Recent comments from ECB policymakers suggest the “gap” between interest rates on the two sides of the Atlantic will be smaller than expected...

As my colleague Joe Perry noted earlier this week, EUR/USD had room to rally toward 1-month highs in the 1.0760 area after ECB President Lagarde opened the door to interest rate hikes in July. We’ve now seen that move evolve as anticipated, leaving traders to wonder: Where will the world’s most widely-traded currency pair head next?

From a fundamental perspective, expectations for interest rate increases from the Federal Reserve have already been heavily discounted, with markets essentially discounting two more 50bps (0.50%) rate hikes followed by 25bps (0.25%) increases for the rest of the year. If inflation readings continue to moderate in the coming months, the central bank may even pause the rate hike cycle for a meeting or two in Q4 of this year or Q1 2023.

In other words, while the Fed will undoubtedly raise interest rates by more than the ECB this year, recent comments from ECB policymakers suggest that “gap” between interest rates on the two sides of the Atlantic will be smaller than expected. As the market is always forward-looking, we’ve seen an impressive rally in EUR/USD to start the week as traders recalibrate to a new smaller-interest-rate-differential scenario for the second half of this year and beyond.

Though yesterday's FOMC minutes might have been a potential event risk for EUR/USD and the greenback more broadly, recent economic data and extensive FOMC comments over the last couple of weeks made them less impactful than usual. At the end of the day, the Fed’s near-term plans appear relatively set, so future movements in EUR/USD will be more likely to come from the European continent.

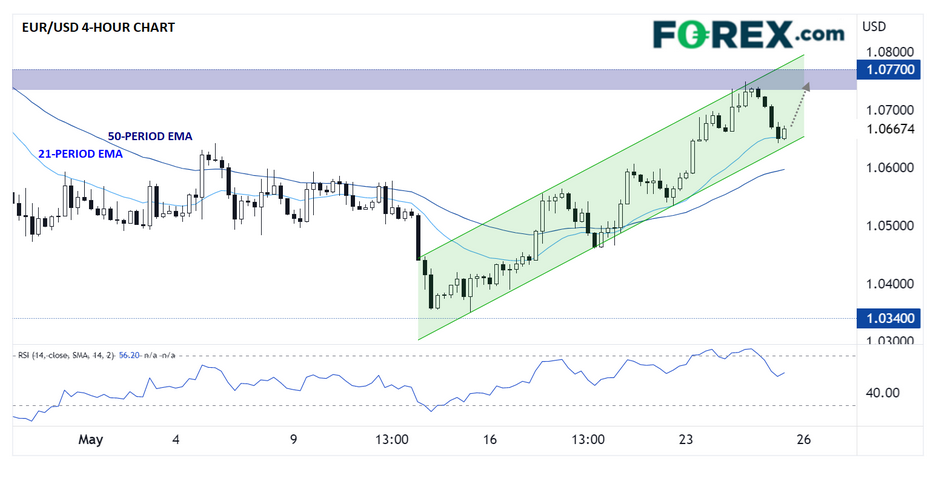

EUR/USD technical outlook

Looking at the 4-hour chart, EUR/USD saw a near-term pullback over the last 24 hours, but the pair remains well within its two-week ascending channel. Looking ahead, traders have only just started to digest this week’s significant acceleration of ECB tightening intentions, so the baseline expectation is that the pair will remain in its rising channel for now. Bulls will be looking for a retest of the key 1.0750-70 area at a minimum, with a break above that area opening the door for a continuation toward the mid-April highs around the 1.0900 handle next.

Source: StoneX, TradingView

At this point, it would take a break below rising support in the 1.0630 area to erase the near-term bullish bias and flip the short-term outlook back to neutral.