- EURJPY edges higher after 50-day SMA prevents decline

- Jumps back within its bullish channel in place since June

- Momentum indicators turn positive

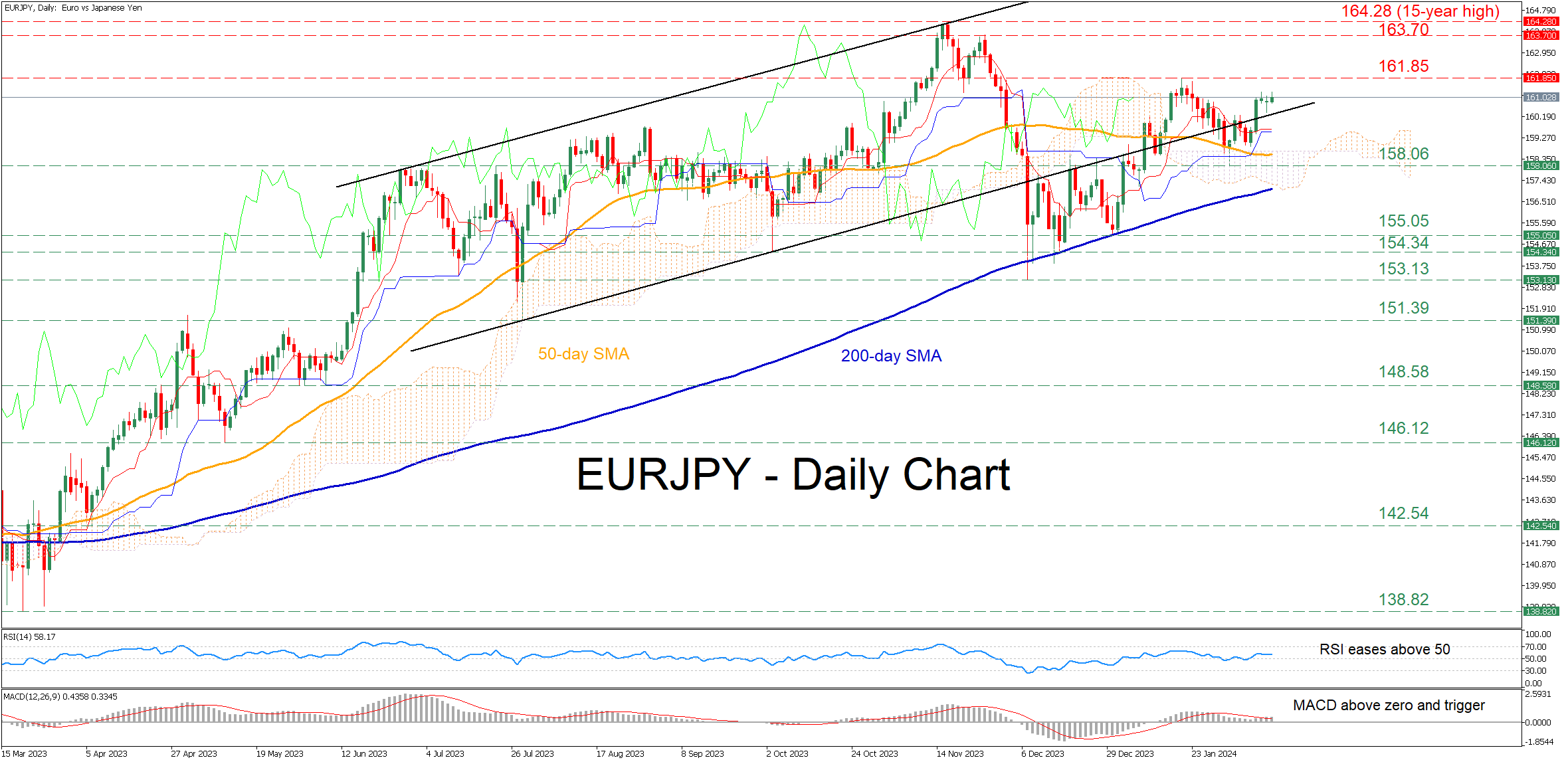

EURJPY had been sliding lower in the short term, following its rejection at 161.85 in late January. Nevertheless, the pair managed to quickly recoup most of its losses after the 50-day simple moving average (SMA) curbed its downside, re-entering its medium-term bullish channel.

EURJPY had been sliding lower in the short term, following its rejection at 161.85 in late January. Nevertheless, the pair managed to quickly recoup most of its losses after the 50-day simple moving average (SMA) curbed its downside, re-entering its medium-term bullish channel.

Given that both the RSI and MACD are within their positive zones, the price may revisit the January high of 161.85. Should that barricade fail, the spotlight could turn to the November resistance of 163.70. A break above that area could pave the way for the 15-year peak of 164.28.

Alternatively, if the rebound falters and the pair drops back below its upward sloping channel, the February support of 158.06 could act as the first line of defence. Further declines could then come to a halt at the January low of 155.05 ahead of the October support of 154.34. Even lower, the December bottom of 153.13 could provide downside protection.

In brief, EURJPY has been on track to erase the recent pullback after finding its feet at the 158.06 mark. Hence, a break above the recent rejection region of 161.85 could bring the multi-year highs registered in 2023 under scrutiny.