Although we have been providing regular updates on Bitcoin (BitfinexUSD), as it is in a clear Bull run, we have not done so on Ethereum. Our last update was exactly three months ago: see here, but with the recent rally since the October 12 low we find, using the Elliott Wave Principle (EWP) that ETH completed a complex double zigzag Wave-2 correction and it should now be at the starting gates of a new Bull run, similar to BTC. As such we will now also update more regularly on Ethereum.

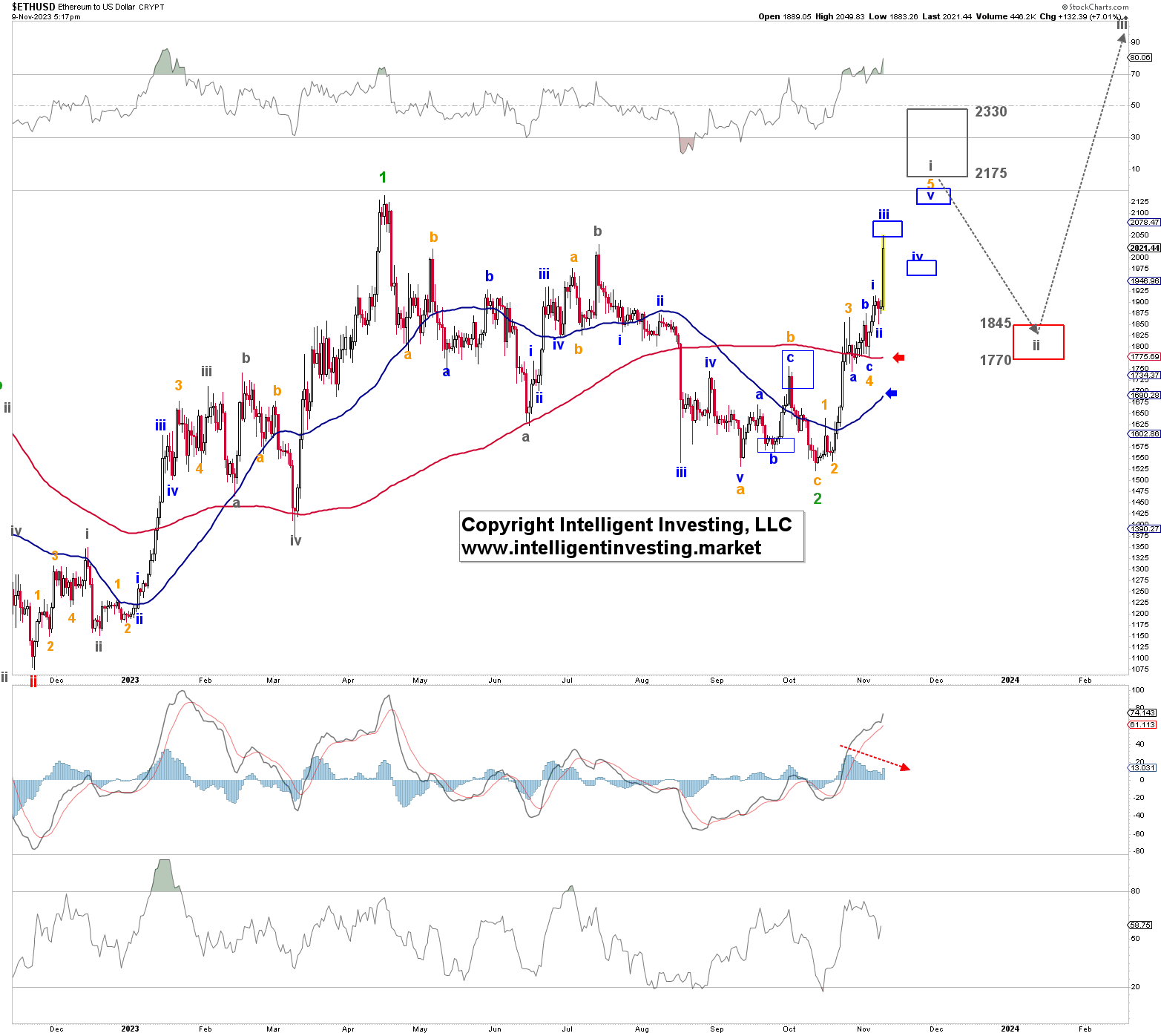

Figure 1. The daily resolution chart of ETH with several technical indicators Namely, the rally from the October 12 low at $1521 until now looks impulsive and should be wrapping up its last (blue) W-iv and W-v to ideally $2125-2150, but possibly as high as $2175-2330. See Figure 1 above. The latter target zone is the 61.80 – 76.40% Fibonacci extension of green W-1, which is typical for the one-degree lower next 1st wave. In this case grey W-i. Although extensions are always possible, at this stage the upper end of that 2nd target zone seems a bit of a stretch and our focus is thus on the happy intermediate: $2150+/-25.

Namely, the rally from the October 12 low at $1521 until now looks impulsive and should be wrapping up its last (blue) W-iv and W-v to ideally $2125-2150, but possibly as high as $2175-2330. See Figure 1 above. The latter target zone is the 61.80 – 76.40% Fibonacci extension of green W-1, which is typical for the one-degree lower next 1st wave. In this case grey W-i. Although extensions are always possible, at this stage the upper end of that 2nd target zone seems a bit of a stretch and our focus is thus on the happy intermediate: $2150+/-25.

Once the grey W-i completes we should expect a pullback for grey W-ii to ideally around the 50-62% retrace of W-i. A typical target zone for a 2nd wave. This would bring ETH back to around the (red) 200-day Simple Moving Average (SMA) as well as the recent “congestion zone”: orange W-3, 4. From that $1770-1845 ideal zone, ETH can then launch into W-iii of 3 of iii of 5 of V and target new All-Time Highs. Now that sequence is a mouth full, but Figure 2 below shows what we mean.

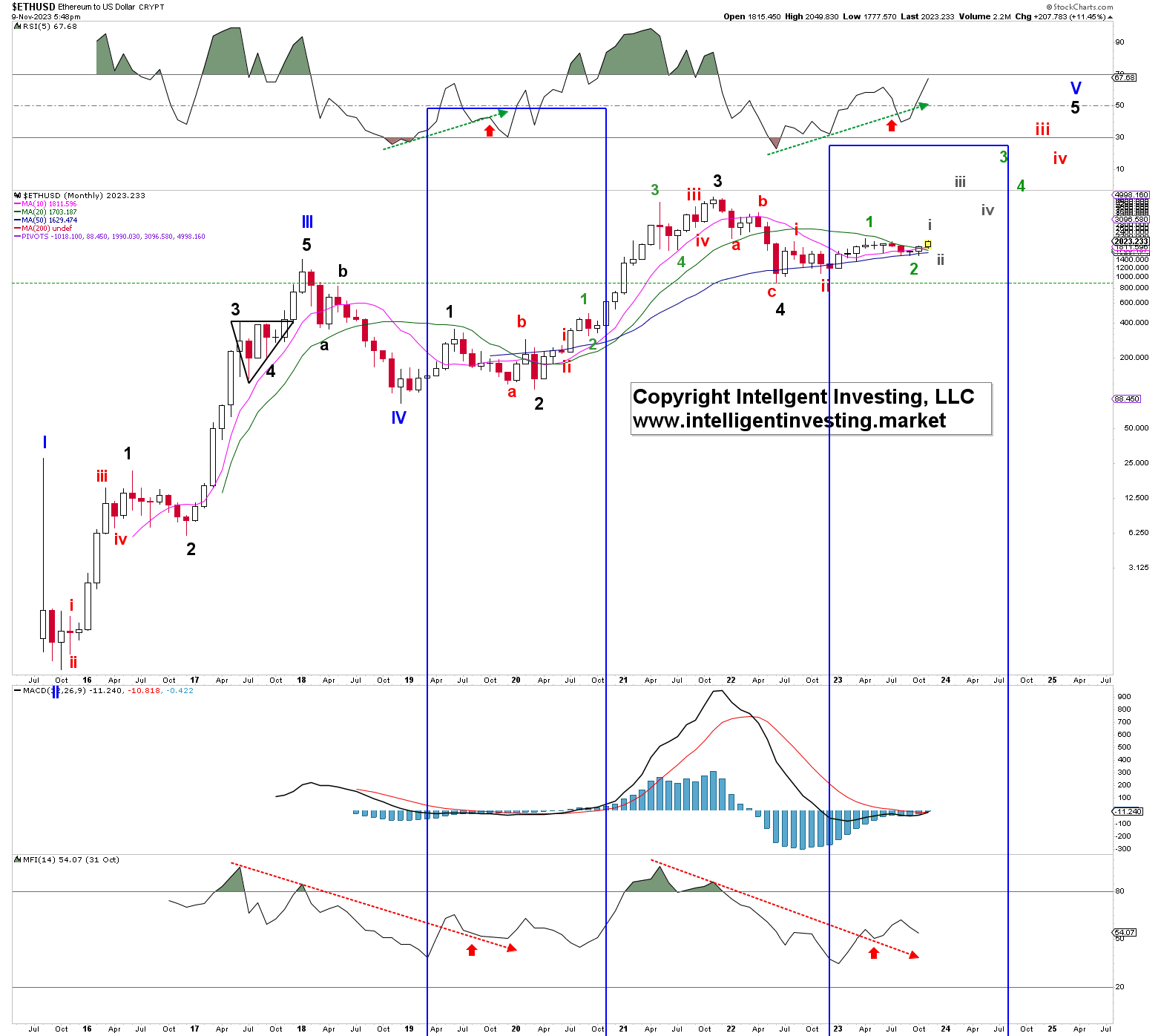

Figure 2. The monthly resolution chart of ETH with several technical indicators

Namely, our long-term view is that ETH is in a larger (blue) Primary-V wave to at least $7500, possibly as high as $15000, and that the June 2022 low was black W-4, and it is now in black W-5. Yes, the largest altcoin already bottomed out one-and-a-half years ago. The retail crowd, however, is still not interested in Ethereum, while it already has appreciated >130% since. Unfortunately, we won’t see the crowd back until ETH is about to top out, again. Just like in 2022. Rinse-lather-repeat.

Besides, the blue boxes show the self-similar setups between price patterns, technical indicators, and SMAs. Back then ETH was also forming a 1-2/i-ii/1-2 setup, exhibiting breakouts on its RSI5 and MFI14 (red arrows), and crossed back and held above its 10, 20, and 50m SMAs. Lastly, the grey, green, and red wave labels in the upper right corner of the chart show the approximated ideal impulse path forward.

Thus, short term we expect that if ETH can stay above the blue W-i high at $1913 it can wrap up its more minor 4th and 5th wave to ideally $2150+/-25. From there we expect a pullback to ideally around $1800+/-50. Long-term the cryptocurrency must simply stay above the June 2022 low ($883), with a severe warning to the Bulls already below the October 12 low at $1521, to allow for this Bullish path to unfold.