It is not the job of a currency pair to rise 16% in a matter of months. That’s what stocks and crypto are for. Yet, between August 2022 and March 2023, EUR/CAD surged from 1.2876 to as high as 1.4939, showing that even Forex traders can sometimes “buy and hold. “ Only sometimes, though, because this strategy only works until it doesn’t.

With the pair currently hovering near 1.4700, traders are wondering if its rally can continue. We’re wondering the same thing. However, correctly deciphering the plethora of macro factors that influence the foreign exchange market is next to impossible. That’s why we rely on Elliott Wave analysis instead, whose patterns are known for their ability to absorb related news and events.

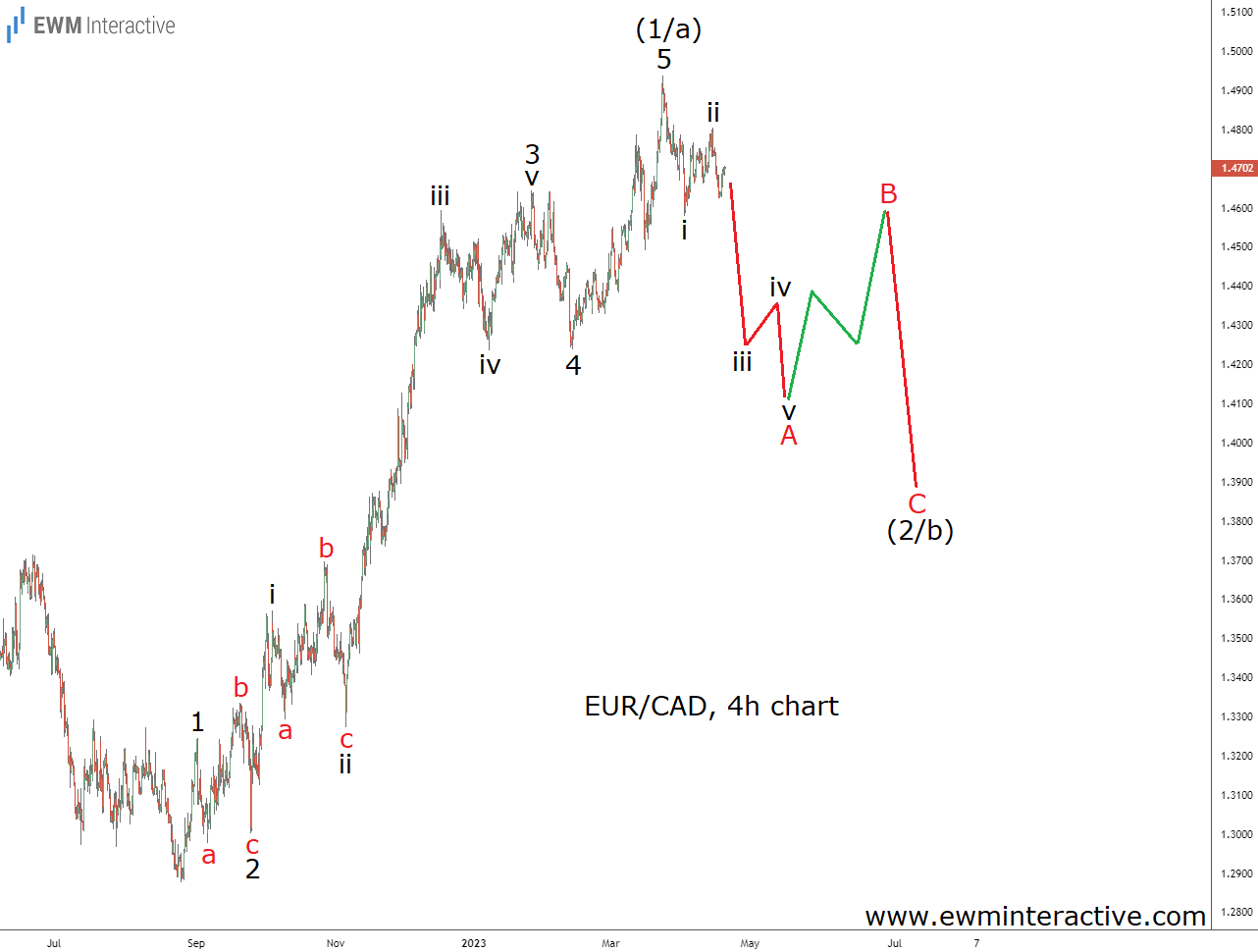

The 4h chart of EURCAD reveals that the surge from 1.2876 to 1.4939 is a five-wave impulse. We’ve labeled the pattern 1-2-3-4-5. The five sub-waves of wave 3 are also visible and marked i-ii-iii-iv-v. The pair has taken the guideline of alternation into account, as well. Waves 2 and ii have taken the shape of sideways flat corrections, while waves iv and 4 are both sharp drops.

If this count is correct, 1.4939 marks the end of wave 5 and thus the completion of the entire wave (1/a). According to the theory, a three-wave correction follows every impulse. Here, we can expect a drop back below the 1.4000 mark and towards 1.3800 in wave (2/b). It looks like EURCAD bulls are going to take a longer rest before showing up again.