Ericsson (BS:ERICAs) (NASDAQ:ERIC) has been selected by T-Mobile to provide 5G radio access products for the latter’s deployment of a nationwide 5G network in the United States. The company’s latest products, available for 600 MHz and millimeter-wave in 28 GHz and 39 GHz, will enable T-Mobile to start deployment of 5G in its network in the current year.

In collaboration with Ericsson, T-Mobile is building out 5G in New York, Las Vegas as well as Los Angeles by leveraging Ericsson's 5G New Radio (NR) radios and baseband. In fact, Ericsson's enhanced 5G Platform will aid the rollout of the network, catering to the increasing needs for customers. Based on first 3GPP 5G NR standards, Ericsson had also launched 5G Radio Access Network (RAN) commercial software in early February. The software will be available in fourth-quarter 2018, which will offer multi-band support for worldwide deployment thus enabling T-Mobile to build out 5G network in the current year.

Meanwhile, Ericsson and TIM, an Italy's major ICT company, has successfully deployed first virtual Radio Access Network (vRAN) platform in a live advanced LTE network in Turin. Notably, both companies have begun to digitalize TIM's nationwide radio access network in Italy. The vRAN technology supports network transformation into a flexible cloud platform, thereby facilitating optimization of processes and reducing associated costs related to the management of innovative services and automation.

Additionally, Ericsson and TIM are looking to pool their efforts to develop Self Organizing Network solutions that have increased automation with considerable improvements of customer experience. The partnership also augments TIM's transformation project, DigiTIM, which focuses on better customer experience and improved operational efficiency through automation of network systems and virtualization.

Existing Business Scenario

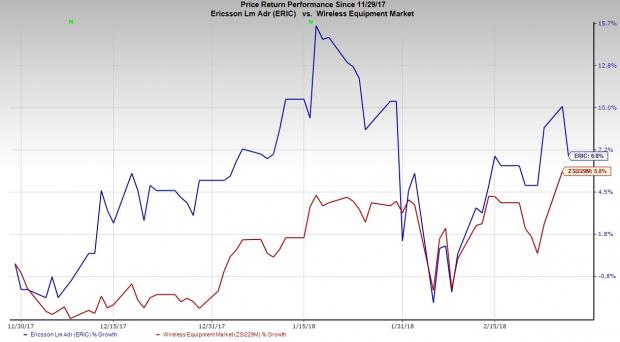

Being one of the premier telecom services providers, Ericsson is much in demand among operators to expand network coverage and upgrade networks for higher speed and capacity. As operators continue to invest in telecom core networks for deployment of new service offerings such as Voice over LTE, the company stands to benefit significantly from the same. For instance, the company is enthusiastic about the turnaround of the Chinese market in terms of 4G deployments and believes, which is likely to be a significant growth driver going forward. In the past three months, this Zacks Rank #3 (Hold) company has gained 6.8% outperforming the industry’s rally of 5.8%.

Moving ahead, the company foresees mainstream 4G offerings to give way to 5G technology. Meanwhile, the impending deployment of 5G networks in 2020 is expected to boost the adoption of IoT devices with technologies like network slicing gaining more prominence. In fact, we believe 5G is likely to accelerate the digital transformation in many industries, thereby enabling new use cases in areas such as IoT, automation, transport and big data. For 2022, the Ericsson Mobility forecasts 550 million 5G subscriptions, with North America expected to lead the way. Such positive industry trends are expected to boost the company’s long-term growth.

However, of late, the company seems to be grappling with negative industry trends and a declining wireless equipment market. Additionally, it expects an increasingly challenging investment environment in Europe and Latin America. Lower IPR licensing revenues and an unfavorable mix between coverage, and capacity and services are further adding to the company’s concerns.

Stocks to Consider

Some better-ranked stocks from the same space are Aspen Technology, Inc. (NASDAQ:AZPN) , Applied Materials, Inc. (NASDAQ:AMAT) and AMTEK, Inc. (NYSE:AME) . While Aspen Technology sports a Zacks Rank #1 (Strong Buy), Applied Materials and AMTEK carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Aspen Technology has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 33.7%.

Applied Materials has outpaced estimates in the trailing four quarters, with an average earnings surprise of 4.8%.

AMTEK has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 5.3%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Ericsson (ERIC): Free Stock Analysis Report

Aspen Technology, Inc. (AZPN): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research