The euro has posted small losses in the Thursday session. Currently, EUR/USD is trading at the 1.15 line. On the release front, German PPI improved to 0.0%, above the estimate of -0.1%. The eurozone current surplus jumped to EUR 30.1 billion, well above the estimate of EUR 23.3 billion.

Later in the day, the ECB meets for a policy meeting. In the US, there are two key events. Unemployment claims is expected to edge lower to 245 thousand, and Philly Fed Manufacturing Index is forecast to slip to 23.4 points.

All eyes are on the ECB, which will release a rate statement, followed by a press conference with Mario Draghi. In December 2016, the bank tapered QE while extending the scheme until December, and this type of scenario could be adopted once again. Will the bank make a similar move at this meeting? OANDA Senior Currency Analyst Craig Erlam explains that we’re unlikely to see any moves today, but the markets are casting a glance ahead to the September meeting:

While we’re not expecting any changes from the ECB today, it’s €60 billion a month asset program expires at the end of the year and traders are looking for clues regarding what comes next. An announcement on this is unlikely until September when it releases its new macro-economic projections but Mario Draghi may offer some insight into what we can expect during the press conference.

The most likely decision, despite the central bank still falling well short of its inflation target, will be to cut its purchases by another €20 billion as it did in April and extend by another six months. There has been a lot of speculation about a more explicit phasing out but I think the ECB want to be more careful given the fragile nature of the recovery. The result will likely be the same though with the central bank ending its quantitative easing program either at the end of 2018 or early 2019.

President Trump hasn’t done very well at learning how to tango with Congress, and this week’s debacle on Capitol Hill could make the gap between Trump and Republican lawmakers even harder to bridge. Trump had vowed to replace Obamacare, but his health care bill has stalled in the Senate before lawmakers even had a chance to vote on the proposal.

With some conservative Republicans coming out against the bill, it’s questionable if the Republicans can pass another version before Congress takes a recess in August. Trump had promised to pass a health care before the summer break, so his credibility will take another hit if he’s unable to do so. Trump has been in office for six months, but has been unable to get Congress to pass any significant bills, even though the Republicans enjoy a majority in both houses of Congress.

With this latest setback, there is growing skepticism as to whether Trump will be able to convince Congress to pass other key parts of his agenda; tax reform and fiscal spending. This paralysis on Capitol Hill has deepened investor pessimism about Trump’s legislative agenda and is weighing on the US dollar.

Traders Eye ECB Move in September

Will Draghi Drop Any Tapering Clues?

EUR/USD Fundamentals

Thursday (July 20)

- 2:00 German PPI. Estimate -0.1%. Actual 0.0%

- 4:00 Eurozone Current Account. Estimate 23.3B. Actual 30.1B

- Tentative – Spanish 10-y Bond Auction

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US Unemployment Claims. Actual 245K

- 8:30 US Philly Fed Manufacturing Index. Estimate 23.4

- 10:00 Eurozone Consumer Confidence. Estimate -1

- 10:00 US CB Leading Index. Estimate 0.4%

- 10:30 US Natural Gas Storage. Estimate 39B

*All release times are EDT

*Key events are in bold

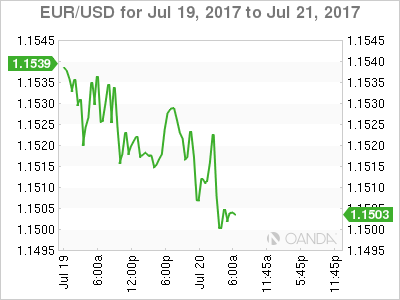

EUR/USD for Thursday, July 20, 2017

EUR/USD Thursday, July 20 at 5:40 EDT

Open: 1.1529 High: 1.1529 Low: 1.1495 Close: 1.1505

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1242 | 1.1366 | 1.1465 | 1.1534 | 1.1616 | 1.1712 |

EUR/USD posted slight gains but then retracted in the Asian session. The pair has ticked lower in European trade

- 1.1465 is providing support

- 1.1534 is a weak resistance line

Further levels in both directions:

- Below: 1.1465, 1.1366 and 1.1242

- Above: 1.1534, 1.1616, 1.1712 and 1.1866

- Current range: 1.1465 to 1.1534

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged this week. Currently, short positions have a majority (69%), indicative of EUR/USD continuing to drop lower.