FireEye Inc (NASDAQ:FEYE) joins a busy line-up of earnings reports this week, with the cybersecurity firm slated to unveil its first-quarter results after tomorrow's close. The stock has a history of volatile earnings reactions, averaging a 10% next-day move over the past eight quarters, regardless of direction. This time around, the options market is pricing in an even bigger move of 15.4%, based on implied volatility data.

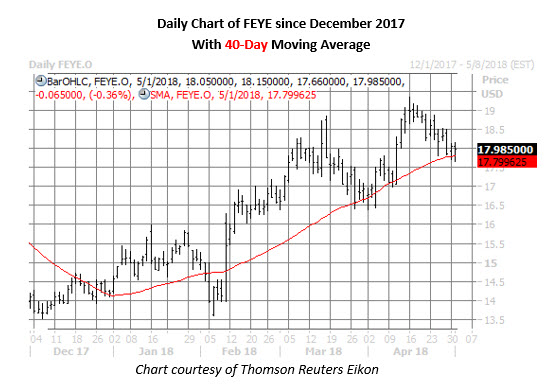

Last February, the stock gapped 9.3% higher the day after FEYE reported earnings -- sending the shares to a three-month high at the time. Since then, the security has added more than 16%. And while the shares have pulled back since hitting a two-year high of $19.36 on April 16, they have found a familiar foothold atop their rising 40-day moving average, last seen trading at $17.99.

Pre-earnings options traders have targeted this area of support in recent weeks. The weekly 5/11 18-strike put has seen the biggest rise in open interest over the past 10 days, and data from the major options exchanges confirms sell-to-open activity. While it's possible put writers are hoping FEYE holds above $18 through expiration at next Friday's close, they are likely betting on a post-earnings volatility crush.

Elsewhere on Wall Street, sentiment is much more skeptical of FEYE stock. While the majority of analysts covering the shares maintain a lukewarm "hold" rating, the average 12-month price target of $18.04 is in line with current trading levels.

Plus, short interest on FEYE rose 5.75% in the most recent reporting period to 15.38 million shares. This accounts for a healthy 8.78% of the stock's available float, and would take nearly a week to cover, at the average pace of trading. A positive earnings reaction could spark a round of upgrades and/or a short squeeze.