In its recently-published update of the world economic outlook, the International Monetary Fund (IMF) revised down its forecast for global growth in 2016 by 0.1 percentage points (pps) to 3.1%. The IMF now expects advanced economies to grow by 1.8% and emerging markets (EMs) by an unchanged 4.1%. We believe the new growth forecasts are still over-optimistic and may be subject to further downward revisions in the coming months. Growth in the global economy is likely to be weighed down by the impact of political uncertainty, the slowdown in China and the fallout from lower commodity prices on EMs.

Why did the IMF revise down its expectations for global growth? The UK’s decision to exit the European Union (Brexit) was the main reason. The resulting increase in uncertainty has led the IMF to lower its growth outlook for advanced economies and, consequently, overall global growth. Meanwhile, the IMF believes that the impact of Brexit on EMs is likely to be muted, leading to an unchanged growth forecast for this group of countries.

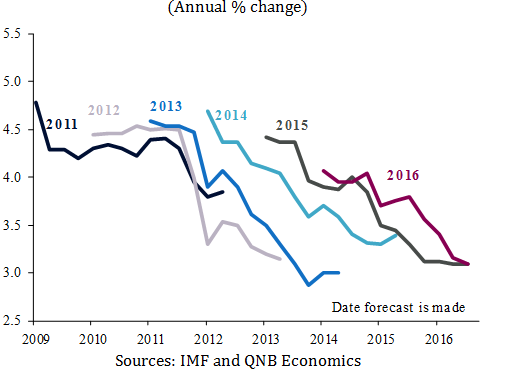

The downward revision of the world economic outlook follows a familiar trend observed in recent years. Since 2011, the forecasts made at the beginning of each year have proven to be too optimistic and have been later revised down by the IMF. Each year seems to begin with hopes that past crises are mostly behind us and that recovery will take a firm hold, only for growth to eventually disappoint and forecasts to be checked by reality.

Should we expect this year to be any different? The statistical evidence suggests not and points that 2016 growth is likely to be revised down further. Since 2011, the IMF has revised down its growth forecast by an average of 0.2ppsbetween July and October. If this pattern continues, then we should expect global growth to fall to 2.9% when the next set of forecasts are published in October.

IMF global growth forecast revisions (Annual % change)

More importantly, there are also economic reasons to believe that global growth might end up being slower than 3.1%, the rate it reached in 2015. Compared to last year, there are three significant headwinds which could lead to slower growth. First, there is heightened political uncertainty globally relative to last year. Brexit is one such uncertainty but it is not the only one. There is also uncertainty associated with the US presidential elections in November as well as numerous geopolitical risks around the world. The resulting uncertainty would be a drag on the global economy as investment and consumption decisions might be postponed untilthe political uncertainty is reduced.

Second, Chinese growth is expected to slow in 2016 relative to 2015. Even under the benign scenario of no hard landing, the long-term decline in Chinese growth would be a drag on the global economy. The IMF expects Chinese growth to slow from 6.9% in 2015 to 6.6% in 2016. With China accounting for nearly 18% of the global economy, its slowdown would alone shave around 5 basis points off global growth.

Third, lower commodity prices are likely to result in slower growth among producing countries.Commodity prices have rebounded recently but they are still expected to be lower on average this year compared to last year. As of today, we expect oil prices to average USD41 per barrel in 2016, lower than the 2015 average of USD54. The decline is testing the finances of oil producers, leading to spending cuts and slower growth in these countries.

Partially offsetting these headwinds is the likely monetary easing in most advanced economies. The Bank of England, the Bank of Japan and the European Central Bank are all expected to provide monetary stimulus sometime this year. The resulting interest rate decline could result in capital flight into EMs in search for yield, easing funding pressures on these emerging countries.

Overall, we do not expect monetary easing to fully offset the drag from political uncertainty, the slowdown in Chinese growth and lower commodity prices. As a result, we expect global growth to reach 2.9% in 2016, the slowest rate since the global financial crisis in 2009. The global economy has again flattered to deceive.