EUR/USD is showing limited movement on Friday, as the pair is trading slightly below the 1.09 line. In the US, banks and bond markets are closed for Veterans Day, but the stock markets are open, so we can expect lighter trading during the day. On the release front, German Final CPI posted a small gain of 0.2%, matching the forecast. In the US, today’s highlight is UoM Consumer Sentiment. The indicator is expected to edge lower to 87.4 points.

The markets went on a wild roller-coaster ride on Wednesday, following the stunning news that Donald Trump had won the US presidential election. Political convention was sent on its head, as most pundits had predicted that Hillary Clinton would win the White House.

Trump’s election victory which has already been labeled the most stunning win in US election history, sent shock waves across global markets to an extent not seen since the Brexit vote in June. The euro surged in a tumultuous Asian session on Wednesday, but the dollar quickly recovered and continues to gain ground, as EUR/USD has dropped 1.8% this week.

What will a Trump election mean for the markets? Like much of his agenda, Trump’s economic platform is unclear. According to Bank of America Merrill Lynch, given that both houses of Congress are under Republican control, Trump could implement steps to loosen fiscal policy. This would lead to greater spending, causing more inflation. In turn, interest rates would move higher and bolster the US dollar.

However, Trump remains an enigma, having never held public office. His ideology is unclear (if he has one), so the markets could be in for a period of uncertainty, at least in the early stages of the Trump administration. This could lead to prolonged volatility in the currency markets. As far as monetary policy is concerned, the odds of a rate hike in December also showed some volatility immediately after the election, but are back at 71 percent, identical to the odds just before the Trump victory.

EUR/USD Fundamentals

Friday (November 11)

- 7:00 German Final CPI. Estimate 0.2%. Actual 0.2%

- 7:00 German WPI. Estimate 0.2%. Actual 0.4%

- 14:00 US FOMC Member Stanley Fischer Speaks

- 15:00 US Preliminary UoM Consumer Sentiment

- 15:00 US Preliminary UoM Inflation Expectations

*All release times are EDT

* Key events are in bold

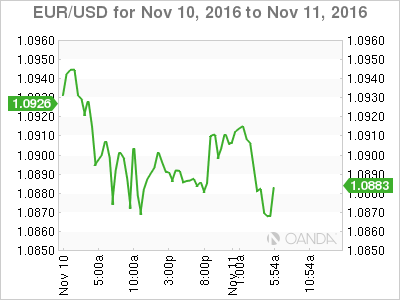

EUR/USD for Friday, November 11, 2016

EUR/USD November 11 at 9:20 GMT

Open: 1.0887 High: 1.0923 Low: 1.0870 Close: 1.0879

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0557 | 1.0708 | 1.0821 | 1.0957 | 1.1054 | 1.1150 |

- EUR/USD posted small gains in the Asian session but has retracted in European trade

- 1.0821 is providing support

- There is resistance at 1.0957

Further levels in both directions:

- Below: 1.0821, 1.0708, 1.0557

- Above: 1.0957, 1.1054 and 1.1150

- Current range: 1.0821 to 1.0957

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Friday session, consistent with the lack of movement from EUR/USD. Currently, short positions have a majority (60%), indicative of trader bias towards EUR/USD continuing to move lower.