.

The fallback in yields helped gold recoup some losses, settling around $1,890/oz, but Bitcoin remained under pressure after yesterday’s 7% tumble. Reports that Elon Musk’s SpaceX has offloaded some of its Bitcoin holdings sparked a massive selloff on Thursday. Bitcoin was last trading around $26,530.