- ECB expected to hold rates

- Fed’s Powell signals rate cuts in 2024

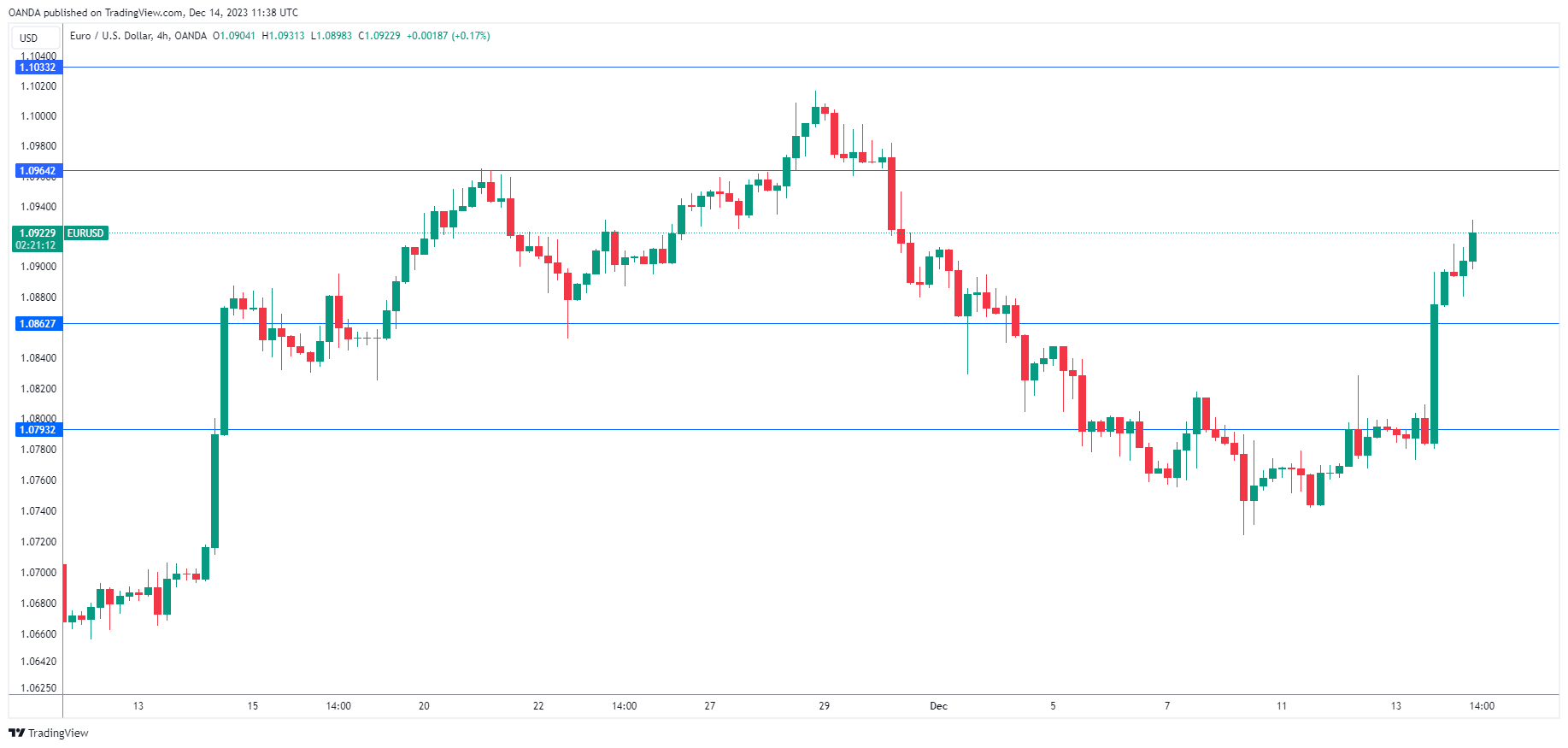

- There is resistance at 1.0964 and 1.1033

- 1.0862 and 1.0793 are providing support

The euro has extended its gains in Thursday trading. In the European session, EUR/USD is trading at 1.0925, up 0.45%. It has been a good week for the euro, which has climbed 1.5% against the US dollar.

ECB Expected to Pause

The European Central Bank meets later on Wednesday and is widely expected to hold rates at 4.0% for a second straight time. The markets will be focusing on the rate statement and ECB President Lagarde’s post-meeting remarks. Lagarde has been hawkish, stressing the need to maintain rates in restrictive territory for a prolonged period – “higher for longer”.

The markets are more dovish and have priced in rate cuts for 2024, with a first cut as early as the spring. The economic landscape in the eurozone could support the market’s view. Inflation has fallen sharply and is at 2.4%, within striking distance of the Bank’s 2% target. The economy has cooled due to high interest rates and is likely in a mild recession.

Will Lagarde push back against market expectations of rate cuts? Or will she set a more dovish stance and avoid ruling out rate cuts? The tone of the rate statement and Lagarde’s comments could have a strong effect on the movement of the euro today.

Fed Surprises With a Dovish Shift

The Federal Reserve maintained the benchmark rate at a target range of 5.25%- 5.50% for a third straight time. That was not a surprise but Fed Chair Powell provided plenty of drama as he pivoted from his usual hawkish rhetoric. There had been expectations that Powell would push back against growing speculation that the Fed would trim rates in 2024. Powell not only failed to push back, he signalled that the Fed expected to cut rates three times next year.

Powell’s dovish message sent equities flying higher and the US dollar tumbling. Just two weeks ago, Powell said it would be “premature” to speculate about the timing of rate cuts and that the door was still open to further hikes. There is still a deep disconnect between the markets and the Fed, as the markets have now priced in six rate cuts in 2024.