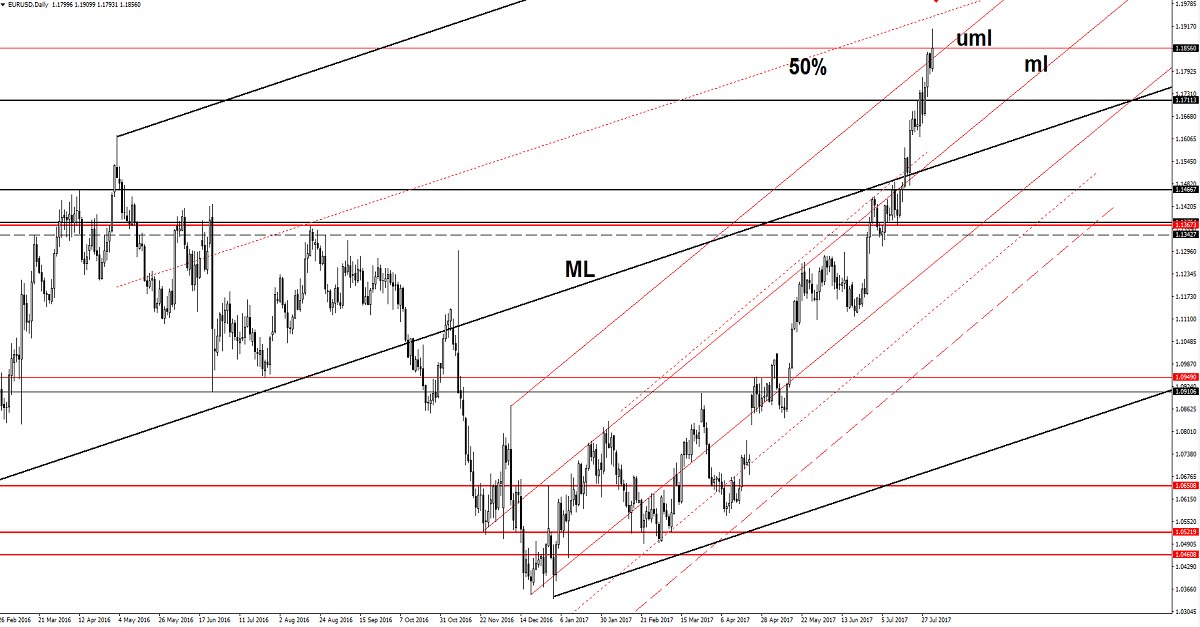

EUR/USD At New Highs

EUR/USD jumped much higher on Wednesday deleting the Tuesday’s losses and now needs to stabilize above the broken dynamic resistance if will want to resume the upside movement. Price rallied today and the USDX plunged and resumed the bearish movement, but the index has failed to reach the 92.49 static support.

USDX squeezed a little in the last hours and forced the EUR/USD to slip lower, but unfortunately, the Dollar Index maintains a bearish bias on the Daily chart. Personally, I believe that the USDX could find strong support at the 92.49 downside obstacle and could increase again.

The price action could be influenced by the fundamental factors today, the economic calendar is filled with important economic reports. You should keep an eye on the calendar to see what will move the rate.

Price has managed to resume the upside movement and to jump much above the upper median line (uml) of the minor ascending pitchfork and above the 1.1845 previous high. Will increase further if will close above the upper median line (uml). Only a false breakout above the uml will signal an overbought and a potential drop.

I want to remind you that the next upside target will be at the 50% Fibonacci line (ascending dotted line), a failure to reach this level will send the rate tumbling on the short term. I want to remind you that the bias is bullish, only an impressive USDX’s rally will force the pair to turn to the downside.

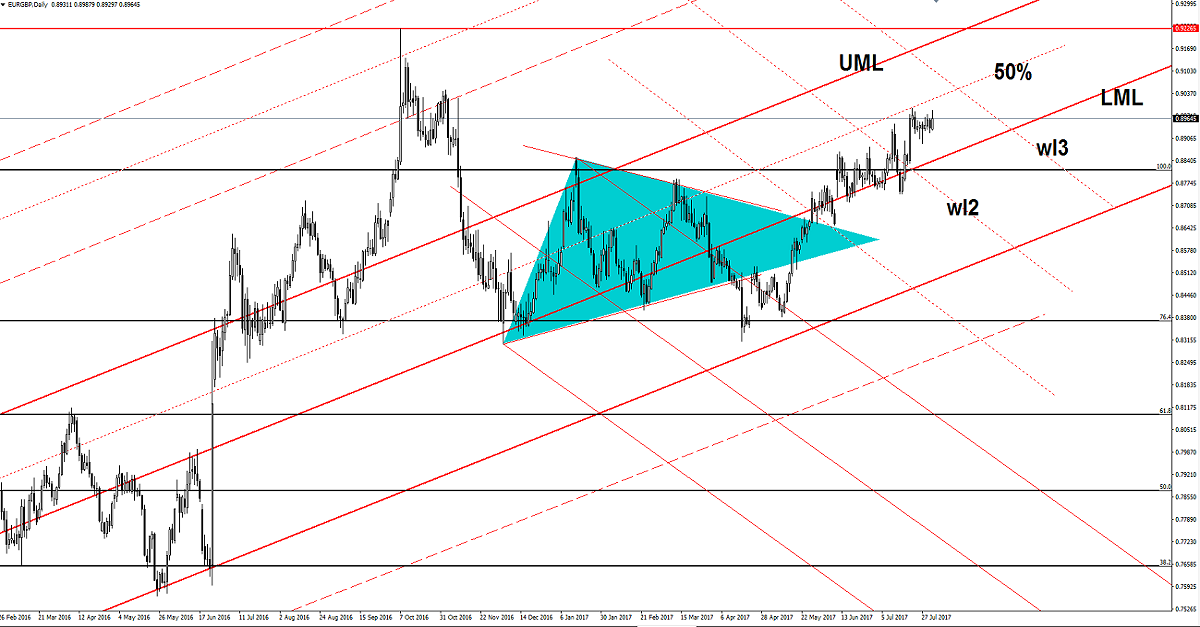

EUR/GBP Poised For Further Gains?

Price is narrowing and is struggling to resume the upside movement as it is located in the buyer’s territory. Has somehow expected to decrease on the short term to retest the median line (ML) of the major ascending pitchfork, but the buyers are very strong and have kept the rate higher.

Is trading above the 0.8950 level and is approaching the 0.8976 previous high, could reach also the 0.9000 psychological level as the Euro is strongly bullish and the Cable looks tired.

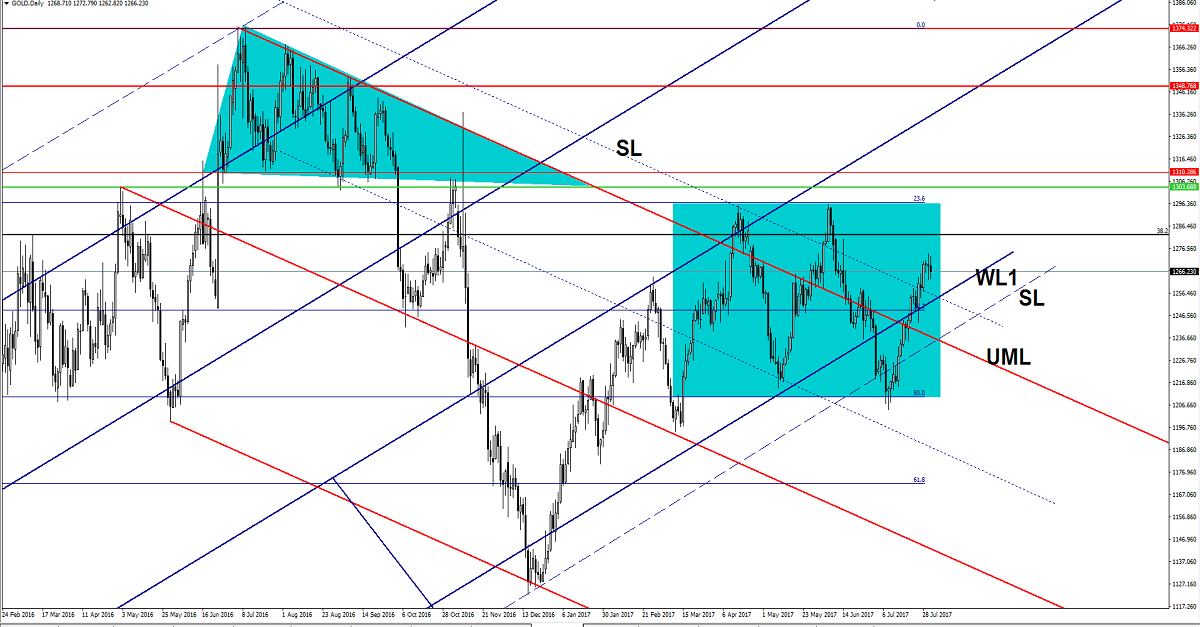

GOLD More Upside In View

The yellow metal continues to move in range, is trapped between the 23.6% and the 50% retracement levels. Could come down to retest the warning line (WL1) of the ascending pitchfork before will resume the upward movement. We could go long if the mentioned support will hold, the next important target is near the $1295 per ounce.

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.