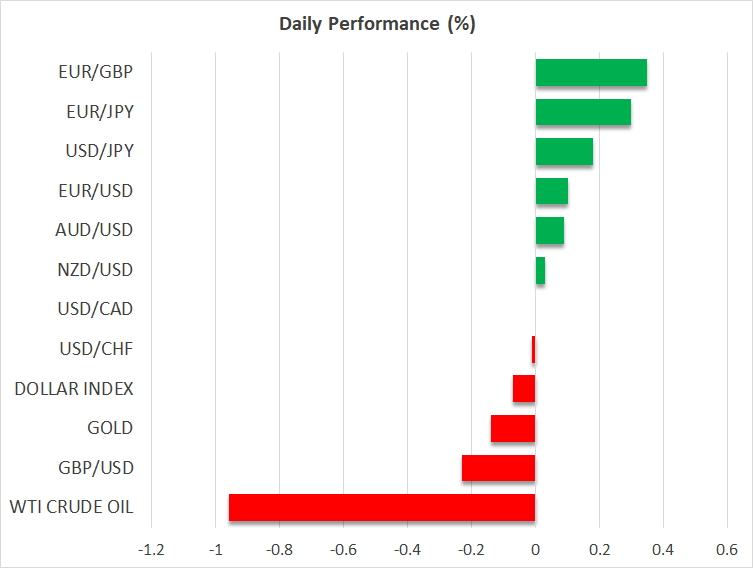

- Dollar trades cautiously ahead of Fed decision

- Yen extends slide despite fresh intervention warnings

- Pound slides after lower-than-expected UK CPI data

- Wall Street ends in the red as investors turn focus to Fed

Will the Fed add fuel to the dollar’s engines?

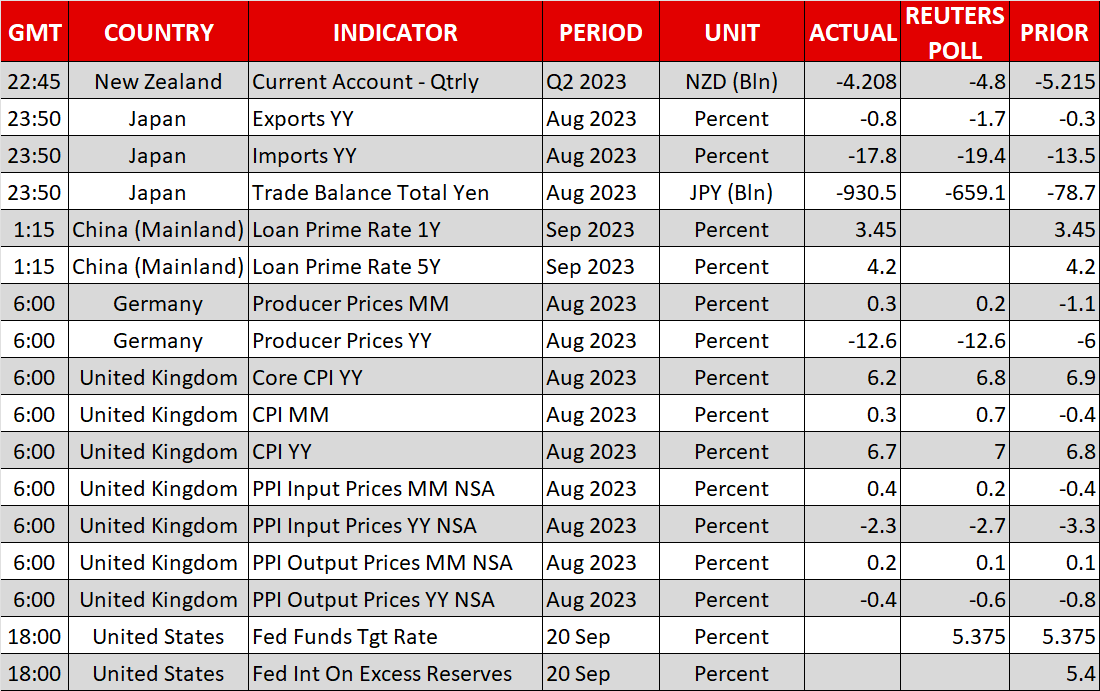

- It seems that dollar traders prefer not to engage in large positions ahead of the FOMC decision as they don’t want to risk being on the wrong side at the time of the announcement. The market is largely convinced that Fed officials will hold their hands off the hike button this time, assigning only a 45% probability for another quarter-point increment by the end of the year. They are also pricing in more than 80bps worth of rate cuts for 2024.

- With that in mind, should the Committee indeed take the sidelines as expected, attention is likely to fall on the updated economic projections and the new dot plot. Recent data has been suggesting that the US is in a better shape than other major economies, in no way justifying the market’s rate cut bets. This, combined with the inflation risks arising from the latest rally in oil prices, suggests that the new dot plot may point to a higher rate path than the market’s own projections. Such an outcome could take Treasury yields higher and thereby add fuel to the dollar’s engines.

Yen traders defy fresh intervention warnings

- The Japanese yen continued sliding, with dollar/yen now trading slightly above the 148.00 level, shrugging off renewed warnings by Japan’s vice minister of finance for international affairs, Masato Kanda, who said that they are in close communication on currencies with US and overseas policymakers, while watching market moves with a “high sense of urgency”.

- With the Bank of Japan expected to take the sidelines on Friday, as officials evaluate the effects of their decision in July to adjust their yield curve control policy, a hawkish Fed may drive dollar/yen higher and perhaps trigger louder warnings by Japanese authorities. Although officials have been repeatedly highlighting that they pay attention to the pace of the yen’s slide instead of a specific level, market participants see the 150.00 zone in dollar/yen as the line in the sand which, if breached, could result in action.

Pound traders reconsider hike bets after UK CPIs

- Although the pound stood well against the dollar yesterday, it tumbled today after the UK CPI data revealed an unexpected slowdown in headline inflation and a larger-than-forecast decline in the core rate, which likely strengthens the view that the Bank of England is also nearing the end of this tightening crusade.

- Investors are now assigning only a 54% probability of a rate hike at tomorrow’s meeting, and if indeed the decision is a close call, with policymakers hinting at a more cautious approach moving forward due to the deepening wounds of the UK economy, the pound is likely to extend its slide.

- The loonie was among yesterday’s winners, after hotter-than-expected inflation data heightened expectations for further tightening by the Bank of Canada.

Wall Street investors lock gaze on Fed

- Despite the risk-linked currencies enjoying some gains yesterday, all three of Wall Street’s main indices closed slightly in the red as equity investors are also reluctant to add large exposures to their portfolios ahead of the Fed outcome.

- A “higher for longer” guidance on interest rates could further weigh on stocks and especially those of high growth firms, which are more sensitive to changes in interest-rate expectations. Growing jitters that a stalemate in the US Congress could result in the fourth partial government shutdown in a decade may also weigh on investors’ appetite in the following days. US lawmakers have until September 30 to pass spending legislation and keep vital federal agencies running.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.