Whilst knowledge that the Fed has its back boosted market sentiment on Wednesday evening investors are starting to get jittery as they look ahead to US GDP. While German GDP released this morning disappointed coming in at -10.1%, instead of the forecast -9.0%. German unemployment was slightly lower than expected.

Fed has your back

As expected, the Fed kept interest rates unchanged at near 0%. Federal Reserve Chairman Jerome Powell provided the markets with a healthy dose of reality highlighting that the COVID-19 pandemic was far from over and that the US economy was facing mounting challenges. Uncertainty remains high and the path forward depends on the virus.

The Fed promised to use its full range of tools if needed showing it remains prepared to do whatever it takes. The Fed’s large presence in the market boosted sentiment with Wall Street closing in positive territory.

His comments come as the number of coronavirus cases in the US continues to rise at an alarming rate. Deaths in the three largest states, California, Florida and Texas hit record highs.

US GDP today

The mood in the market has turned jittery as investors look ahead to US GDP data. The US economy is forecast to contract -34.1% in Q2 YoY after a 5% annualized contraction in Q1. This would be the largest decline on record as the lockdown in April and part of May sent consumer spending plunging and saw business investment dry up. The unprecedented nature of the coronavirus crisis leaves plenty of room for surprises.

Q2 is expected to be as bad as it gets. However, concerns are growing over the recovery as COVID numbers show little sign of slowing.

Recovery in US labor market still stalling?

US jobless claims will also provide further insight as to how the recovery in the US labor market is progressing. Last week jobless claims pointed to the recovery in the labor market stalling. Whilst one week by no means constitutes a new trend, two weeks of a stalling recovery could be more unnerving and drag sentiment lower.

FAANGs to report

Later today the remainder of the FAANGs report. They do so after a phenomenal run-up from mid-March lows. However, since reaching recent all-time highs the rally in the FAANGs has run out of steam. Expectations are high, leaving plenty of room for disappointment.

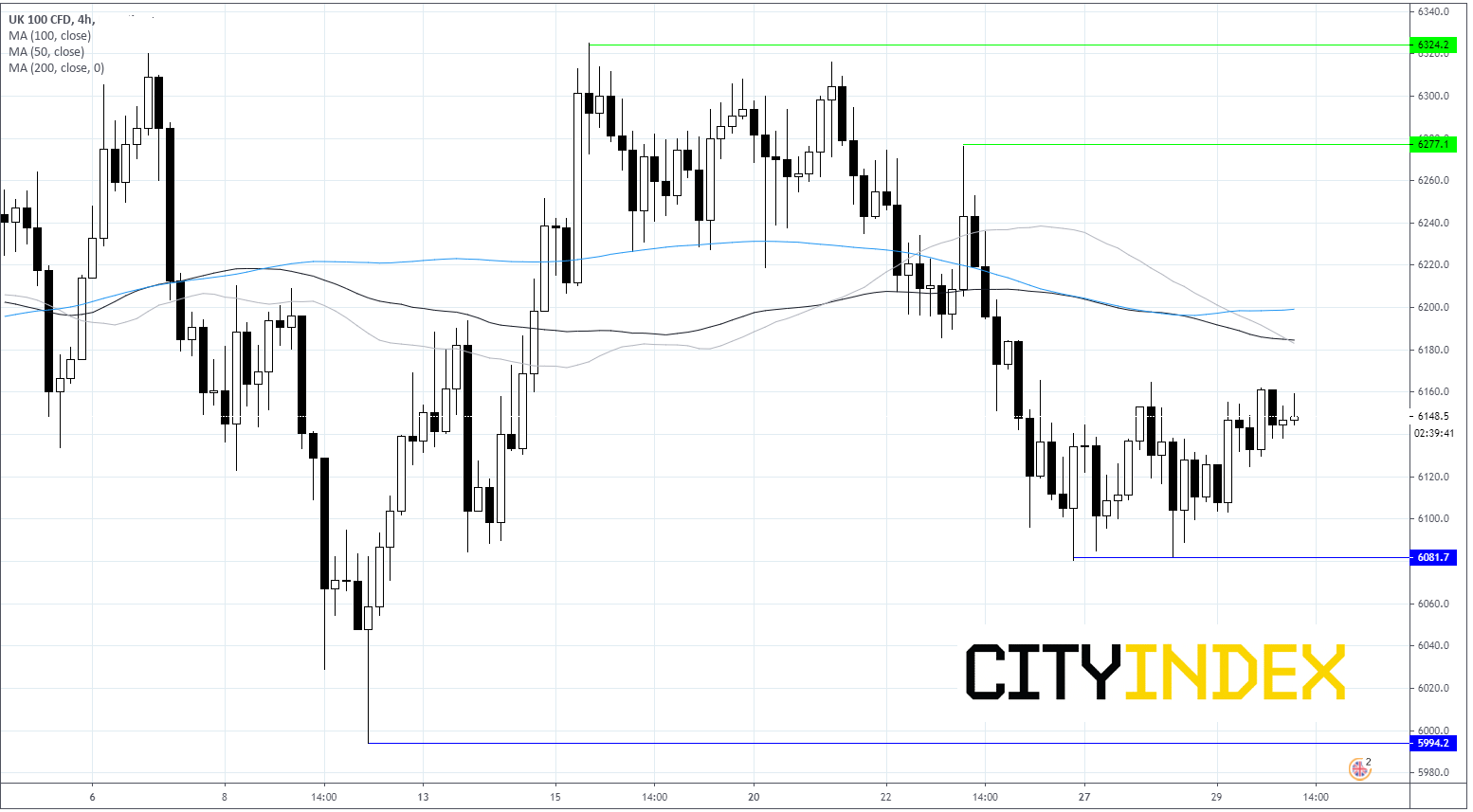

FTSE Chart