GameStop Corp. (NYSE:GME) is slated to report second-quarter fiscal 2016 results on Aug 25 after the closing bell. The question facing investors now is whether the company will be able to post a positive earnings surprise in the quarter to be reported.

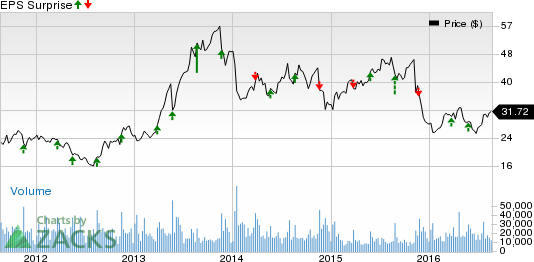

Notably, in three out of the last four quarters, the company surpassed the Zacks Consensus Estimate with an average positive earnings surprise of 8.9%. Let’s see how things are shaping up for this announcement.

Likely Earnings Beat in the Cards

Our proven model shows that GameStop is likely to beat earnings estimates this quarter. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. The Most Accurate estimate is 27 cents while the Zacks Consensus Estimate is pegged at 26 cents. So the ensuing difference, that is, an Earnings ESP of +3.85%, combined with the company’s Zacks Rank #3, makes us reasonably confident of an earnings beat.

We caution against stocks with a Zacks Rank #4 or #5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Factors Influencing This Quarter

GameStop’s foray into the entertainment collectibles and licensed merchandising category has been profitable. The company expects the collectibles business to improve further. GameStop anticipates the collectibles business to garner revenues of $450–$500 million in 2016 and $1 billion by 2019.

During the fiscal first quarter, the collectibles business sales soared 260% to $82.3 million. The company expects the collectibles business to grow further in the fiscal second quarter. The company’s pilot project in Australia was highly successful. The company is now remodeling stores to showcase more Loot products as survey shows huge demand for these.

The collaboration with AT&T (NYSE:T) and Apple (NASDAQ:AAPL) has proved to be lucrative for GameStop. Spring Mobile is now AT&T’s biggest dealer in the U.S. In the first quarter of fiscal 2016, the Technology Brands segment’s revenues surged 62.2% year over year. Earlier, the company said that its digital, collectibles as well as technology brand businesses will drive the company’s revenues higher in the second quarter.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar Tree, Inc. (NASDAQ:DLTR) has an Earnings ESP of +4.11% and a Zacks Rank #2.

Smith & Wesson Holding Corp. (NASDAQ:SWHC) has an Earnings ESP of +1.89% and a Zacks Rank #2.

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +4.76% and a Zacks Rank #3.

SMITH & WESSON (SWHC): Free Stock Analysis Report

BEST BUY (BBY): Free Stock Analysis Report

GAMESTOP CORP (GME): Free Stock Analysis Report

DOLLAR TREE INC (DLTR): Free Stock Analysis Report

Original post

Zacks Investment Research