The Dollar was on the front foot yesterday with profit taking extending for a third day in Asia and most majors were slightly lower on the day. Stocks remain resilient near year highs in the US with the earning season beginning positively. December Industrial Production increased 0.3% vs. 1.1% previously. December CPI was flat 0.0% m/m. Looking ahead, December Housing Starts forecast at 0.89mn vs. 0.86mn previously. Also Weekly Jobless Claims forecast at 365k vs. 371k previously.

The Euro (EUR)

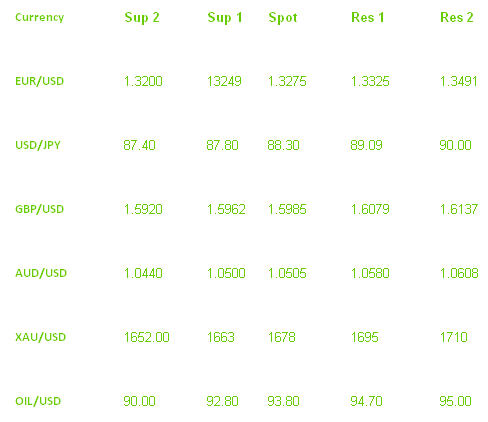

The pair tested the downside on the major and most crosses with profit taking entering critical period that is threatening the uptrend. EUR/USD found support at 1.3260 and was helped off the lows with comments from ECB’s Nowotny that the current Euro exchange rate was not worrying. This contrasts with ECB Juncker comments the day before that the Euro was ‘dangerously high’. The Sterling (GBP) tested the downside in sympathy with the Euro for a test of the 1.6000 major Psychological level. Support was found in the US session at 1.5980 and we closed back at the 1.6000 in mixed trade. Sellers looking for a fresh downtrend will be surely frustrated at the lack of progress the pair has been making especially in the last few sessions. Looking ahead, ECB Monthly Bulletin.

The Japanese Yen (JPY)

The USD/JPY was dragged lower to Y88 for a strong test of the uptrend overnight. Support was found at Y87.80 before we rebounded aggressively back to Y88.70 in the US session. EUR/JPY amplified the USD/JPY move with a dip to Y116.50 reversing to Y118. The BOJ meeting next week is growing in importance for a market heavily short the Yen in anticipation of major announcements. Australian Dollar (AUD) the AUD/USD continues to trade in a very tight range between 1.0530-1.0580 and we are waiting for a catalyst to break out. The risk on trading environment is generally supportive for the risk sensitive currency but the local economy is weakening and the central bank has been cutting interest rates in the last 6 months. Traders are watching China’s economy very closely with the sharp rebound in recent months also supporting the AUD outlook. UPDATE AUSTRALIAN December Employment Change -5.5k vs. +10k forecast. Unemployment Rate forecast at 5.4% vs. 5.2% previously.

Oil And Gold (XAU)

XAU/USD trading range continued to compress overnight indicating that a break out is imminent. Topside strong resistance at $1685. Oil bucked the rest of the market to continue with its uptrend solo overnight. Resistance was found above $94.20 and traders will be naturally targeting the round number $95 level.

Pairs To watch