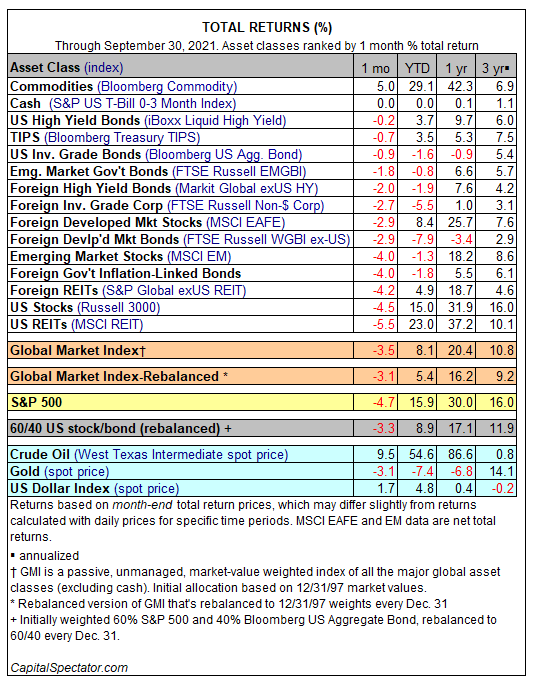

Global markets suffered their broadest retreat in a year during September. The bullish exception: commodities, which delivered a solid gain last month. Cash, as usual these days, was flat. Otherwise, red ink dominated performances for the major asset classes last month.

Let’s begin with commodities, which rose 5.0% last month, based on the Bloomberg Commodity Index. The advance marked the strongest monthly gain since April. It’s fair to say it’s been a winning year in this corner: Commodities have scored gains in all but two calendar months during 2021. Year to date, commodities are up 29.1% — the top performer for the major asset classes.

The rest of the field (except cash) posted losses in September. Notably, US stocks and bonds lost ground, giving support to concerns that the historical diversification benefits of pairing the two asset classes is breaking down.

The steepest loss last month was in US real estate investment trusts (REITs). But the 5.5% decline for the MSCI REIT Index in September was overdue – the loss marked the first monthly setback since October 2020. Note, too, that on a year-to-date basis, MSCI REIT is still flying high via a 23% gain – second only to commodities so far in 2021.

Meantime, the Global Market Index (GMI) took a hit last month. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, slumped a hefty 3.5%. That’s the first monthly slide since January and the deepest since the coronavirus crash crushed markets in March 2020. Year to date, however, GMI is still posting a solid 8.1% gain — better than most of the major asset classes so far in 2021.

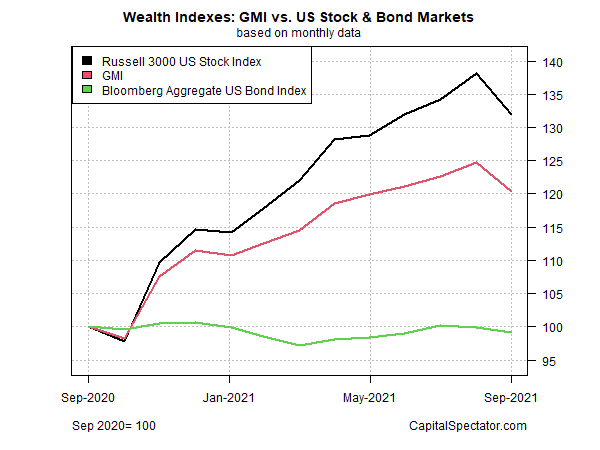

Reviewing GMI relative to US stocks and bonds continues to show a strong middling performance over the trailing one-year period. GMI earned roughly half of the gain posted by US stocks with substantially less risk over the past 12 months. US bonds, by contrast, are flat for the trailing 12-month window.