Global Payments, Inc. (NYSE:GPN) came up with second-quarter 2019 adjusted earnings of $1.51 per share, beating the Zacks Consensus Estimate by 3.4% and improving 17.1% year over year.

The reported quarter benefited from the company’s higher revenues, partly offset by increase in expenses.

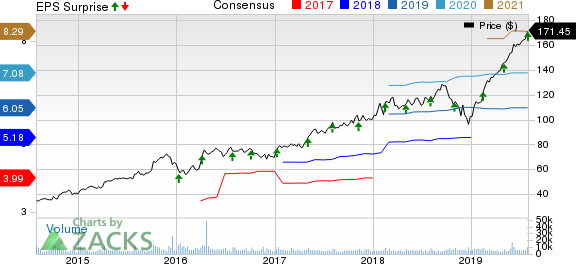

Global Payments Inc. Price, Consensus and EPS Surprise

Behind the Headlines

The company’s revenues of $1.14 billion, were up 13.4% year over year. The top line marginally surpassed the Zacks Consensus Estimate by 0.8%, mainly driven by segmental performances.

Total operating expenses of $713 million increased 11% year over year, led by higher cost of services as well as selling, general and administration expenses.

Adjusted operating margin expanded 100 basis points to 32.4%.

Growth Across Segments

North America: Adjusted net revenues plus network fees of $840.4 million increased 17% year over year. Operating income of $285.9 million was up 23% year over year.

Europe: Adjusted net revenues plus network fees of $194.9 million grew 2.5% year over year. Operating income of $94.7 million rose 5.1% year over year.

Asia-Pacific: Adjusted net revenues plus network fees of $79.2 million climbed 7.3% year over year. Operating income of $26.2 million improved 12.6% year over year.

Dividend Update

Global Payments’ board of directors has approved a dividend of 1 cent per share, to be paid out on Sep 27, 2019 to shareholders as of Sep 13, 2019.

Balance Sheet Position

Total cash and cash equivalents as of Jun 30, 2019 were $1.04 billion, up 13.3% from Dec 31, 2018 level.

Long-term debt as of Jun 30, 2019 was $5 billion, almost unchanged from year-end 2018 levels.

Net cash provided by operating activities for the second quarter of 2019 was $247.3 million, down 51% year over year.

2019 Outlook

The company raised its earnings outlook in the range of $6.00-$6.15, indicating growth of 16-18% over 2018 (compared with the earlier guidance of $5.95 –$6.12). For 2019, it expects adjusted net revenues plus network fees in the band of $4.44-$4.49 billion, suggesting growth of 12-13%.

Adjusted operating margin is expected to expand by 90 basis points.

Business Update

During the quarter, Global Payments announced to buy Total System Service, Inc. (NYSE:TSS) , a merchant acquirer and bank credit card issuer and the largest third-party credit-card processor in the United States. The deal will transform Global Payments into a pure play payments technology company with extensive scale and unmatched global reach.

Zacks Rank and Performances of Other Industry Players

Global Payments carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some stocks worth considering are Visa Inc. (NYSE:V) and EVO Payments, Inc. (NYSE:V) .

EVO Payments sports a Zacks Rank #1 and has surpassed earnings estimates in three of the trailing four quarters with an average positive surprise of 34.9%.

Visa carries a Zacks Rank #2 (Buy) and beat earnings estimates in each of the four reported quarters by 3.4%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Visa Inc. (V): Free Stock Analysis Report

Global Payments Inc. (GPN): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

EVO Payments, Inc. (EVOP): Free Stock Analysis Report

Original post

Zacks Investment Research