The British pound has posted small losses in the Monday session. In North American trade, GBP/USD is trading at 1.3809, down 0.14% on the day. On the release front, there are no British data releases on the schedule. The US federal budget is expected to rebound and show a large surplus of $50.2 billion. The last time the federal government posted a surplus was in September. On Tuesday, the UK releases a host of inflation indicators, led by CPI.

It was the Bank of England’s turn to be in the spotlight on Thursday. The BoE made no changes to interest rates or quantitative easing, and both moves were unanimous (9-0). There was some surprise however, at the hawkish tone of policymakers, who said that interest rates could rise “earlier” and by a “somewhat greater extent” than they predicted at their previous meeting in November. Bottom line? We could see an interest rate in the first half of 2018, with analysts circling May as the most likely date. At the same time, the effect that Brexit is having on the economy is difficult to predict, and if the economic conditions worsen, the BoE could delay a rate hike. The hawkish message from the BoE pushed the British pound above the 1.40 level, but the upward swing didn’t last, as the pound had to settle for small gains on Thursday.

It’s a quiet start to the week in the US, and the US dollar has been generally subdued. That will likely change on Wednesday, with the release of inflation and retail sales reports. The markets will be glued to the inflation indicators, as last week’s stock market slide was triggered by concern that higher inflation would lead to additional rate hikes from the Federal Reserve and other central banks. If inflation numbers are higher than expected, we could see some volatility from the US dollar as well as the stock markets.

GBP/USD Fundamentals

Monday (February 12)

- 4:50 MPC Member Gertjan Vlieghe Speaks

- 11:30 MPC Member McCafferty Speaks

- 14:00 US Federal Budget Balance. Estimate 50.2B

Tuesday (February 13)

- 4:30 British CPI. Estimate 2.9%

*All release times are GMT

*Key events are in bold

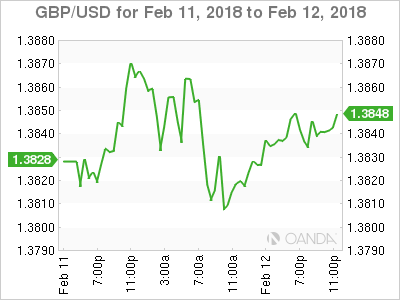

GBP/USD for Monday, February 12, 2018

GBP/USD February 12 at 11:30 EDT

Open: 1.3828 High: 1.3876 Low: 1.3796 Close: 1.3809

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3613 | 1.3744 | 1.3809 | 1.3901 | 1.4010 | 1.4128 |

GBP/USD posted gains in the Asian session but gave these up in European trade. The pair is steady in North American trade

- 1.3809 was tested earlier in support and is under strong pressure. It could break in the North American session

- 1.3901 has some breathing room in resistance following losses by GBP/USD on Friday

Current range: 1.3809 to 1.3901

Further levels in both directions:

- Below: 1.3809, 1.3744, 1.3613

- Above: 1.3901, 1.4010, 1.4128 and 1.4271

OANDA’s Open Positions Ratio

In the Monday session, GBP/USD ratio is showing short positions with a majority (56%). This is indicative of trader bias towards GBP/USD continuing to lose ground.