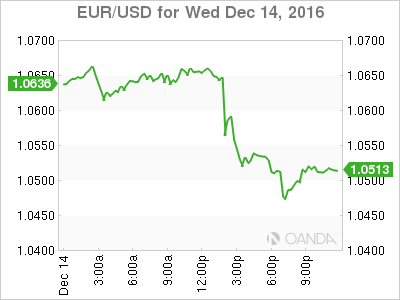

EUR/USD finally cracks 1.0500 as the Federal Reserve puts more dots then expected in its plots.

EUR/USD and 1.0500 seem to be a bit like the Fed’s rate hike last night. A TV programme's season finale that has just dragged on far too long. This morning in Asia though the series finale finally came to an end with the euro breaking 1.0500, triggering some messy price action as options strikes and stop losses were finally taken out.

EUR/USD has been flirting with 1.0500 a number of times since April 2015. Almost as long, it seems, as it has taken MS Yellen and Co. to stop waiting and seeing and assimilate more ”data.”

Overnight we had the briefest of touches at 1.0495 before early Asia finally swung the bat and this saw EUR/USD drop to 1.0465. Perhaps more strangely, EUR didn’t loiter there at all. After touching the lows we saw a just as rapid short squeeze take us back to 1.0520 before we settled around 1.0500/10.

Talking to a few contacts on the wholesale Treasury side, it looks as if after the initial options cull and stop-loss run they saw a lot of real money buying from corporates and investment funds doing year-end rebalancing before the holiday season sets in with a vengeance next week. These flows will make themselves felt in a variety of currencies in the next two days and should be regarded as transitory in their effects.

The low of 1.0465 was just shy of March 2015’s 1.0460 low. These two levels are initial support with last night’s high of 1.0667, first resistance on the daily chart.

Looking at the big picture, a weekly close below the 1.0460/65 level opens up a move to the 1.0100 area on a technical basis, last seen way back at the end of 2002. Interesting times indeed!

Disclosure: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.