The euro has posted slight losses in the Monday session. Currently, EUR/USD is trading at 1.1450. On the release front, it’s a very quiet start to the week. Eurozone Final CPI edged down to 1.3%, matching the forecast. In the US, today’s sole event is the Empire State Manufacturing Index, which is expected to dip to 15.8 points.

Inflation levels in the US remain stubbornly low, but the Federal Reserve remains convinced that it’s only a matter of time before inflation levels move higher. This stance was reiterated by Fed Chair Janet Yellen last week, as she testified before congressional and senate committees. With the labor market close to capacity and the unemployment rate at just 4.4%, economists are puzzled why this hasn’t pushed inflation to higher levels. In her testimony, Yellen admitted that the Fed was at a loss to explain the lack of inflation, but insisted that it was “premature to conclude that the underlying inflation trend is falling well short of 2 percent”, and that with a strong labor market “the conditions are in place for inflation to move up”. Is Yellen’s argument just wishful thinking? The markets aren’t buying in, with the odds of a December hike at just 43%, according to the CME Group (NASDAQ:CME).

Fed policymakers surely weren’t smiling after Friday’s consumer inflation and spending numbers. CPI edged up to 0.0%, short of the forecast of 0.1%. There was no relief from Retail Sales, which declined 0.2%, missing the estimate of 0.1%. This marked the third decline in the past four months. Consumer spending accounts for 2/3 of US economic activity, so it’s no surprise that weak spending has also meant weak inflation, despite Yellen’s claim that low inflation is a temporary phenomenon. The economy had a weak first quarter, with growth of just 1.4%. If the second quarter follows suit, investors could sour on the US dollar in favor of other assets, and the euro could take advantage.

Eurozone inflation levels continue to soften. Eurozone Final CPI edged down from 1.4% to 1.3% in June, marking its weakest gain in 2017. Germany may be the catalyst of the eurozone’s economic recovery, but the bloc’s largest economy has not been immune to low inflation. Final CPI improved to 0.2% in June, compared to -0.2% in May. CPI has managed just one reading above 0.2% in 2017, and earlier in the week, WPI came in at 0.0%. German and eurozone inflation levels remain well below the ECB’s target of 2%, and with no indication that inflation levels will move higher anytime soon, the cautious ECB is unlikely to taper its aggressive stimulus package.

EUR/USD Fundamentals

Monday (July 17)

- 5:00 Eurozone Final CPI. Estimate 1.3%. Actual 1.3%

- 5:00 Eurozone Final Core CPI. Estimate 1.1%. Actual 1.1%

- 8:30 US Empire State Manufacturing Index. Estimate 15.2

Tuesday (July 18)

- 5:00 German ZEW Economic Sentiment. Estimate 17.6

*All release times are EDT

*Key events are in bold

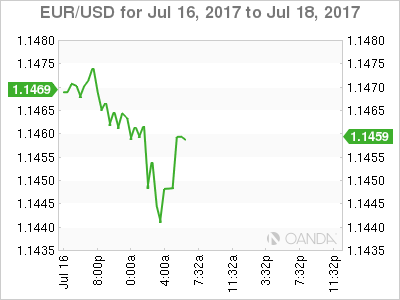

EUR/USD for Monday, July 17, 2017

EUR/USD Friday, July 17 at 6:30 EDT

Open: 1.1469 High: 1.1475 Low: 1.1435 Close: 1.1449

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1122 | 1.1242 | 1.1366 | 1.1465 | 1.1534 | 1.1616 |

EUR/USD has edged lower in the Asian and European sessions

- 1.1366 is providing support

- 1.1465 tested resistance earlier and is a weak line

Further levels in both directions:

- Below: 1.1366, 1.1242, 1.1122 and 1.0985

- Above: 1.1465, 1.1534 and 1.1616

- Current range: 1.1366 to 1.1465

OANDA’s Open Positions Ratio

EUR/USD ratio is showing slight movement towards short positions. Currently, short positions have a majority (70%), indicative of EUR/USD continuing to move lower.