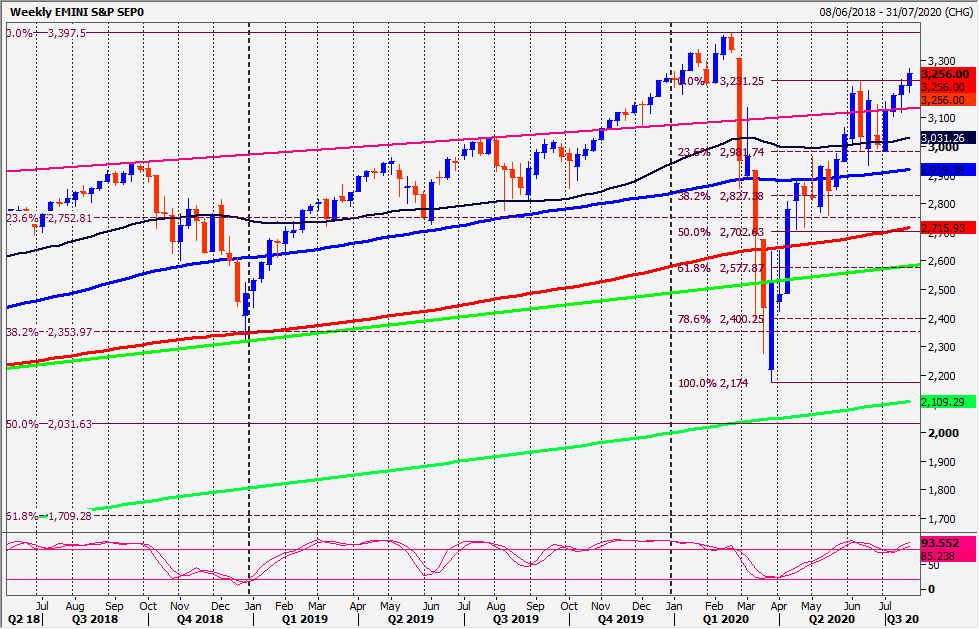

Today’s Analysis

If S&P Emini continues lower look for 3232/31 then the best buying opportunity of the day at 3224/21. Stop below 3215. An unexpected break lower targets 3209/08 then an excellent buying opportunity at 3196/92.

Holding 3254/53 targets 3264/66 before the 3272/73 high. A break higher always possible in the bull trend for 3277/80 and 3295/98. A break above 3300 targets 3310/12.

Nasdaq did test strong resistance at the new all-time high of 11040/060 as predicted and topped exactly here leaving a DOUBLE TOP SELL SIGNAL. There is a significant risk to the downside now.

If you are not short, I cannot give you a 100% reliable sell level (other then 11000/11050), but it would be worth entering shorts with stops above 11100 and running them for a while.

Yesterday’s initial bounce held 10930/940 so let’s assume this is first resistance. Holding here targets 10830/820 and 10790/780 with minor support at 10720/710. So a break below 10660 is the next sell signal targeting 10550/530 and support at 10450/400. There is a good chance of a bounce from here on the first test, but brave longs need stops below 10350.

If you want to try shorts, the best 2 levels are 10930/940 and 11000/11050. A break above 11100 has to be taken as a buy signal.

Trends

- Weekly Outlook Positive

- Daily Outlook Positive

- Short Term Outlook Neutral