EUR/USD has posted modest losses on Tuesday, continuing the downward trend which started on Monday. In Tuesday’s North American session, the pair is trading in the high-1.34 range. After a convincing electoral win in Germany, Chancellor Angela Merkel now faces the tough task of putting together a coalition government. In economic news, German Ifo Business Climate fell short of the estimate. In the US, today’s major release is CB Consumer Confidence. As well, FOMC Member Esther George will address an event in Chicago.

On Sunday, German Chancellor Angela Merkel was re-elected to a third straight term in convincing style. Merkel’s conservative bloc won about 41.5% of the vote, but the bloc did not win a super majority, which would have enabled it to form the government on its own. This means that Merkel will have to reach out to one of the opposition parties to form a coalition, which could lead to some political uncertainty. The most likely scenario is a coalition with the center-left SPD, but that party’s head, Ralf Stenger, is in no rush and can afford to wait to wait for a generous offer from Merkel. Merkel’s big win is good news for the euro, but the ensuing political uncertainty is not.

Euro zone, German and French PMIs were released on Monday, and the results were a mix. Interestingly, there was a solid consistency among the releases, as all of the Manufacturing PMIs lost ground, while the Services PMIs improved. On a positive note, all of the PMIs posted readings above the 50-point level, with the exception of French Flash Manufacturing PMI. This means that with the exception of the French manufacturing industry, the PMIs continue to point to expansion in the services and manufacturing sectors.

The markets have settled down after the US Federal Reserve stunned the markets in deciding not to taper QE at its policy meeting last week. Most analysts had expected the Fed to announce a scaling down of the present bond-buying program of $85 billion/mth by $10-15 billion. However, the Fed was of the opinion that US economic data, particularly employment numbers, did not justify scaling down QE at this time. After the FOMC Statement, Federal Reserve Bank of St. Louis President James Bullard shed some light on the dramatic move (or lack of) by the Federal Reserve. Bullard said the vote was close, but weaker US numbers led to a decision not to taper. He added that the Fed may go ahead with “small” reductions to QE at its next policy meeting in October.

Overshadowed by the FOMC Statement were some excellent US releases on Thursday. Unemployment Claims came in at 309 thousand, well below the estimate of 331 thousand. Existing Home Sales rose to 5.48 million, crushing the estimate of 5.27 million and posting its best level in over three years. The Philly Fed Manufacturing Index rocketed from 9.3 to 22.3 points, its best showing since May 2011. Perhaps if we’d seen this kinds of numbers a week or two ago, the Fed might have introduced QE tapering. In any event, the strong numbers failed to bolster the US dollar, which was broadly down after the non-taper announcement from the Fed.  EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

- EUR/USD continues to trade in the high-1.34 range in Tuesday trading.

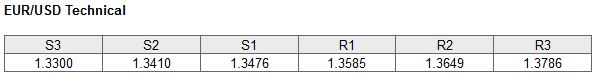

- The pair is facing resistance at 1.3585. The next line of resistance is at 1.3649. This line has remained intact since February.

- On the downside, the pair is testing support at 1.3476. This is followed by a support level at 1.3410.

- Current range: 1.3476 to 1.3585

Further Levels

- Below: 1.3476, 1.3410, 1.3300, 1.3162 and 1.3100

- Above: 1.3585, 1.3649, 1.3786, 1.3893 and 1.4000

EUR/USD ratio is pointing to movement towards long positions in Tuesday trading. This is not reflected in the current movement of the pair, as the pair is showing little movement. The ratio continues to have a solid majority of short positions, indicative of a strong trader bias towards the US dollar continuing to post gains at the expense of the euro.

EUR/USD is trading quietly, showing little reaction to the German elections and key Eurozone releases this week. With the US releasing key consumer confidence numbers later today, we could see further activity from the pair if the release is not in line with the market’s expectations.

EUR/USD Fundamentals

- 8:00 German Ifo Business Climate. Estimate 108.4. Actual 107.7 points.

- 13:00 Belgium NBB Business Climate. Estimate -7.1 points.

- 13:00 S&P/CS Composite-20 HPI. Estimate 12.5%.

- 13:00 US HPI. Estimate 0.9%.

- 14:00 US CB Consumer Confidence. Estimate 79.9 points.

- 14:00 US Richmond Manufacturing Index. Estimate 17 points.

- 17:00 US FOMC Member Esther George Speaks.

*All release times are GMT

Original post