At the beginning of a new week of November, the market major is stepping back. EUR/USD is balancing at 1.0280. The market is very cautious about any comments and views on the future steps of the Federal Reserve System.

The nearest meeting is scheduled for Dec. 14 and is veiled by intrigues. Previously, the interest rate was expected to grow by 50 base points because the inflation pressure had shrunk, and there were risks of recession in the US economy.

However, later the Fed politicians voiced an opinion that the peak of the interest rate may reach higher. This means that the probability of the interest rate growing by 75 base points is increasing. This supports the dollar and impacts other currencies.

At the beginning of the week, the macroeconomic calendar is empty; however, investors are looking at the US statistics and the minutes of the previous ECB meeting.

Technical View

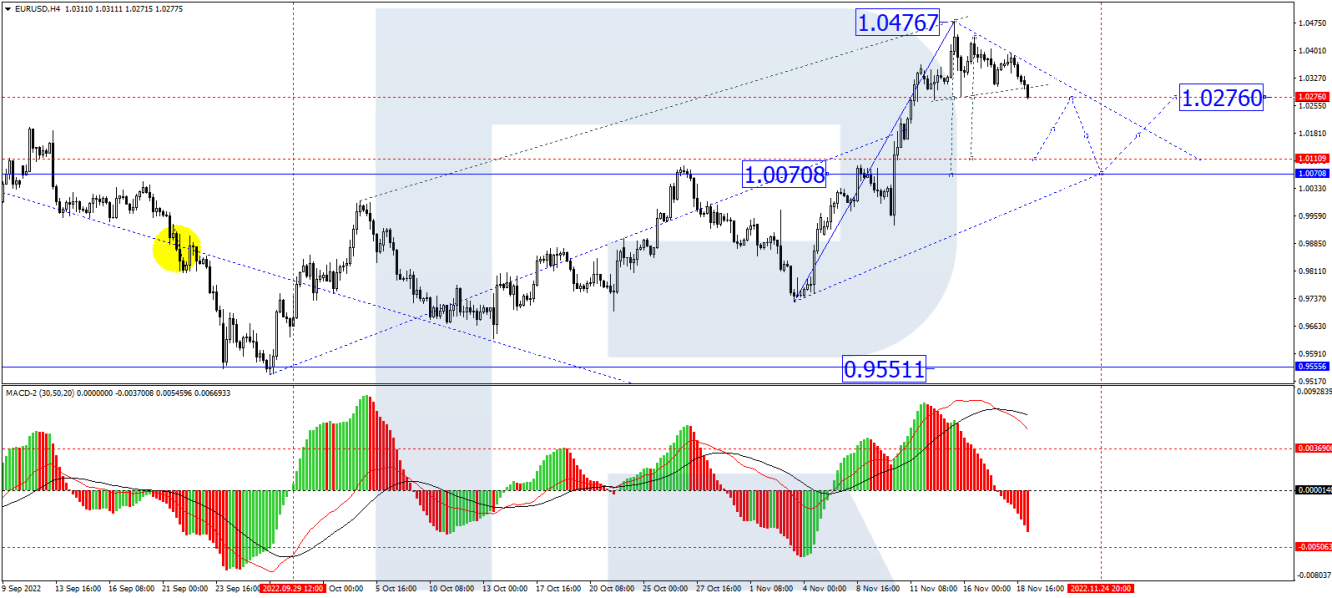

On H4, EUR/USD has completed a decline to 1.0276. Practically, this is just half of the expected wave of decline. Today the market is forming a consolidation range around this level.

With an escape downwards, the second half of this declining wave is expected to develop to 1.0111. After this level is reached, a link of correctional growth to 1.0270 and a decline to 1.0070 are to follow.

Technically, this scenario is confirmed by the MACD. Its signal line is aimed strictly down to zero.

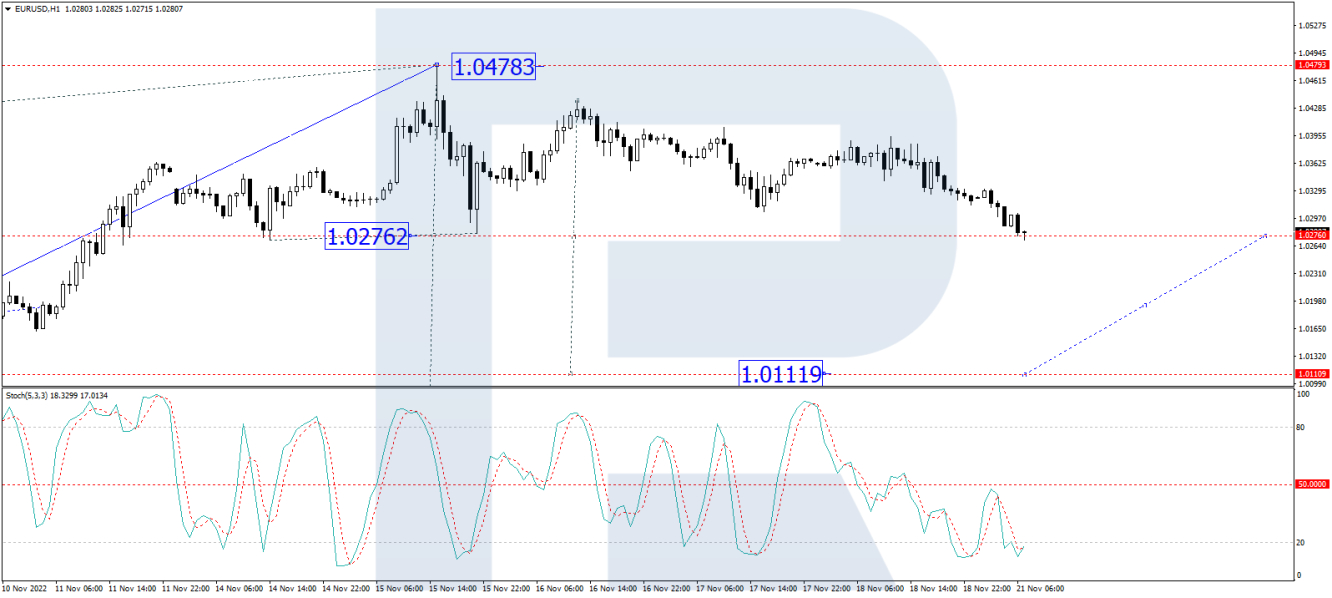

On H1, EUR/USD has completed a structure of decline to 1.0276. At the moment, a consolidation range is forming around it. An escape upwards and a link of correction to 1.0350 are not excluded.

After it is reached, a link of decline to 1.0111 will happen. The goal is local. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is near 20 and continues to decline.

Disclaimer: Any forecasts contained herein are based on the author's opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.