Premium thermal imaging cameras maker FLIR Systems, Inc. (NASDAQ:FLIR) recently launched an airborne thermal imaging system – Star SAFIRE 380-HLDc – that will take the performance of light combat helicopters and similar platforms to the next level.

The Product

Star SAFIRE 380-HLDc, a high-definition, airborne electro-optical/infrared (EO/IR) targeting system, integrates FLIR's state-of-the-art sensor technology with precision laser designation and will be showcased at the 2016 Farnborough Air Show in England. The latest offering complies with industry-leading size, weight, power and cost (SWAP-c) specifications which will eliminate the necessity to select between system size, weight and targeting performance.

FLIR asserts that locating, identifying and laser marking targets will now become easier as these compact imaging systems will fit into smaller aircraft with limited ground clearance. Also, the company believes that Star SAFIRE 380-HLDc will make up for the downsides of the previous versions by providing a significantly longer range Positive ID (PID).

Star SAFIRE 380-HLDc is the brainchild of FLIR’s celebrated “Commercially-Developed, Military Qualified” (“CDMQ”) model that has been driving its government and military businesses over the past few quarters. Through this unique model, the company develops technology by investing in research & development, and then equips it with military standards for sale to the government. As a matter of fact, FLIR’s government sales increased 20% during the first quarter of 2016, backed by this CDMQ model.

The company believes that governments are relentlessly bolstering their mission portfolio of rotary and fixed wing platforms in a bid to fortify surveillance and intelligence programs. FLIR’s CDMQ model has fostered the development of Star SAFIRE 380-HLDc for military customers in a timely and cost effective manner.

Headwinds

Despite the strengths of the CDMQ model, FLIR is currently faced with softness in Maritime segment’s Building & Predictive Maintenance product lines that has been hurting the top line. In addition, the company’s gross profit is being dented by a host of factors including product mix changes, manufacturing cost absorption, adjustments in inventory and rise in competitive pressure in security retail channels.

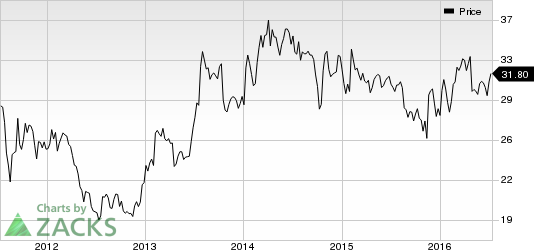

Going forward, poor sales in the maritime segment and escalating operating costs are expected to impact margins. Also, unfavorable product mix is likely to hurt the second-quarter 2016 operating margin at the Surveillance segment. We believe that these short-term headwinds will more than offset sales growth from the government business lines, thereby adding to this Zacks Rank #4 (Sell) company’s woes.

Better-ranked stocks in the sector include B/E Aerospace Inc. (NASDAQ:BEAV) , AeroVironment, Inc. (NASDAQ:AVAV) and Curtiss-Wright Corporation (NYSE:CW) . All the three stocks hold a Zacks Rank #2 (Buy).

AEROVIRONMENT (AVAV): Free Stock Analysis Report

CURTISS WRIGHT (CW): Free Stock Analysis Report

B/E AEROSPACE (BEAV): Free Stock Analysis Report

FLIR SYSTEMS (FLIR): Free Stock Analysis Report

Original post