EUR/USD: FOMC minutes may spur profit taking on recent rally

Macroeconomic overview: The head of the Federal Reserve Bank of Philadelphia Patrick Harker said that U.S. interest rate hike next month is a "distinct possibility”. He added that another disappointing reading on monthly inflation could cause the U.S. central bank to hold back. Minneapolis Federal Reserve Bank President Neel Kashkari said that while the U.S. economy is closer now than it was in March to full employment, he still does not know "if we are there yet," and that the recent decline in core inflation is "concerning." His comments follow Fed Governor Lael Brainard's assessment Monday that there was still a "question" about whether, at 4.4% unemployment, there was still slack left in the U.S. labor market.

The Fed releases minutes of its April meeting on Wednesday, and many investors anticipate it will add to expectations that the Fed is firmly on course to another rate hike in June. But remarks this week from Brainard, Kashkari and Dallas Fed President Robert Kaplan suggest that at least some are still feeling their way. Kaplan on Monday expressed confidence in the Fed's plan to raise rates two more times this year, but said he planned to be "patient" when it comes to making sure inflation is on track toward the Fed's goal.

Kashkari is one of the central bank's most dovish policymakers and in March was the lone dissenter against the Fed's decision to raise rates. Asked if he would dissent once more next month, he said he has not decided. We think it is reasonable to expect a hike in June, but with slightly more dovish statement, which would be USD-negative. Investors are now turning their focus towards the Federal Reserve's monetary policy stance. Minutes of the Fed's latest policy-setting meeting are set for publication at 18:00 GMT today. The market already expects the Fed to raise interest rates in June, but given the greenback's recent weakness, dollar bulls are expected to welcome any hawkish hints by the central bank.

Technical analysis: The pullback from 1.1267 high on May 27 high begins to pick up speed. Monday’s low 1.1160 is near-term support. In our opinion deeper corrective move is possible in the coming days, to 50% fibo of May rally at 1.1054.

Short-term signal: We got short at 1.1183, as we expect that today’s FOMC minutes will spur some profit taking on recent EUR/USD rally.

Long-term outlook: Bullish

USD/CAD: Stay cautious ahead of BoC statement, OECD meeting is likely to support the CAD tomorrow

Macroeconomic overview: The Canadian dollar eased modestly against its U.S. counterpart on Tuesday after notching a nearly one-month high earlier in the session, as the greenback bounced from recent lows on expectations of a U.S. interest rate hike in June. Traders were also awaiting the U.S. Federal Reserve's latest policy-setting meeting minutes, due to be released on Wednesday, for further clues on what the central bank may do at its June meeting.

In Canada, the Bank of Canada is widely expected to hold interest rates at 0.50% today. The loonie is likely to weaken if the Bank of Canada maintains a cautious tone in contrast to the Fed and amid ongoing worries about an overheated Canadian housing market.

We think that CAD depreciation will be short-lived. Some relief for the CAD could come from the OPEC meeting. On Thursday, OPEC will meet in Vienna to discuss a six-month extension of the decision of 27 November 2016 to cut oil production by 1.8m barrels per day (together with key non-OPEC countries) in order to restore the global-oil supply-and-demand balance and to reduce the global stock overhang. Saudi Arabia and Russia, the largest participants of the output cut, already announced on 15 May that they had reached an agreement to extend their oil output cuts for another nine months, through March 2018. This increases the probability that all other members will also agree to such an extension.

Technical analysis: USD/CAD hit a fresh cycle low yesterday. The pair broke 50% fibo of April-May rise at 1.3507, but did not manage to close below that level. Today’s BoC statement and FOMC minutes may support recovery moves. But we think that medium-term bias remains bearish and the USD/CAD is likely to fall further in reaction to OPEC decision on Thursday.

Short-term signal: Profit taken on USD/CAD short at 1.3535. We stay cautious ahead of BoC statement and FOMC minutes, but will be looking to get short as OECD meeting should support the CAD.

Long-term outlook: Flat

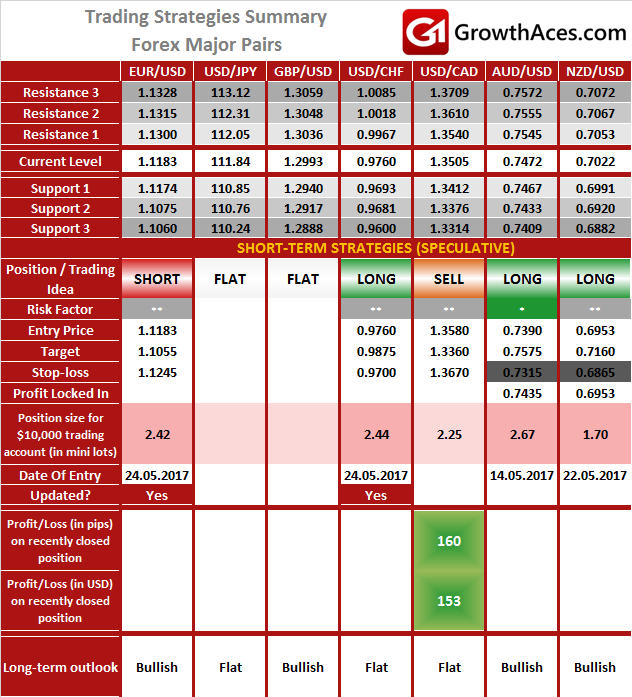

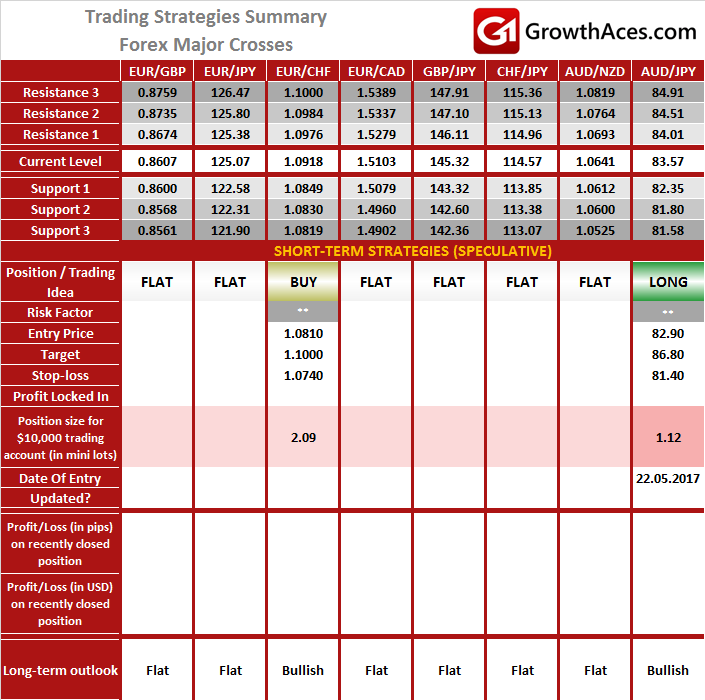

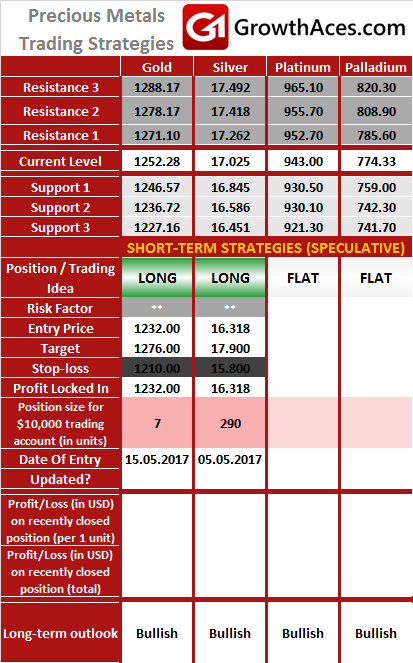

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR PAIRS:

FOREX - MAJOR CROSSES:

PRECIOUS METALS:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Source: GrowthAces.com - your daily forex trading strategies newsletter