For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.1222, after Germany’s GfK consumer confidence index unexpectedly climbed to a level of 10.4 for June, on the back of further improvement in expectations on income and economy, following a reading of 10.2 in the previous month. Investors had expected the index to remain unchanged.

Meanwhile, the European Central Bank (ECB) President, Mario Draghi, hinted that there would be no changes to monetary policy at its upcoming meeting on 8 June 2017. He further stated that monetary policy would stay very supportive of borrowing and investment for some time. Moreover, the central bank ruled out the possibility that Brexit could pose a major risk to the Eurozone economy.

Separately, in its semi-annual Financial Stability Review, the central bank stated that recent increase in yields and political uncertainty in some nations have raised fresh concerns over debt-sustainability in the last six months.

In the US, the latest FOMC minutes signalled that policymakers could raise interest rates “soon” and supported a plan to gradually shrink the Federal Reserve’s (Fed) $4.5 trillion balance sheet. However, the central bankers added that it would be prudent to wait for additional data to check whether recent slowdown in economic growth is temporary or not.

In other data, the US existing home sales declined 2.3% in April to an annual rate of 5.57 million units, against market expectations for a 1.1% drop. In the prior month, existing homes sales had risen 4.2% to an annual rate of 5.70 million. Moreover, the US mortgage applications rose 4.4% on a monthly basis during the week ended 19 May, from a 4.1% drop reported in the previous week. Additionally, the nation’s housing price index rose more than expected by 0.6% in March, compared to an advance of 0.8% in the prior month. Market expectation was for the housing price index to climb 0.5%.

In the Asian session, at GMT0300, the pair is trading at 1.1240, with the EUR trading 0.16% higher against the USD from yesterday’s close.

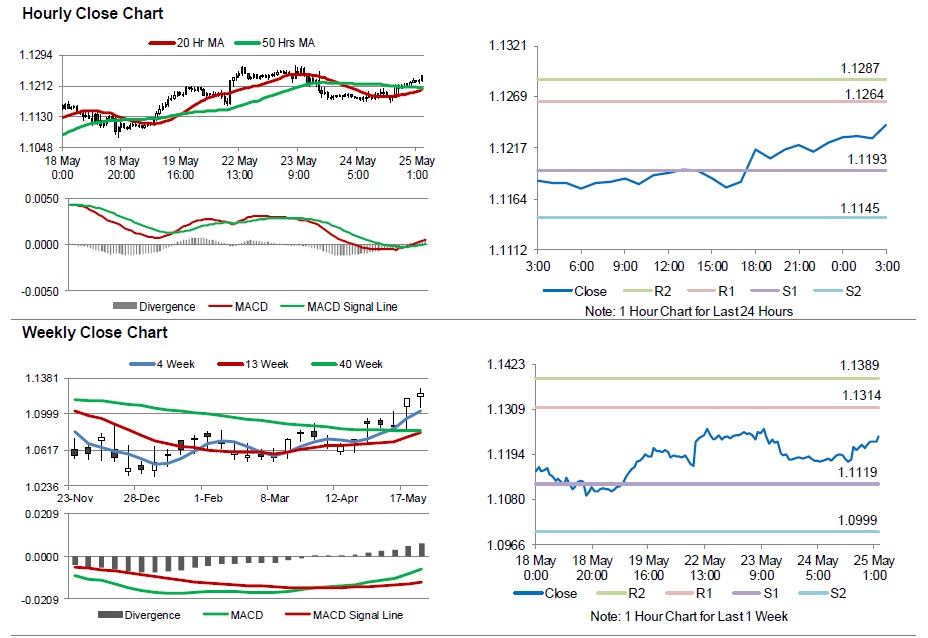

The pair is expected to find support at 1.1193, and a fall through could take it to the next support level of 1.1145. The pair is expected to find its first resistance at 1.1264, and a rise through could take it to the next resistance level of 1.1287.

Ahead in the day, market participants would keenly await the release of the US advance goods trade balance for April and initial jobless claims for the week ended 20 May, for further direction in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.