The FDIC closed 1 bank on Friday, December 14, 2012. Total bank failures for 2012 increased to 51.

#51 Community Bank of the Ozarks, Sunrise Beach, MO

* Bank of Sullivan, Sullivan, MO assumed all of the deposits and purchased most of the assets

* As of September 30, 2012, the bank had approximately $42.8 million in total assets

* FDIC estimates the cost to the Deposit Insurance Fund (DIF) will be $10.4 million

* The last bank closed in the state had been Excel Bank, Sedalia, on October 19, 2012

States where banks have been seized by the FDIC in 2012 (in alphabetical order): Alabama 1, California 1, Florida 8, Georgia 10, Illinois 8, Indiana 1, Kansas 1, Maryland 2, Michigan 1, Minnesota 4, Missouri 4, New Jersey 1, North Carolina 1, Oklahoma 1, Pennsylvania 2, South Carolina 2, Tennessee 3.

Florida, Georgia, and Illinois have accounted for 26 total or 51% of all bank failures in 2012 to-date. Florida, Georgia, and Illinois accounted for 45 total or 49% of all bank failures in 2011.

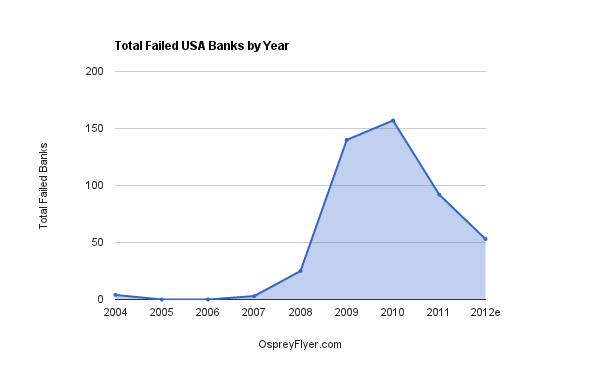

USA Failed Banks by Year Bank failures skyrocketed in 2009 and 2010 to 140 and 157, respectively – a 2-year total of 297 compared to 32 from 2004 through 2008. Bank failures in 2011 continued at a high rate of 92. The total 2012 closings are currently estimated at 53. The 2012 annual bank failures are extrapolated from the weeks reported and failures year-to-date.

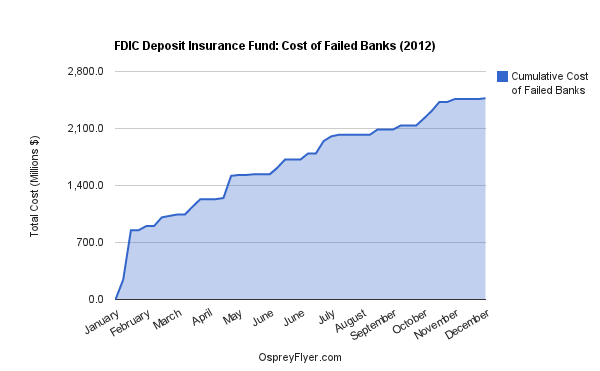

Cost of Failed Banks The total estimated cost to the FDIC Deposit Insurance Fund for the 2012 bank closures year-to-date is $2.47 billion.

The most costly banks to the Deposit Insurance Fund (DIF) in 2012 year-to-date:

1 Tennessee Commerce Bank, Franklin, TN $416.8M

2 The First State Bank, Stockbridge, GA $216.2M

3 Inter Savings Bank FSB, Maple Grove, MN $117.5M

4 Fidelity Bank, Dearborn, MI $92.8M

5 NOVA Bank, Berwyn, PA $91.2M

6 First Guaranty Bank & Trust Company of Jacksonville, Jacksonville, FL $82.0M

7 Second Federal Savings and Loan Association of Chicago, Chicago, IL $76.9M

8 Plantation Federal Bank, Pawleys Island, SC $76.0M

9 BankEast, Knoxville, TN $75.6M

0 Montgomery Bank & Trust, Ailey, GA $75.2M

Failed Credit Unions

The NCUA closed and liquidated G.I.C. Federal Credit Union of Euclid, OH on December 13, 2012. The NCUA closed and liquidated Border Lodge Credit Union of Derby Line, VT on November 30, 2012. Credit union closings for 2012 have increased to 15. No credit unions are now in conservatorship and managed by the NCUA.

5 have been liquidated and sold

* Telesis Community Credit Union of Chatsworth, CA

* Wausau Postal Employees Credit Union of Wausau, WI

* Saguache County Credit Union of Moffat, CO

* People Community Development Credit Union of Philadelphia, PA

* A M Community Credit Union of Kenosha, WI

8 have been liquidated and closed

* G.I.C. Federal Credit Union of Euclid, OH

* Border Lodge Credit Union of Derby Line, VT

* Women’s Southwest Federal Credit Union of Dallas, TX

* U.S. Central Bridge Corporate FCU of Lenexa, KS

* El Paso’s Federal Credit Union of El Paso, TX

* United Catholic Credit Union of Temperance, MI

* Western Bridge Corporate FCU of San Dimas, CA

* Shepherd’s Federal Credit Union of Charlotte, NC

2 have been liquidated and merged

* Trinity Credit Union, Trinidad, CO

* Eastern New York Federal Credit Union of Napanoch, NY

States where credit unions have been seized by the NCUA in 2012 (in alphabetical order): California 2, Colorado 2, Kansas 1, Michigan 1, New York 1, North Carolina 1, Ohio 1, Pennsylvania 1, Texas 2, Vermont 1, Wisconsin 2.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FDIC Seizes Missouri Bank, NCUA Closes 2 Credit Unions

Published 12/16/2012, 03:47 AM

Updated 07/09/2023, 06:31 AM

FDIC Seizes Missouri Bank, NCUA Closes 2 Credit Unions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.