Market Overview: Weekend Market Update

The Emini is closing out the decade at a new high after opening the decade near the low. This increases the chance for a couple weeks of profit-taking in early January, or possibly beginning on Monday. However, Thursday might gap up. If it did, there would then be a gap on the monthly, yearly, and decade charts!

The 4 month selloff in the bond futures market is stalling. There will probably be a bounce over the next couple weeks.

The EUR/USD Forex market has been sideways for 6 months. It will probably be in a trading range throughout 2020 between around 1.08 and 1.18

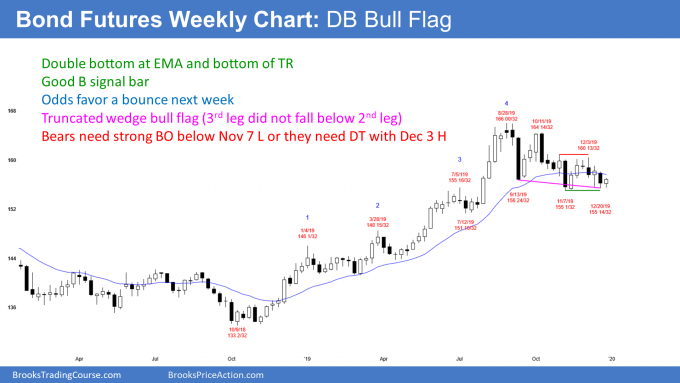

30 year Treasury bond Futures market:

Bottom of developing trading range

The 30 year Treasury bond futures has sold off for 4 months from a 10 year nested wedge buy climax on the monthly chart (the chart above is a weekly chart). I have been saying for 3 years that the bond market was probably putting in a major top. By major, I mean that the high will last 10 – 20 years. That means traders should expect interest rates to work higher over the next decade.

But I keep making the point that a major top on the monthly chart can take several years to complete. Have we seen the top? We might have, but the yearlong bull channel was tight. That reduces the chance that the current 4 month selloff will continue straight down to below the October 2018 low. That is where the tight bull channel began.

Instead, it is more likely that the bond market has entered a trading range. It could last for all of 2020.

Bear trend, but trading range likely

On the weekly chart above, there have been 3 legs sideways to down. If the current leg falls below the bottom of the 2nd leg, the bears will try for a strong breakout. They then would want a measured move down.

It is more likely that there will be buyers around the start of the most recent buy climax. That is the August low. The most recent buy climax low is a common target when there is a reversal down.

The weekly chart has been mostly sideways for a few months, even though it is sloping down. This is an early trading range.

Furthermore, the monthly chart has had 4 consecutive bear bars. That is extreme, especially after such a strong rally in 2019. These factors make more sideways trading likely over the next several weeks.

Possible truncated wedge bottom

The current 4 week leg down does not have to fall below the bottom of the 2nd leg down (the November 7 low). Instead, the bonds could reverse up next week. This leg down would then form a double bottom with the November low.

I would also call the 4 month selloff a “truncated wedge.” This is when a chart looks like it is going to form a wedge bottom. However, the 3rd leg down reverses up from just above the bottom of the 2nd leg down. The forces are the same as in a wedge. I therefore like to use the term “wedge.” But since the 3rd leg failed to fall below the 2nd, the wedge is truncated.

This means that traders were very confident that there would be a reversal up from below the 2nd leg. In fact, they were afraid that the 3rd leg might not get there. Because the bulls did not want to miss the rally, they began to buy above the bottom of the 2nd leg.

Also, the bears who were hoping to take profits below the 2nd leg were worried that there was not much momentum down. They were concerned that they might not be able to exit their shorts below that 2nd leg. They, too, begin to buy just above the bottom of the 2nd leg down.

If there are enough buyers, the 3rd leg fails to break below the low of the 2nd. Therefore, the wedge bottom is truncated. But since it is still a wedge variant, traders expect at least a couple legs sideways to up.

Strong selloff so only minor reversal up

It is important to note that the weekly chart has been sideways for 11 weeks. Consequently, a bounce could test the top of this developing trading range over the next few weeks. Traders should expect either a bounce from here or from just below the November 7 low.

But after 4 consecutive bear bars on the monthly chart, any rally will probably be minor. That means that the trading range should last for at least another month.

EUR/USD weekly Forex chart:

5 month trading range late in 2 year bear trend

The EUR/USD weekly Forex chart has been sideways since early August. Traders are wondering if the 2 year bear trend is finally ending.

The bear trend has been in the form of a tight bear channel for 16 months. A bear channel typically has a bull breakout. Then, traders expect the rally to become a bull leg in a developing trading range rather than a new bull trend.

The top of the range is usually around the start of the bear channel. That is the September 2018 high at around 1.18.

Any rally from here will probably be a leg in a trading range. Traders are not expecting a strong bull breakout and strong follow-through buying.

The current 3 month rally is a bull leg within a 6 month trading range. If the rally continues above the bear trend line, it will probably become a bull leg in a bigger trading range. The next major target is that September 2018 high.

If the EUR/USD gets there, the bulls will take profits and the bears will sell again. Traders should expect a leg down from that level. They would then conclude that the 2 year selloff was just a bear leg in a trading range and not a bear trend. That trading range would have begun with the selloff from the September 2018 high.

Continued trading range in 2020

This is the most likely scenario over the coming year. Traders should expect a rally to around 1.18 within several months and then several months of sideways to down trading from there. The bears might get one or two more new lows before the rally to 1.18 begins.

Since the EUR/USD probably has been in a trading range for 16 months, nothing is clear. Because the range will probably last for most or all of 2020, patterns will continue to be imperfect. Probabilities will be less. Traders will continue to expect reversals every 2 – 3 weeks on the up to the September 2018 high, just like they did on the way down.

One final point. There is always an increased chance of a dramatic move in any Forex market at the start of the year. However, because of what I wrote above, a trading range is still most likely for 2020.

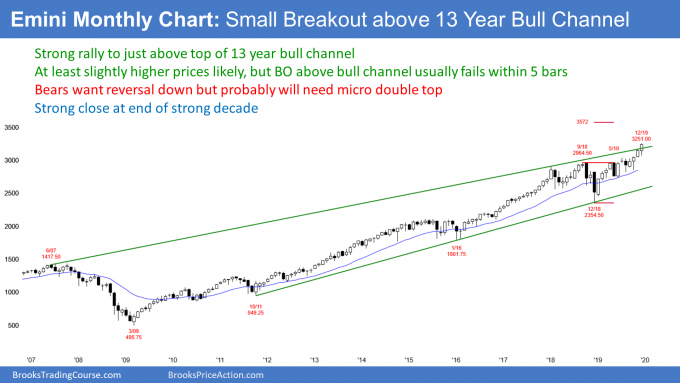

Monthly S&P500 Emini futures chart:

Strong rally, but that could attract profit-takers

The monthly S&P500 Emini futures chart is forming its 4th consecutive bull trend bar. With only 2 trading days left in December, the month will probably close near its high. The yearlong rally has been a resumption of the strong bull trend that ended with a buy climax in January 2018.

That was the most extreme buy climax on the monthly, weekly, and daily charts in the history of the stock market. I talked about that often in late 2017. The result was exhausted bulls. But after a year of sideways trading in 2018, they again bought aggressively throughout 2019, creating trend resumption up.

How far can this rally go? The 1st target traders always consider is a measured move. The 2 year trading range was about 600 points tall. A measured move up is 3,575.

Will the Emini get there? It might, but it could take more than a year.

What could go wrong?

There are several hurdles ahead. First, the inverted yield curve in August is a reliable predictor of a recession. The recession typically starts 1- 2 years later. Since the stock market usually sells off about 6 months before a recession begins, the bulls might not have enough time to reach the measured move target.

Also, this is the longest bull trend in the history of the stock market. That reduces the chance of it lasting several more years.

Additionally, a trading range late in a bull trend is usually the Final Bull Flag. That means that traders should expect a reversal back down into the 2 year trading range before too long.

The breakout often continues for 10 or more bars before the reversal begins. Ten bars on the monthly chart is about a year. Again, there might not be enough time to reach 3,575 before then.

Finally, the monthly chart is breaking above a bull channel. There is typically a 75% chance of the start of a reversal back down before about 5 bars (months). If there is a reversal, the minimum target is the middle of the channel. If the correction continues below that, the next target is the bull trend line at the bottom of the channel.

Trading range for the next 10 years

I want to make one final point about the unusually strong and long-lasting bull trend. The bulls always keep buying until they are confident that the price is clearly far above what the fundamentals would dictate.

They then start to take profits and wait until the fundamentals catch up to the price. They need to see the market go sideways to down for a long time before they conclude that it is once again cheap. That sideways to down trading means that the bull trend evolved into a trading range.

The legs in a trading range on the monthly chart can be huge and last a year or more. Look at what happened after strong rally in the late 1960’s and the one in the late 1990’s. Both led to a decade of sideways trading. Furthermore, each trading range had 2 or more selloffs of at least 40%. The selloff in 2009 was 60%.

There is no top yet and the Emini could go higher for a year or more. However, traders should expect the trading range to begin within 3 years. Once it does, traders should look to buy 30 – 50% selloffs and take profits on 50 – 100% rallies for the next decade.

Strong bull trend on yearly chart

Tuesday is not only the final bar of the month and year, it is also the end of a very strong decade. Think about a yearly chart for a moment where every bar is one year. 2019 is a huge bull trend bar. A huge bull bar on any timeframe often attracts profit-takers. There often is a pause on the next bar.

For example, the next bar could be an inside bar. When the next year opens on Wednesday, if the open is below this year’s high, traders might wonder if 2020 will be an inside bar on the yearly chart. If enough think so, then the year would be opening near the high of the coming year. Traders would look for an early selloff, and then sideways to lower prices all year.

Alternatively, next year could go above this year’s high, but close at or below this year’s high. If 2020 closed on the low, it would be a sell signal bar on the yearly chart. That would increase the chance of lower prices in 2021.

If it closed around the middle, it would be a doji bar. That is neutral and it would make more sideways trading likely in 2021.

Possible gap up on yearly and decade charts!

Now, here’s a thought. Markets constantly probe. They try to do things that have never been done before. They look for extreme behavior to see how traders will respond. For example, buy and sell climaxes can be extreme. Look at the 1929 Crash and the 2017 buy climax. Both were the most extreme in history.

What if next Wednesday gaps up to a new all-time high? There would be a gap up on the monthly chart, like in November. Gaps on the monthly chart are rare.

However, there would also be a gap up on the yearly chart. I doubt there has ever been a gap up on the yearly chart that has stayed open. I did not check, but there might never have been a gap up on that chart.

Finally, consider a decade chart where each bar is one decade (not shown). A gap up to a new high on Wednesday would create a gap up on that decade chart!

I doubt that has ever happened. If it did, it would probably close before the end of the bar. But the bar closes 10 years from now. Therefore a gap up next Wednesday could stay open for several years.

Exhaustion gap or measuring gap?

A gap up late in a bull trend usually closes within a few bars. For example, the gap above October’s high will probably close within the next 6 months.

However, sometimes the gap stays open for a long time and becomes a measuring gap. It could be a measuring gap on the daily or weekly charts and an exhaustion gap on the monthly, yearly, and decade charts.

For example, it could lead to a rally lasting several months and reaching some measured move target on the weekly chart. Then, if there was a reversal over the next many months, the selloff could close the gap. The gap would then be an exhaustion gap on the monthly, yearly, and decade charts.

In any case, you will never see this type of price action again in your trading career. Gaps up on the monthly chart are rare. They may never have happened on the yearly and decade charts and will probably not happen again in your lifetime. It will be interesting to see what follows.

Parabolic wedge top on the yearly chart

If you look at a yearly chart where each bar is one year, you will notice that the past decade had several breakouts. Each one was followed by a pause. That is a parabolic wedge buy climax and it typically attracts profit-takers. This is especially true when a bar is the biggest bull bar late in the trend, like 2019. Ordinary profit-taking usually results in a 1 – 3 bar pullback. Since this is a yearly chart, a pullback could easily last more than a year.

But this is a parabolic wedge buy climax. When it ends, there is often about a 10 bar sideways to down pullback before the bull trend resumes. That is a decade, and it is consistent with I just wrote above. After a parabolic wedge buy climax, the market often goes sideways for about 10 bars. That means the next decade could be a trading range.

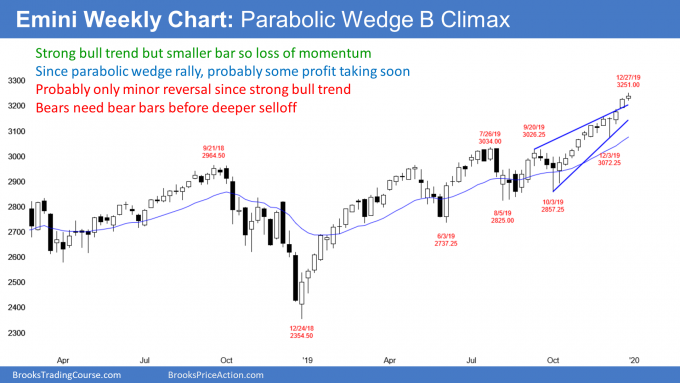

Weekly S&P500 Emini futures chart:

Small doji bar indicates loss of momentum

The weekly S&P500 Emini futures chart has rallied strongly for 4 months. However, this week was a small bar with prominent tails. It is relatively neutral, which means a loss of momentum. That is often the first sign of impending profit-taking.

Because the bull trend is so strong, if there is profit-taking, it will probably lead to a bull flag or a trading range and not a bear trend. A strong bull trend usually needs at least a micro double top before a bear trend can begin.

I mentioned 4 weeks ago that the big doji buy signal bar was a problem. Yes, it was the 1st pullback in a 9 bar bull micro channel. Traders expected at least slightly higher prices.

But the big tail on the bottom of a doji bar means that there was strong selling early in that week. That increases the chance of additional selling soon afterwards.

When a doji bar is the buy signal bar in a buy climax, the rally usually has more profit-taking within a few bars (here, weeks). This week’s small bar might be the start. Therefore, there is an increased chance of a 1 – 2 week pullback beginning within the next couple weeks.

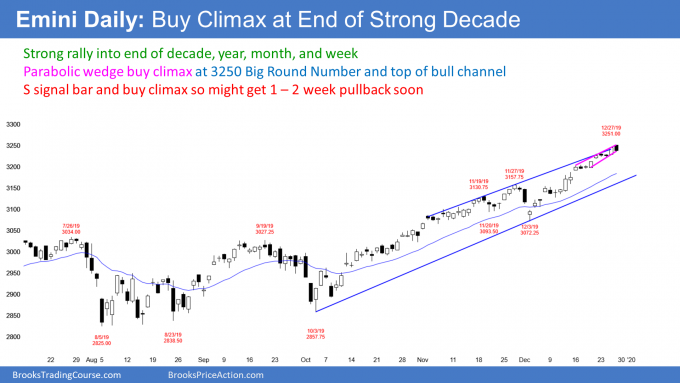

Daily S&P500 Emini futures chart:

Parabolic wedge buy climax, but no top yet

The daily S&P500 Emini futures chart was in a tight trading range for 3 days but resumed up at the end of the week. Christmas week is usually the quietest week of the year, but there typically is at least one strong trend day, like Thursday or Friday. The daily ranges tend to be small and big moves are the exception. With New Year’s being in the middle of next week, next week will probably also be quiet.

Markets pay attention to past behavior

Markets often repeat behavior or do the opposite of recent behavior. Last December crashed and January reversed up. The rally began on December 26, 2018.

This December is crashing up. That increases the chance of an attempt of a reversal down in January. Friday is a sell signal bar for a parabolic wedge top on the daily chart. It is at the top of a 2 month bull channel and at the 3250 Big Round Number. Finally, Friday was December 27. That is only 1 day after last year’s trend reversal.

If the bulls take profits here, traders will expect a brief pullback. There is no strong top yet. Tight bull channels do not typically immediately reverse into bear trends without 1st going sideways for at least a few bars. The best the bears will probably get is a 10 bar tight trading range or bear leg in a broader trading range. Then traders will decide if the selloff is a pullback or the start of a bigger reversal.

The January Barometer and the January Effect

The news always talks about the great predictive power of January’s performance. You will hear them talk about the January Barometer. If January is up, the rest of the year has an 82% chance of being up.

But remember, the world’s population has constantly increased, as has productivity. That means the world’s wealth continues to increase. The result is that the stock market on a yearly chart has never been in a bear trend. In fact, 65% of all months are up. If there is a strong January, the market has an 82% chance of being up for the remainder of the year. That is not much different from 65%, and it is not different enough to change your trading behavior.

The January Effect means that the bulls who sold stock in December for tax reasons will buy stock in January. That theoretically can lead to a January rally. However, most months are up about 0.5 – 1.5%. January is no different. Also, with the year ending strong, there might be some profit-taking in January.

What will happen? Who cares? I will trade what I see, not what the news tells me will happen. Therefore, traders should view all of this as having only entertainment value. Listen to it and smile. Just understand that no one makes money trading based on any of these concepts.