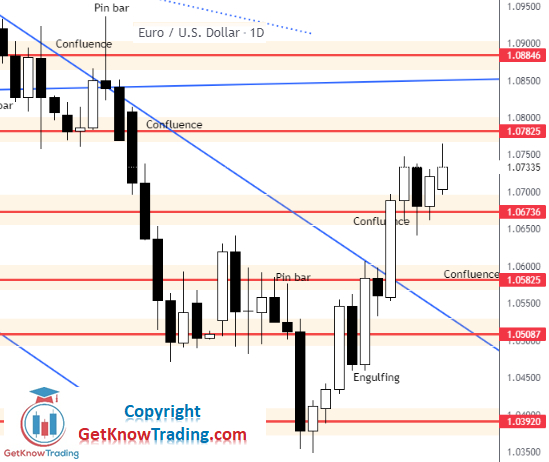

In our previous EURUSD forecast, we discussed EUR/USD price reaching higher levels, such as, $1.06400, which was a high reached on its last bullish attempt last Monday, forming a 144 pips large candle.

It was a sharp move that took the price outside the downtrend channel and above two resistance levels: $1.05825 and $1.06736, both confluences of resistance.

After breaking above resistance levels, the price slid down to $1.06736 and verified that level as a support. From there, the price was able to maintain higher levels.

The week ended on the upper level of daily candles with Friday's wick above all previous candles. That means the price has tested higher levels and was not pushed down as a sign of bullish strength.

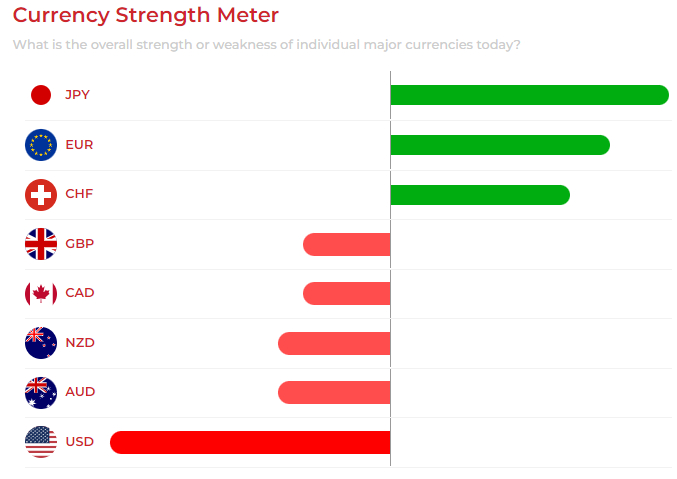

The currency strength meter reflects EUR as a much stronger currency than USD, which is also confirming the bulls' strength.

EUR/USD price is above the $1.06736 support level and a little below the next resistance level at $1.07825 which was a significant level it tried to break below during its previous price attempts. And it was a good support level that held the price for a week.

After breaking that level the price dropped 300 pips.

Now, the price has a resistance level that must be tested. And the price will likely test that resistance and price around $1.08300 which is close to the monthly trendline. That trend line was a trigger for a big sell off because the price has broken outside of the triangle.

$1.08300 is around 100 pips from the current price, a two days' pip range for EUR/USD. If the price manages to close above the $1.08446 resistance level, that will be the signal the price has moved outside of the bearish trend and we can look for more bullish trading opportunities.

$1.07825 is the first step and it is a base for bullish attempts to attack higher levels. But, keep in mind that $1.08446 is above the monthly trendline. And price could retrace to test the breakout from the monthly triangle which will be the start of a new selloff.

If the sell off happens, the price will need to move below $1.05825 in order for the price to return to a downtrend.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD Forecast: Bulls Targeting $1.08300 At The Monthly Triangle

Published 05/28/2022, 01:02 AM

Updated 07/09/2023, 06:32 AM

EUR/USD Forecast: Bulls Targeting $1.08300 At The Monthly Triangle

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.