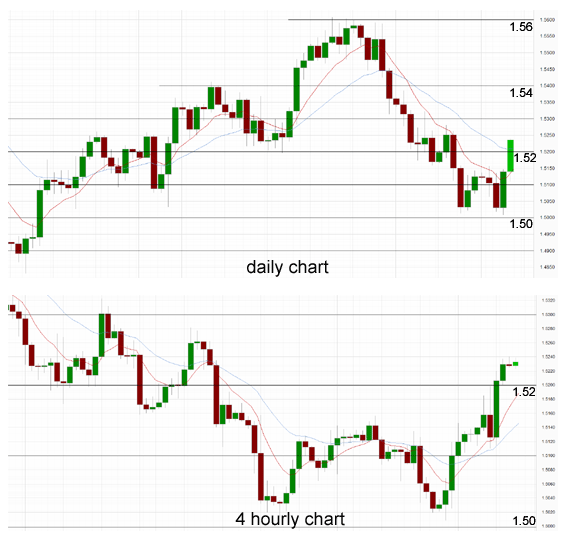

The GBP/USD has done very well to surge higher and move back through the 1.52 over the last couple of days. In doing so, it has moved through 1.5150 which it had previously experienced some difficulty with over the last week or so. It did well at the end of last week to reverse and recover a little back above 1.51 after having fallen strongly to a new two month low close to 1.50 in the couple of days prior. Interestingly in the last 48 hours it has moved to a lower level and therefore a reached a new two month low close to 1.50 before the strong surge higher.

For a few days about a week ago it found some support around 1.5160 however this level has been clearly broken. The area around 1.5160 level has been providing some resistance of late as the pound continues to try and rally higher. The pound has now experienced a strong fall over the last few weeks. Prior to the last few weeks, the pound enjoyed a strong couple of weeks and move to new highs above 1.56. It experienced all sorts of bother at 1.56 as it made several pushes to this significant level however it was turned away with excessive supply. For about a week it ran into a wall of resistance right around the 1.56 level. The pound had enjoyed a very solid couple of weeks moving from the support level at 1.52 to reach new highs at 1.56, a new ten week high.

Back around mid April the pound experienced solid support at 1.52 for about a week which greatly assisted the recent surge higher, and recently this level was called upon again to offer some support and a soft landing, however the pound fell strongly through it on its way down to near 1.50. A couple of weeks ago, we saw some evidence that the decline had been slowed down as it traded around 1.52 for about a week whilst receiving solid support from around 1.5160. The last few weeks has seen the pound fall strongly and return almost all of its gains from the few weeks before that. About a month ago the 1.54 level provided a little piece of resistance and this level has since been broken as it offered limited support. Now that the pound has drifted back down below 1.54, it may provide some resistance again although presently it has some other levels to deal with beforehand.

Over the last month or so, the GBP/USD has been experiencing a variety of different levels which have played a role on the price action. Towards the end of March the GBP/USD was trading within a range roughly between 1.51 and 1.5250 and now on a couple of occasions it has been able to move outside that range and push higher. A few weeks ago, the 1.5350 level was one of significance as it offered resistance before the GBP/USD was able to move higher through to 1.56. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. With the surge higher over the last couple of months, the GBP/USD had completely turned around its fortunes from earlier in the year, however it is starting to ease off and return most of the good work.

The British pound continues to push hard against the US dollar. GBP/USD has crossed above the 1.52 line in Thursday’s North American session. The pound has taken advantage of disappointing US numbers earlier today, as GDP, employment and housing numbers missed their estimates. In the UK, Nationwide HPI rose 0.4%, just shy of the estimate of 0.5%. The US dollar is broadly weaker in Thursday trading, following weak US numbers. Unemployment Claims, which often moves the markets, disappointed this week. The key indicator jumped from 340 thousand to 354 thousand. This was well above the estimate of 342 thousand. Preliminary GDP rebounded nicely, climbing from 0.1% to 2.4%. However, this missed the estimate of 2.5%. Pending Home Sales was dismal, posting a weak gain of 0.3%, way off the estimate of 1.3%. The pound took full advantage of the situation, and has crossed above the 1.52 line. The pound has shown some surprising strength, gaining close to two cents against the dollar since Wednesday.

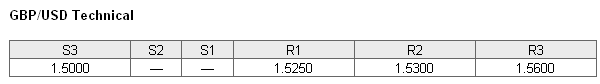

GBP/USD May 31 at 03:05 GMT 1.5232 H: 1.5240 L: 1.5110 GBP/USD Technical" title="GBP/USD Technical" width="565" height="101">

GBP/USD Technical" title="GBP/USD Technical" width="565" height="101">

During the early hours of the Asian trading session on Friday, the GBP/USD is consolidating in a very narrow trading range around 1.5230 after having recently surged higher through the 1.52 level. Throughout the first part of this year, the pound fell very strongly from the key resistance level at 1.63 level down to levels not seen in two and a half years and has done well the last month to rally well and move back up above 1.56. Current range: Just above 1.5200 around 1.5230.

Further levels in both directions:

• Below: 1.5000.

• Above: 1.5250, 1.5300 and 1.5600.

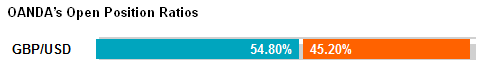

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has remained above 50% after the GBP/USD has surged higher through the 1.52 level. Trader sentiment remains in favour of long positions.

Economic Releases

- 01:00 NZ NBNZ Business Confidence (May)

- 01:30 AU Private Sector Credit (Apr)

- 05:00 JP Housing Starts (Apr)

- 05:00 JP Construction Orders (Apr)

- 07:00 CH KOF leading indicator (May)

- 08:30 UK BoE – Mortgage Approvals (Apr)

- 08:30 UK BoE – Net Consumer Credit (Apr)

- 08:30 UK BoE – Secured Lending (Apr)

- 08:30 UK M4 Money Supply (Apr)

- 08:30 UK BSA Mortgage Statistics (Mar)

- 09:00 EU HICP (Flash) (May)

- 09:00 EU Unemployment (Apr)

- 12:30 CA GDP (Q1)

- 12:30 CA GDP (Mar)

- 12:30 US Core PCE Price Index (Apr)

- 12:30 US Personal income & spending (Apr)

- 13:55 US Univ of Mich Sent. (Final) (May)