For nearly the last couple of weeks the Euro has fallen strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks near 1.31. Despite a couple of rallies back above 1.32 in the last 48 hours, it has continued to drift lower and fall below 1.3150. For about a week or so the Euro was placing upward pressure on the 1.34 level however it stood firm. A couple of weeks ago the Euro made a run at the 1.34 level only to be turned away yet again and ease back under – this has been the story for the last few weeks. A few weeks ago it retreated heavily from above 1.34 after having reached a six month high around 1.3450. Over the last few weeks it has made several attempts to push through the 1.34 level only to be consistently repelled with ample supply. Several weeks ago it spent about a week drifting lower from the resistance level at 1.34 back towards the previous resistance level of 1.33. This level provided very little support for the Euro as it continued to move down strongly towards 1.3230 before consolidating recently above the support level at 1.3250.

Looking at the bigger picture the Euro has spent most of the last six weeks or so trading within a range between 1.32 and 1.34, with the former level now in the spotlight as it tries to prop up the Euro and keep it within the range. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period earlier in July when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750. After reaching a four month high above 1.34 about seven weeks ago, the EUR/USD was in the midst of a very solid medium term down trend which has seen it fall sharply.

Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

German industrial orders fell more than expected in July but a sharp upward revision for the previous month suggested the industrial sector in Europe’s largest economy has extended its recovery into the third quarter. A plunge in euro zone orders for capital goods drove a 2.7 percent drop in industry orders in July, seasonally adjusted data from the Economy Ministry showed on Thursday, missing the consensus forecast in a Reuters poll for a 1 percent fall. But the reading for June was revised up to a 5.0 percent surge, the sharpest rise in more than two and a half years, from a previously reported 3.8 percent. The ministry said bulk orders were slightly below average in July. Industry intake remained overall on a moderate upward path, rising 3.3 percent over June and July compared with the previous two months, it added.

EUR/USD September 6 at 01:20 GMT 1.3124 H: 1.3223 L: 1.3110

During the early hours of the Asian trading session on Friday, the Euro is consolidating in a narrow range right around 1.3120 after having recently dropped sharply from above 1.32 in the last 24 hours. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again, although it has just eased back to 1.32 recently. Current range: right around 1.3120.

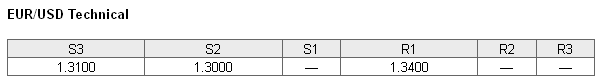

Further levels in both directions:

• Below: 1.3100 and 1.3000.

• Above: 1.3400.

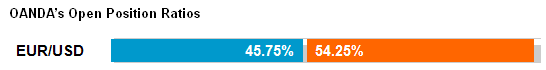

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved back up above 40% even though the Euro has slumped back below 1.32. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 05:00 JP Leading indicator (Prelim.) (Jul)

- 05:00 JP BoJʼs Monthly Economic Report for September

- 08:30 UK Industrial Production (Jul)

- 08:30 UK Manufacturing Production (Jul)

- 08:30 UK Trade Balance (Jul)

- 12:30 CA Unemployment (Aug)

- 12:30 CA Labour Productivity (Q2)

- 12:30 US Private & Non-farm Payrolls (Aug)

- 12:30 US Unemployment (Aug)

- 14:00 CA Ivey PMI (Aug)