STOCKS:

The world economy is weakening: the US payroll tax increase and “sequestration” are pressuring the US economy; China is being pressured by Japan, and has “dampened” their housing market. However, the Eurozone is seriously contemplating loosening up their austerity plans. For now, although we feel that risk is being mispriced at current levels given recent pressure upon world economic figures and the developing pressure upon corporate margins/ earnings — the consensus is that the world’s central banks will save the day.

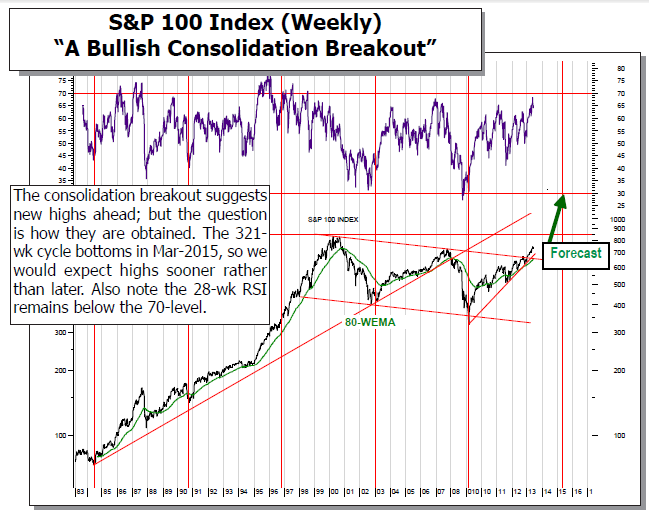

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1317; and the standard 200-dma support level at 1490. But perhaps more importantly, the distance above the 160-wma has grown to +25%...which now means that a “bubble-like” rally is developing, and we can see sharp gains such as 1986-1987 and 1995-2000.

WORLD MARKETS ARE ON BALANCE “HIGHER” THIS MORNING as the world continues to contemplate the Fed’s timing to taper their bond-buying campaign. This seems to be all that is on anyone’s mind these days, and it has – for quite some time really – supplanted any rationale analysis of economic conditions. This also applies to deteriorating or improving fundamentals on a corporate scale. To this end, China closed lower on their session, while Japan closed higher. European bourses are higher, with the southern peripheral countries of Spain and Italy leading the charge higher. When these two countries are rising, then all is to be considered well, for when the dourest of the dour are rising…then so too must be the cream of the crop.

To Read the Entire Report Please Click on the pdf File Below.