Pre-Open Market Analysis

Yesterday closed near its open and therefore was a doji day. Furthermore, it was an inside day. There is now an ioi Breakout Mode setup on the daily chart. However, the 4-day tight trading range is probably a bull flag after a strong 6-day rally. Less likely, it is the resumption of the January bear trend after a double top with the February 7 lower high.

Today is Friday . The most important magnets are the open of the week and last week’s high. The week will probably be the 2nd consecutive inside bar on the weekly chart. That would create an ii Breakout Mode pattern on the weekly chart for next week.

Many Magnets Around 2725

The odds are that the Emini will stay in the 4-day range today and be another mostly sideways day. It will probably focus on the open of the week, yesterday’s high, the 20-day EMA, the 20 bar EMA on the 60-minute chart, and the February 7 lower high today. These are all clustered around 2720 – 2730, which is therefore a strong magnet. All are above the current price. Therefore, the odds favor at least a small rally today.

The Emini will probably get drawn there today, but then have a difficult time breaking free of that area. If it is within about 10 points of the open of the week in the final hour, it might get drawn there by the end of the day. If so, that would create a perfect doji bar on the weekly chart and be an expression that the market is neutral. The developing ii on the weekly chart is also a sign of balanced bulls and bears. The Emini would then wait for next week for a breakout up or down.

Overnight Emini Globex Trading

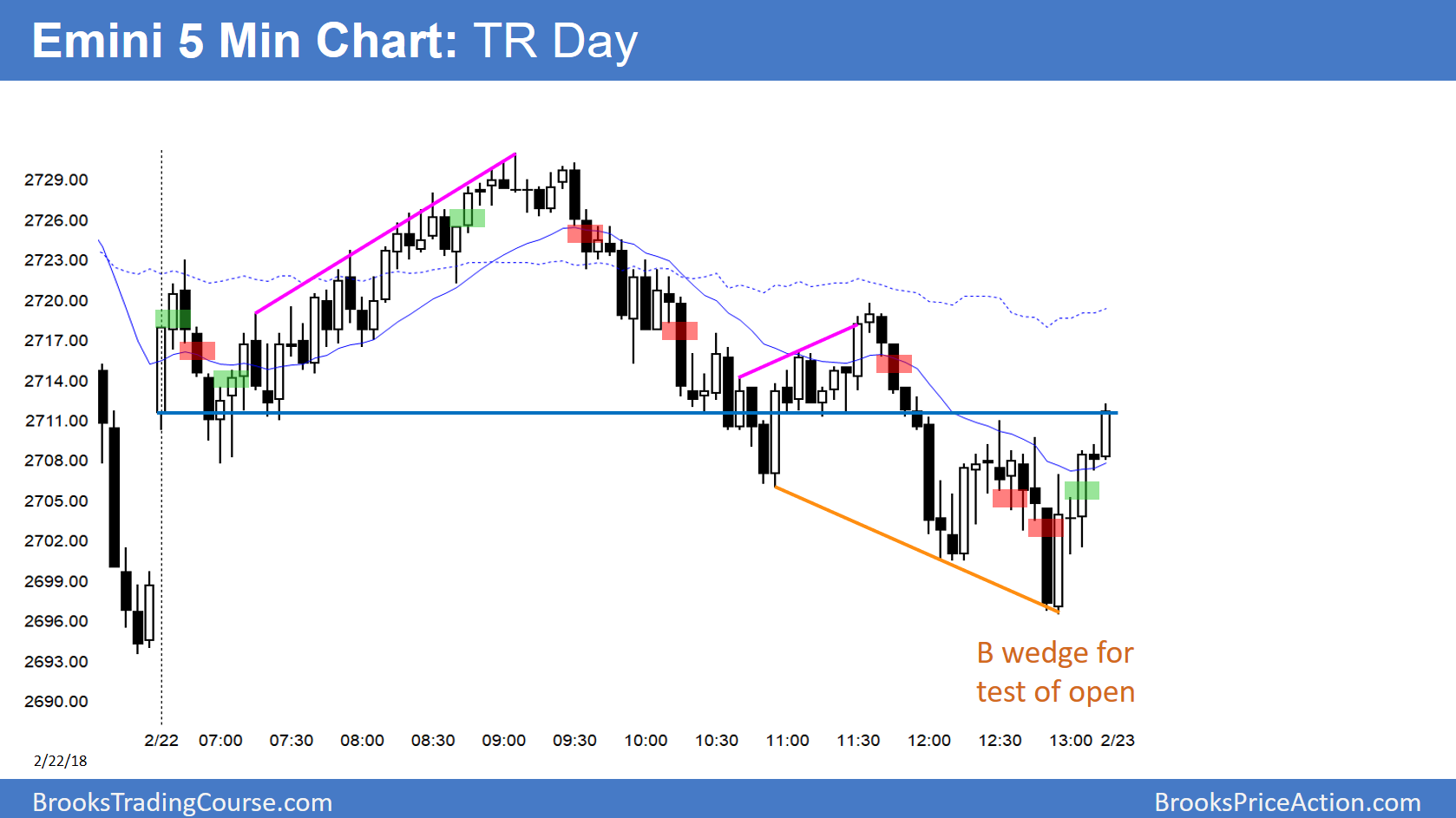

The Emini is up 8 points in the Globex market after yesterday’s late reversal up from a wedge bottom. The bulls are hoping that yesterday formed a double bottom with Wednesday’s low. Yesterday’s high is the neck line. A measured move up would break above last week’s high and trigger the buy signal on the weekly chart. That is unlikely today because of the lack of energy over the past 4 days. Last week’s high is 35 points above, and it is probably too far for the bulls to reach today.

The bears want a break below the 2-day double bottom. However, the lack of energy this week reduces the chances of a strong break below the 4 day bull flag. Furthermore, the 6 day rally prior to this 4 day bull flag makes a bull breakout more likely. However, the breakout will probably come next week. Today will probably get drawn up to all of the magnet between 2720 and 2730, but have a hard time breaking out of that area.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.