EUR/USD has edged lower in the Thursday session. Currently, the pair is trading at 1.1620, down 0.05% on the day. On the release front, German Final CPI dipped to 0.1%, matching the forecast. The ECB releases its main refinancing rate, which is expected to remain at 0.00%. The U.S releases key consumer inflation reports. CPI is expected to edge up to 0.3%, while Core CPI is forecast to remain pegged at 0.2%. As well, unemployment claims are expected to rise to 213 thousand. On Friday, the U.S release retail sales and UoM Consumer Sentiment.

The ECB has pegged interest rates at 0.00% since March 2016, and no change is expected at Thursday’s policy meeting. The markets will be focusing on the rate announcement and Mario Draghi’s press conference. The Bank is expected to lower its growth forecast due to weaker global growth and could spell out downside risks to growth. Inflation is expected to remain steady at 1.8% in 2018 in 2019, which means that the ECB is on track to wind up its asset-purchase program in December. Any change in monetary policy will not occur before next year, and an interest rate hike in unlikely before the second half of 2019.

German ZEW economic surveys are well respected and often have an impact on the movement of the euro. Earlier in the week, ZEW Economic Sentiment improved in September, but remains mired in negative territory. The indicator came in at -10.6, posting a decline for a sixth straight month. The survey press release noted that during the survey period, Turkey and Argentina saw their currencies plunge, and German industrial production was soft. On Thursday, German Final CPI dipped to 0.1%, down from 0.3% a month earlier.

EUR/USD Fundamentals

Thursday (September 13)

- 2:00 German Final CPI. Estimate 0.1%. Actual 0.1%

- 2:45 French Final CPI. Estimate 0.5%. Actual 0.5%

- 7:45 ECB Main Refinancing Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US CPI. Estimate 0.3%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 210K

- 10:00 US FOMC Member Rafael Bostic Speaks

- 10:30 US Natural Gas Storage. Estimate 65B

- 13:01 30-year Bond Auction

- 13:15 US FOMC Member Raphael Bostic Speaks

- 14:00 US Federal Budget Balance. Estimate -169.8B

Friday (September 14)

- 5:00 Trade Balance. Estimate 16.3B

- 8:30 US Core Retail Sales. Estimate 0.5%

- 8:30 US Retail Sales. Estimate 0.4%

- 8:30 US Import Prices. Estimate -0.2%

- 9:15 US Capacity Utilization Rate. Estimate 78.3%

- 9:15 US Industrial Production. Estimate 0.3%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 96.7

- 10:00 US Business Inventories. Estimate 0.5%

- 10:00Preliminary UoM Inflation Expectations

*All release times are DST

*Key events are in bold

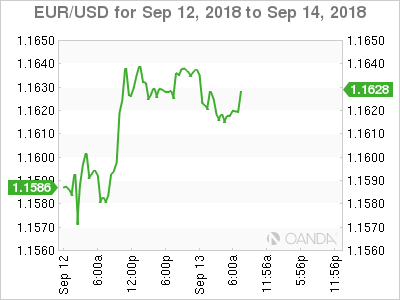

EUR/USD for Thursday, September 13, 2018

EUR/USD for September 13 at 6:30 DST

Open: 1.1626 High: 1.1643 Low: 1.1609 Close: 1.1620

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1312 | 1.1434 | 1.1553 | 1.1637 | 1.1718 | 1.1840 |

EUR/USD ticked higher in the Asian session but retracted in European trade

- 1.1553 is providing support

- 1.1637 was tested earlier in resistance. It is a weak line

Further levels in both directions:

- Below: 1.1553, 1.1434 and 1.1312

- Above: 1.1637, 1.1718, 1.1840 and 1.1961

- Current range: 1.1553 to 1.1637