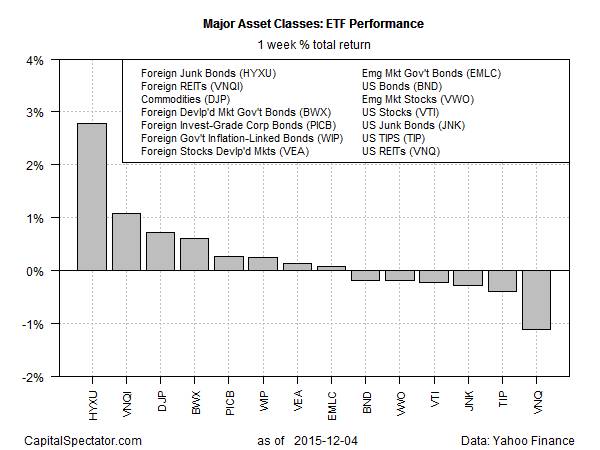

Yield-sensitive assets in foreign markets topped last week’s performance ledger for the major asset classes via a set of proxy ETFs. iShares International High Yield Bond (N:HYXU) secured the top spot for the five trading days through Dec. 4 with a strong 2.8% total return. Following up in 2nd and 3rd place: foreign real estate (O:VNQI) and broadly defined commodities (N:DJP), respectively.

The US dollar’s sharp reversal last week played a role in boosting the fortunes of foreign junk, real estate and commodities for the week just passed. The main event for the greenback was last Thursday, when the US Dollar Index slumped a hefty 2.4%. The catalyst for the selling: disappointment after the European Central Bank delivered a weaker-than-expected announcement to juice the Eurozone economy with additional monetary stimulus. In turn, the euro soared, taking a bite out of the dollar.

To the extent that last week’s leaders depend on dollar weakness for future gains the near-term outlook is cloudy. For starters, the dollar will likely claw back some if not all of its losses, in part because the macro stars are now aligned for a US rate hike later this month. In addition, the technical profiles for HYXU, VNQI, and DJP remain bearish. Last week’s rallies in those markets, in other words, don’t look like convincing signs of sustainable rebounds at this point.

Meanwhile, last week’s losers share a common trait: all are interest-rate sensitive assets in the US. Receiving a bit of comeuppance after a run of strength, US REITs (N:VNQ) was the red-ink leader, dipping 1.1% for the five trading days through Dec. 4.

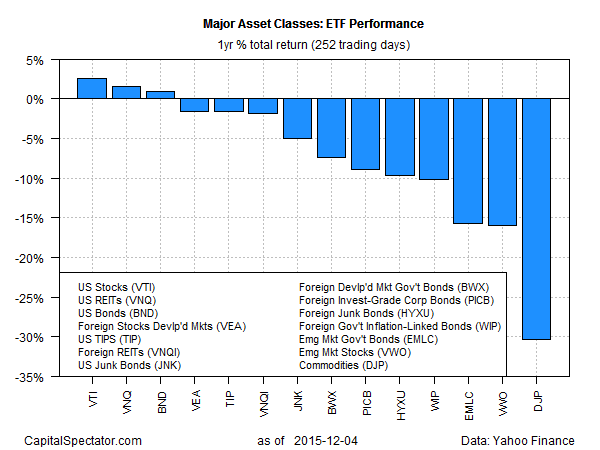

Turning to the trailing one-year return (252 trading days) reminds us that the trend remains bearish for commodities and foreign bonds (priced in US dollar terms). Last week’s rebound for these assets is a welcome break from the usual, but it’s still premature that the latest upside blip marks a convincing turning point.