EUR/USD has edged higher on Friday, recovering the losses sustained on Thursday. Currently, the pair is trading at 1.1324, up 0.18% on the day. On the release front, the focus is on inflation data. German WPI rebounded after two straight declines, posting a gain of 0.3%. In the eurozone, CPI came in at 1.5% and Core CPI gained 1.0%, as both readings matched their estimates. In the U.S., there are two key events. The Empire State Manufacturing Index is expected to climb to 10.1, while UoM Consumer Sentiment is projected to remain at 95.5 points.

In the eurozone, inflation levels remain below the ECB target of around 2 percent. There were no surprises from February data, as German and eurozone CPI was within expectations. At a time when Germany and the rest of the eurozone are mired in an economic slowdown, the bank is unlikely to raise rates until there is a significant improvement in economic data. Back in 2018, the ECB had projected raising rates later this year, but the worsening economic landscape has forced the ECB to push back its forecast for future rate hikes. In last week’s rate statement, the ECB set guidance at maintaining rates until 2020, and this dovish stance soured investors on the euro, sending the currency sharply lower.

With the U.S-China trade war showing signs of easing, there were expectations that President Trump and Chinese President Xi might hold a summit in late March. However, it was reported on Wednesday that the two leaders will not meet before April. This has raised concerns that the sides have not managed to resolve their differences. Trump has said that he is not in a rush to reach an agreement, but a deal with China would be a huge victory for Trump ahead of the U.S. election in 2020. If there are further signs that an agreement between the U.S. and China remains elusive, risk appetite could sour and hurt the euro.

EUR/USD Fundamentals

Friday (March 15)

- 3:00 German WPI. Estimate 0.3%. Actual 0.3%

- 6:00 Eurozone Final CPI. Estimate 1.5%. Actual 1.5%

- 6:00 Eurozone Final Core CPI. Estimate 1.0%. Actual 1.0%

- 8:30 US Empire State Manufacturing Index. Estimate 10.1

- 9:15 US Capacity Utilization Rate. Estimate 78.5%

- 9:15 US Industrial Production. Estimate 0.4%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 95.5

- 10:00 US JOLTS Openings. Estimate 7.27M

- 10:00 US Preliminary UoM Inflation Expectations

- 16:00 US TIC Long-Term Purchases. Estimate -6.9B

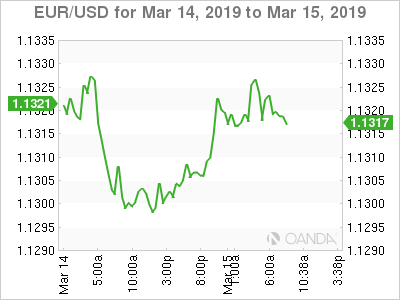

EUR/USD for Friday, March 15, 2019

EUR/USD for March 15 at 6:40 DST

Open: 1.1304 High: 1.1329 Low: 1.1300 Close: 1.1326

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1120 | 1.1212 | 1.1300 | 1.1434 | 1.1553 | 1.1610 |

EUR/USD posted small gains in Asian trade and is showing limited movement in European trade

- 1.1300 is a weak support level

- 1.1434 is the next resistance line

- Current range: 1.1300 to 1.1434

Further levels in both directions:

- Below: 1.1300, 1.1212, 1.1120 and 1.1046

- Above: 1.1434, 1.1553 and 1.1610