It is with trepidation that independent petroleum geologist Jeffrey Brown has watched global oil exports decline since 2006. With all the controversy in the past several years over whether worldwide oil production can rise to quench the world's growing thirst for petroleum, almost no one thought to ask what was happening to the level of oil exports. And yet, each year a dwindling global pool of exports has been generating ever greater competition among importing nations and has become a largely unheralded force behind record high oil prices.

Even though the trend in oil exports has been evident in the data for some time, the analyst community was caught by surprise when a Citigroup report released earlier this month forecast an end to oil exports in 2030 from Saudi Arabia, currently the world's largest oil exporter.

Brown, as you might expect, wasn't surprised at all. His own forecasting model, which he calls the Export Land Model, has been predicting more or less the same thing for some time. He doesn't think the Saudis will actually let exports to go all the way to zero because they'll probably want at least some revenue from exports. But "one to two million barrels per day of exports [from Saudi Arabia] between 2030 and 2040 will not be a big deal in the world," said Brown, who runs a joint venture exploration program based in Ft. Worth.

Brown estimates that worldwide net exports of petroleum liquids--a number that includes both crude oil and refined products such as gasoline and diesel--declined from 45.6 million barrels per day (mbpd) in 2006 to 43.7 mbpd in 2011. He uses the net exports number because importers such as the United States export some of the crude they import back into world markets in the form of refined products such as gasoline and diesel. Even so, the United States remains the world's largest net importer of petroleum products.

The decline in global net exports may seem small for now. But it is persistent and comes in the face of growing demand among the rapidly expanding economies of Asia, particularly China and India. And the trendlines, if they were to continue, would mean that China and India alone would consume all the world's available petroleum exports by around 2030. Something's bound to give before then, but it's not clear what.

Brown focuses on a key number which he calls cumulative net exports (CNE). It's the total expected volume of exports from oil-exporting countries over the entire period from now until global exports are presumed to drop to zero around 2060 based on the trajectory established in data from 2005 through 2011. Though the timetable is likely to change, when he looks at CNE alongside the current rate of decline for exports, it's clear that the world's remaining exports are "front-loaded." The largest portion will be delivered in the years immediately following the export peak.

"A rough, but fairly consistent rule of thumb is that half of post-peak CNE tend to be shipped about one-third of the way into the net export decline period, which suggests that post-2005 global CNE would be about half gone around the year 2024," he explained. It's why "we've experienced something close to business as usual" since the apparent export peak in 2006, he added. That tells him that the economic pain associated with the loss of global exports is likely to become very acute in the not-too-distant future.

If this happens, the world will be forced to adjust. But that adjustment is likely to be rather wrenching for some. Already, consumers in the United States, for instance, have actually partly accommodated rising demand in Asia by reducing U.S. consumption of oil products from 20.8 mbpd in 2005 to 18.8 mbpd in 2011. But the cutback has been largely a matter of necessity for those who have lost jobs or experienced wage cuts and for businesses which are struggling in a weak economy.

As Brown began to think about the export issue back in 2006, he made two observations which seem obvious once you hear them: First, if the economy of an oil-exporting country grows, that country typically will use more oil to support that growth. Second, once total production peaks and starts to decline in an oil-exporting country, exports almost always decline much faster than total production. This is because exports are typically being squeezed from two sides. Production is falling making less oil available for exports, and consumption is rising with the same effect. (Declining net exports can also occur if domestic consumption is rising faster than production which is what happened in the United States, causing the country to become a net importer for the first time way back in 1948.)

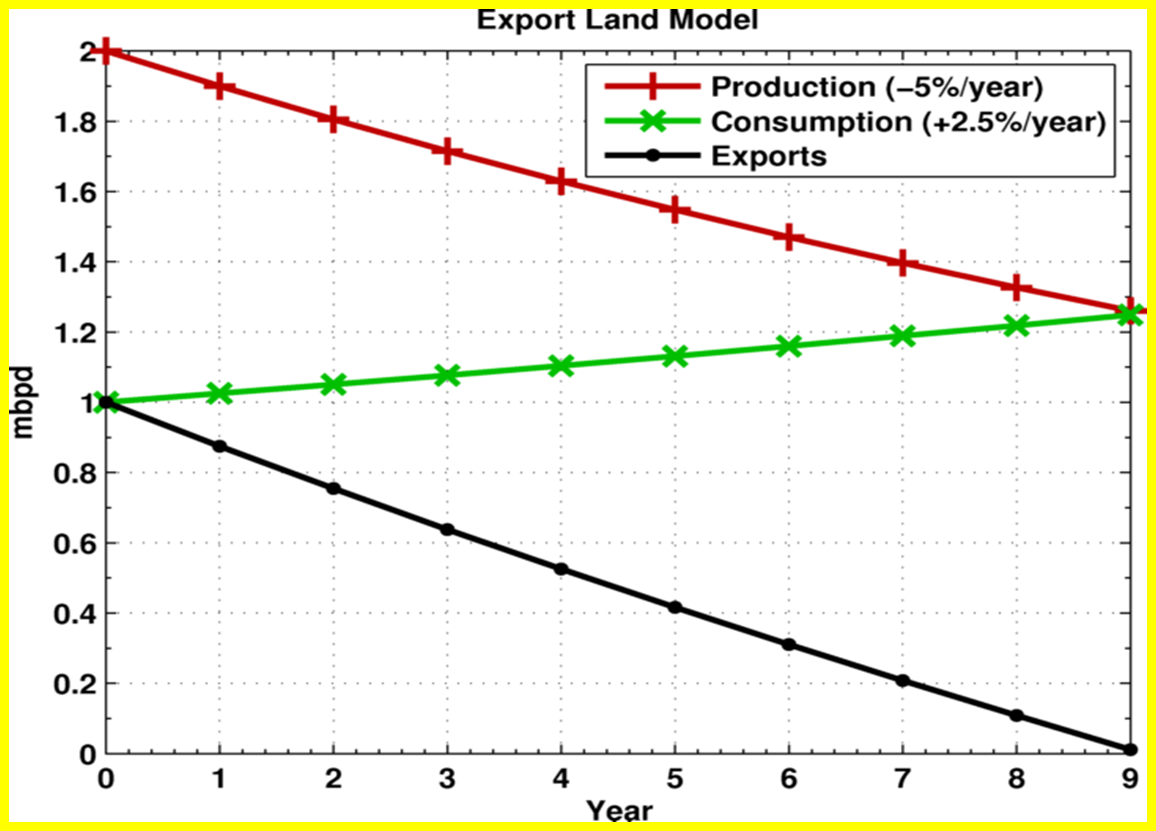

The two observations above led Brown to develop what he dubbed the Export Land Model. It was a simple model that seemed to explain a lot. Here's how he set up his first case: Brown assumed that a hypothetical oil exporter--which he designated as Export Land--had reached its peak in oil production. He assumed that domestic users in Export Land consumed half of all the oil the country produced. He then assumed a 5 percent annual decline in the rate of oil production and a 2.5 percent annual increase in domestic consumption. The results astonished and troubled him. In just nine years oil exports from Export Land went to zero.

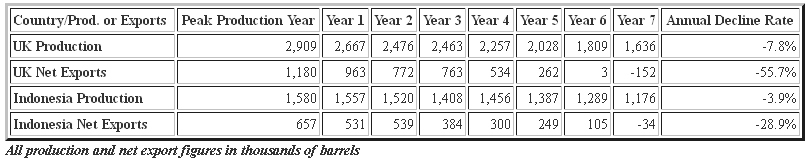

He then tried the model out on two real world examples, the United Kingdom and Indonesia. Both countries were consuming about 50 to 60 percent of their own oil production at the time their production peaked, close to Brown's hypothetical case. But the U.K. had a higher production decline rate, -7.8 percent per year and a very modest 0.2 percent annual growth in oil consumption. Indonesia had a lower production decline rate than the hypothetical case, -3.9 percent, but a higher yearly increase in domestic oil consumption, 4.1 percent. Despite these differences, the results were quite similar to the hypothetical case. From its 1997 peak in oil production, Indonesia's net exports took only seven years to fall to zero. From the U.K.'s oil production peak in 2000, it took only six years for net exports to approach zero.

After modelling these two real world examples, Brown and his colleague Sam Foucher began tracking petroleum exporting nations with more than 100,000 barrels per day of exports (based on 2005 data). These 33 countries represented 99 percent of the globe's net exports at the time. Strangely, no official energy agency calculates global net exports. So, Brown and Foucher have had to compile data from the U.S. Energy Information Administration, the statistical arm of the U.S. Department of Energy, and the BP Statistical Review of World Energy, a widely cited annual survey produced by oil giant BP. By the end of last year, six of the original 33 countries--the United Kingdom, Indonesia, Egypt, Vietnam, Malaysia and Argentina--had dropped off the list. Of those only Egypt had any exports at all, about 26,000 barrels per day. The rest of the countries had become net importers.

"We're losing one major exporter per year," Brown said. He expects that rate of loss to continue. He added that as a group, oil production in the 33 countries he tracks has hit a plateau, bouncing between 61 and 63 million barrels per day since 2005. If total production from exporting nations starts to fall, look for an acceleration in the decline of net exports. (Total worldwide oil production also appears to have been on a bumpy plateau since 2005.)

Brown said importers around the world are already being forced to respond to an ongoing decline in net exports. "We are on our way to energy independence," he joked. "Just not in the way that we expected." The United States and other developed countries are now being outbid by the developing world for oil and ending up with a declining share of a declining supply of exports. "While the recent rise in U.S. production will help, it will not save us," he added. That's because the rise is too modest to put much of a dent in imports which have declined primarily because Americans have simply cut back their consumption of gasoline and other petroleum products.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Oil Exports In Decline Since 2006

Published 09/24/2012, 02:13 AM

Updated 07/09/2023, 06:31 AM

Global Oil Exports In Decline Since 2006

This is the fourth of a six-part series introducing readers of The Christian Science Monitor to concepts useful in understanding the Resource Insights blog. Selected posts from Resource Insights are now appearing regularly on the Monitor's Energy Voices blog. To read the previous installments of this series click on the following: Part 1, Part 2, Part 3

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.