- Rompuy announced that EU has agreed to drop preferred creditor status on Spanish bank rescue loans and to allow rescue funds to capitalize banks directly.

- Monti refuses to sign growth package until Germany agrees to support short-term measures.

- Risk sentiment has improved and EUR has strengthened after the Rompuy news.

EU President Rompuy said that EU leaders have agreed to drop the requirement that governments get preferred creditor status on loans given to Spain’s banks. Banks can also be capitalized directly by the EU’s rescue funds without going through governments.

According to media sources, Italian prime minister Monti is holding up the EUR 120bn growth package already agreed upon last week, refusing to sign the final document until Germany agrees to support short-term measures to provide relief from the debt crisis. Senior officials from the 17 eurozone finance ministries met on the sidelines of the EU summit to discuss emergency plans for Italy and Spain, focusing on how to use the rescue funds (EFSF/ESM) for short-term fire-fighting. Different media sources suggest that the preferred tool is primary market purchases of Spanish and Italian bonds funded through the EFSF/ESM. This is already an existing option for the rescue funds but such assistance is prescribed to go hand in hand with an adjustment programme. However, we will have to wait for today’s press conference to get more concrete information on the final outcomes of the EU summit.

The US supreme court concluded Thursday that Obama’s health care reform, which requires citizens to carry insurance or pay a penalty, is valid under Congress’ constitutional authority to lay and collect taxes to the general welfare of the United States. The ruling leaves health care as one of the hot topics for this fall’s presidential election campaign as Republican presidential candidate Romney has stated that if elected, he will repeal the law first thing.

It was a volatile day in US stock markets. Early losses reversed later in the trading session on hopes that the EU summit would provide short-term measures dampening the current market stress. The S&P500 ended the day down 0.2%. In Asian trading markets are taking the news of the EU dropping the senior seniority on bank rescue loans well and stocks are generally higher.

In European bond markets the 10-year Spanish and Italian spreads towards Germany widened modestly yesterday leaving the spread 40 to 60bp wider so far this week. In the US, Treasurys had a good day but reversed some of the gains late in the session as stock markets rebounded. The 10-year yield ended the day 5bp lower.

In forex markets EUR rebounded strongly after the Rompuy news and is now trading just below 1.26 against USD. Raw materials advanced and oil prices are up 2% this morning.

Global Daily

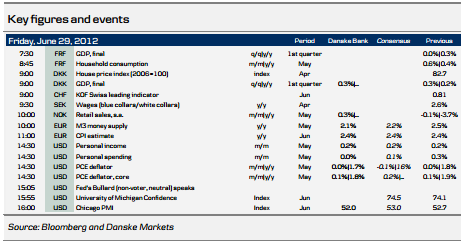

Focus today: The progress at the EU summit will also be the centre of attention today. Today’s meeting will start at 10:00 CET and there are two press conferences scheduled. The first will be on the outcome of the EU27 meeting. After this a euro summit will commence, so from a market perspective the afternoon press conference will be the most interesting. We also have a couple of interesting releases in the European session. We expect euro area M3 growth to drop further to 2.1% y/y, while we expect CPI for June to be unchanged at 2.4%. Inflation expectations are coming down in the euro area on the back of decreasing oil prices and should pave the way for an ECB cut at the meeting in the coming week. In the US we are due to receive data for core PCE. As it is the Fed’s preferred inflation measure, we will look to this to see whether inflation continues to ease. We expect to see a reading of 0.1% m/m and 1.8% y/y, well within the Fed’s confidence band, allowing the Fed to focus on the second part of its mandate – employment.

Fixed income markets: Even though policy makers may be edging towards the right solution, large political hurdles remain regarding implementation. The situation is still uncertain and fundamentals continue to deteriorate rapidly as the macro picture worsens and yields are high. Overall we see value in being overweight core market duration following the sell-off in most of June, where for instance the German Bund yield moved some 30bp higher. Lately the ECB has signalled a rate cut in the refi rate and possibly also in the deposit rate at the July meeting. Currently, it is roughly priced into the markets that the deposit rate will be lowered by 10bp to 0.15% and the refi rate by 25bp to 0.75%.

FX markets: EUR rebounded strongly on the announcement that seniority is renounced on Spain loans and that EU bailout fund can be used more flexibly. EUR/USD jumped more than one big figure to trade as high as 1.2628 before edging slightly lower again to trade around 1.2575. The strong reaction shows just how low expectations were going into the summit and just how long dollar investors were. We will have to see if more comes out of the meeting today but so far it has certainly been a much more market positive outcome than most would have hoped for. Previous policy responses have tended to deliver only short-lasting rallies and with the ECB set to cut rates next week it should be difficult for EUR/USD to edge significantly higher. That said, this should certainly act as an important backstopper for a further near-term EUR sell-off.

Scandi Daily

Sweden: Household lending for May will be released today. The year-on-year rate has gradually declined by about 0.1 percentage point per month of late and that trend is expected to continue. In April lending was up by 4.8% y/y basically reflecting base effects.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers

covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the

Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be

obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be

considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or

options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without

limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not

undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United

Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S.

Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”.

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction. Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.