Retail concernExpress Inc (NYSE:EXPR) is down 1.4% at $4.90, at last check, as investors ready for the company's fourth-quarter earnings, set to take the stage before the market opens on March 13. Below we will dive into what the options market has priced in for the shares' post-earnings move, and see how the stock has been performing on the charts.

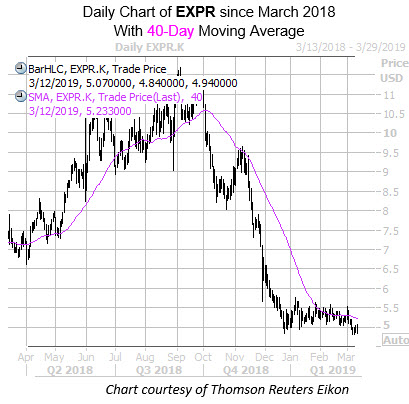

The Express stock has been falling long term, already down more than 58% from its Sept. 6 high of $11.68. Pressuring the shares lower has been the 40-day moving average -- despite its brief performance as a trendline of support late last year. Following today's drop, EXPR has fallen 3% year-to-date.

Moving onto EXPR's earnings history, the stock has fallen the day after reporting in six of the past eight quarters, including the last four in a row. On average, the shares have swung 8.5% the day after earnings, regardless of direction. This time around, the options market is pricing in a 17.6% move for Wednesday's trading.

EXPR calls have been flying off the shelves in recent weeks. This is per data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows the retailer with a 10-day call/put volume ratio of 78, ranking in the 95th annual percentile.

Plus, call volume is just 12 percentage points from an annual high, last seen with 967 on the tape, four times its average daily volume. Seeing the most action today are the March 5 and July 6 calls, where over 600 contracts have traded.

Lastly, short interest has risen 10.1% during the past two reporting periods on EXPR, and currently accounts for 24.3% of the stock's total available float. At the security's average daily trading volume, it would take shorts over two weeks to buy back their bearish bets.