The British pound is lower on Tuesday. In the European session, GBP/USD is trading at 1.2680, down 0.23%.

UK Shop Inflation Decelerates Sharply

Inflation in UK shops rose 2.9% y/y in January, compared to 4.3% in December. This was the lowest pace since May 2022. This was an encouraging sign after consumer price inflation surprised by ticking higher to 4.0% in December, up from 3.9% a month earlier. Retailers are enticing shoppers with discounts, which has helped to lower inflation. Still, The Christmas shopping season was weak as consumers are holding back on spending due to the cost-of-living crisis.

The Bank of England meets next on Thursday and is likely to maintain the benchmark rate of 5.25% for a fourth straight time. The rate-hiking cycle is likely over, although the BoE is likely to continue its “higher for longer stance” and keep rates in restrictive territory until inflation falls closer to the 2% target. Services inflation and wage growth are both above 6% and the Bailey & Co. will want to see these numbers drop before cutting rates.

The markets were exuberant in December about rate cuts, pricing in six cuts in 2024, starting in May. The markets have since tempered expectations and have priced in four cuts this year, with the odds of a May cut around 50%, but more likely in August. The central bank hasn’t sent out any signals about rate cuts, but at the Thursday meeting, Governor Bailey might choose to soften the pushback against rate cuts expectations without endorsing rate cuts.

The US will release employment and consumer confidence data later in the day, with mixed readings expected. JOLTS Job Openings is expected to drop to 8.75 million, down from 8.79 million, which CB Consumer Confidence is projected to rise to 115 in January, up from 110.7 in December.

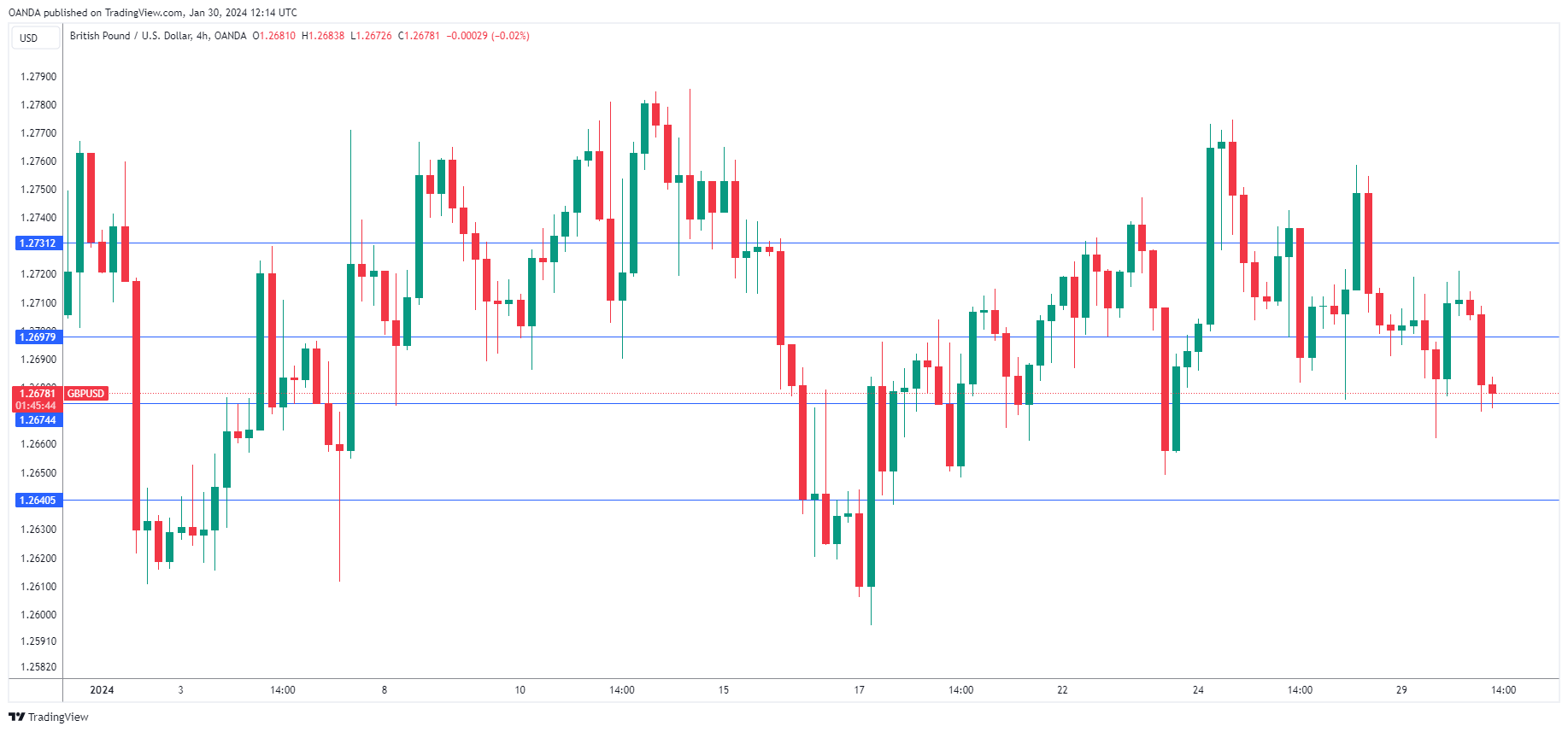

GBP/USD Technical

- GBP/USD is testing resistance at 1.2740. Next, there is resistance at 1.2772

- There is support at 1.2711 and 1.2679