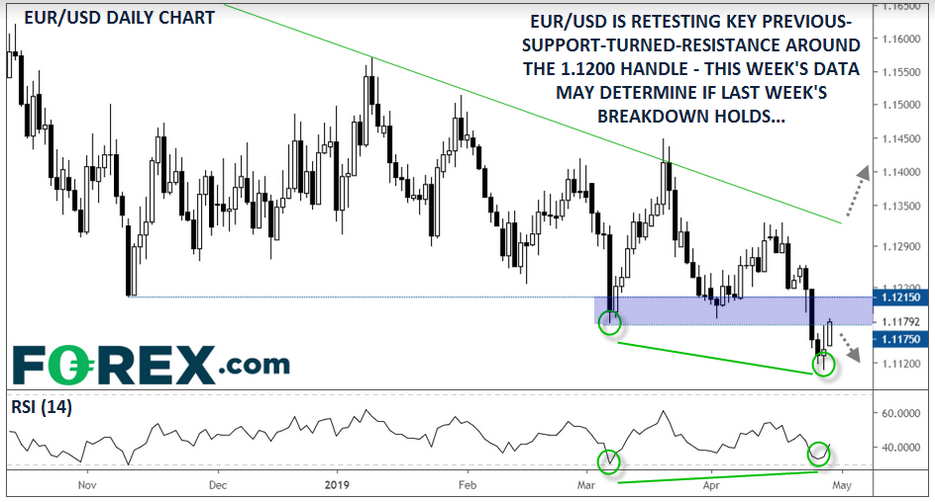

After potentially the quietest quarter in its history, the world’s most widely traded currency pair finally broke out last week…but the big question for traders is, “will it hold?”

EUR/USD spent over five months contained between about 1.1200 and 1.1500 before breaking down to a 22-month low on last week’s big breakout in the US dollar. Crucially, this breakdown corresponded with net short positioning in the euro rising to its highest level since 2016, signaling that the downtrend could potentially extend further from here.

So far today, EUR/USD has bounced back to retest its key previous-support-turned-resistance zone around 1.1200. For traders who missed the initial breakdown last week, today’s retracement back to that area may offer a second opportunity to enter short positions:

Source: TradingView, FOREX.com

While we still maintain a generally bearish posture toward EUR/USD, it’s worth noting that last week’s move may represent a “false break” lower given the clear RSI divergence at the lows. If the pair manages to break back above the key 1.1200 support area, and especially the month’s high around 1.1325, it may mark a significant long-term bottom.

To that end, this week’s economic data will be critical. As my colleague Fawad Razaqzada outlined on Friday, traders will see the latest figures on Eurozone GDP and German CPI on Tuesday, US Manufacturing PMI and the FOMC’s monetary policy statement on Wednesday and the marquee Nonfarm Payrolls report on Friday (stay tuned for our full preview on Thursday).

One way or another, this week’s data and price action could set the tone for the month of May, if not the rest of Q2, for EUR/USD.

Cheers