The July round of flash manufacturing PMIs showed a slight but important rebound in the "global flash manufacturing PMI" (an indicator we put together based on the Markit readings). Our data show the global flash reading up +0.4pts to 54.3 - which is the highest reading since February this year, thus while the move is not huge, it is very important that the indicator has begun to accelerate again after a period of consolidation. On the detail, it was driven by a stronger US: +1.2pts to 53.2 which offset falls in Europe (-0.6 to 56.8) and Japan (-0.2 to 52.2).

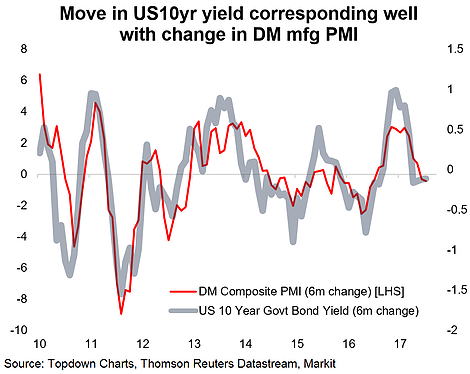

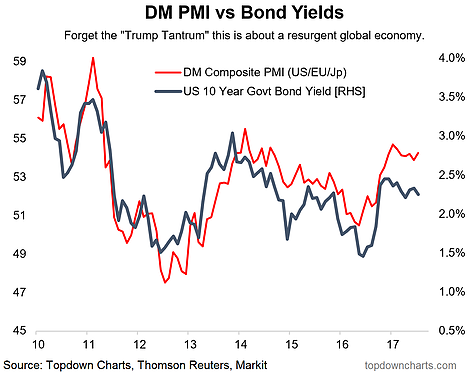

As for the market implications, the US 10-year bond yield has shown a habit to move in line with this indicator, and for now appears to be diverging to the downside. Either way this is an opportunity because it means one of these two series is likely to move to close the gap. But as the second chart shows, acceleration or rate of change in the indicator is important, so we will need to see follow-through for bond yields to move higher. For now at least it removes some of the doubt that the softer June reading brought, and lines up with our broadly constructive medium term view on global growth.

The "global flash manufacturing PMI" improved to a 6-month high in July, and while the move was small, the fact it's accelerating again is very important and follow-through will be key.

As the companion chart shows (6-month rate of change), acceleration is just as important as levels, and after the big acceleration in 2016 there has been a reset, so if we do see follow-through on the July improvement then that will provide fuel to higher bond yields.