Games Workshop Group PLC (LON:GAW) has published a trading statement for the first five months of FY20, highlighting an acceleration in revenue growth to c 12% (versus our previous forecast for the year of c 4%), strong margin growth and encouraging signs with respect to its ability to leverage its intellectual property through royalty income. Our PBT estimates increase by c 9% for FY20 and FY21, and our DCF-based valuation increases by 10% to 5,176p.

Five-month trading update: A strong start

GAW has published a trading statement for the five-month period ending 3 November 2019. Sales for H120 will be not less than £140m and profit before tax will be not less than £55m. This implies revenue growth of c 12% (from £125.2m in H119) and PBT growth of c 35% (from £40.8m in H119). There is no detail on the relative performance of the three reportable segments: Trade, Retail and Online. Royalty income is ‘significantly ahead’ of the prior year; we assume this means being just less than double the £5.5m of H119 at c £10.5m in H120, representing £5.0m of the incremental c £14.5m of PBT. This is due to the timing of signing licences and the change in accounting standard, making income more lumpy. Therefore, the incremental sales of at least £14.8m (£140m - £125.2m) generated an incremental PBT (ex-royalty income) of £9.5m (£14.5m - 5.0m). This implies better than average growth for the higher-margin segments, Trade and Online.

Forecasts: Upgraded by 9% for FY20 and FY21

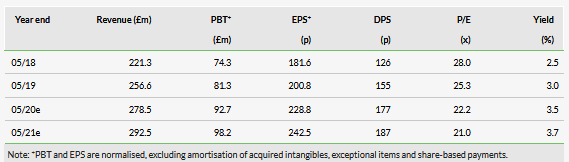

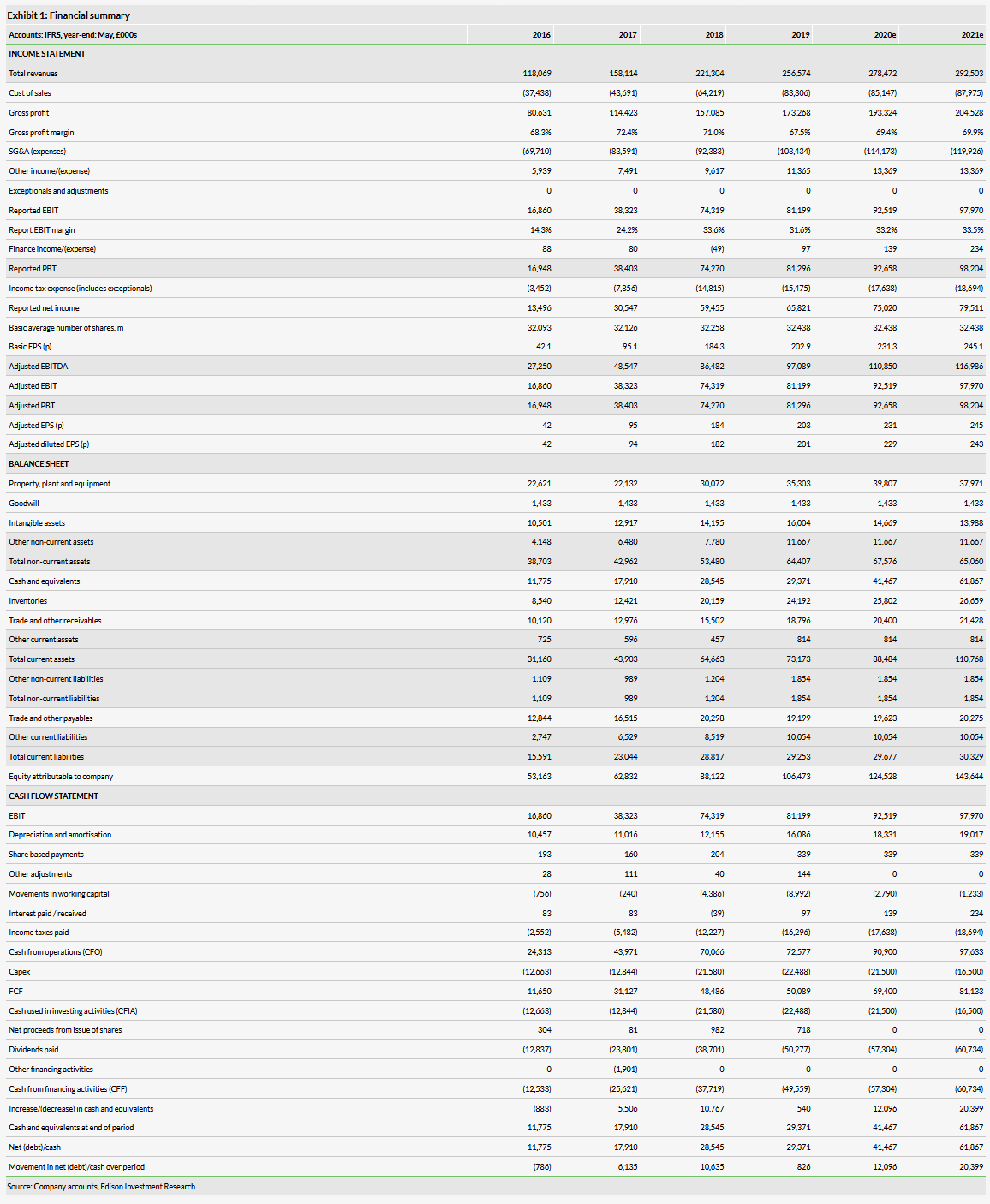

In the absence of detailed disclosure until the interim results, we assume that all three segments grow by c 12% in H120. We continue to assume similar revenue growth in H220 to previously, ie underlying growth of c 5% for Trade and Retail. Our gross margin assumption increases to 69.4% for FY20 versus 68% previously. We cautiously assume lower royalty income year-on-year in H220 than H219 given the strong performance in H120, ie FY20 increases to £13.4m from £11.4m previously. As a result, our PBT forecast for FY20 increases from £85.2m to £92.7m, and for FY21 from £89.8m to £98.2m, increases of c 9%. EPS in FY20 increases from 210.3p to 228.8p, and in FY21 increases from 221.7p to 242.5p.

Valuation: DCF-based valuation increases by 10%

The shares had marginally underperformed the wider market over the last three months, having performed strongly earlier in the year. At 5,085p, the P/E is 22.2x for FY20e and 21.0x for FY21e. Our DCF-based valuation increases to 5,176p from 4,703p. We forecast FY20 net cash of £41.5m, supporting the 3.5% dividend yield.

Share price performance

Business description

Games Workshop is a leading international specialist designer, manufacturer and multi-channel retailer of miniatures, scenery, artwork and fiction for tabletop miniature games set in its fantasy Warhammer worlds.