Market Overview: S&P 500 Emini Futures

The S&P 500 Futures breakout above the February 2 high this week. The bulls will need to create follow-through buying next week to increase the odds of higher prices. The bears want a failed breakout above the February 2 high. If the Emini trades higher, they want a reversal down from a double-top bear flag with the August high.

S&P 500 Emini futures

The Monthly Emini chart

- The May monthly Emini candlestick was an outside bull doji closing in the upper half of its range.

- Last month, we said that traders will see if the bulls can create another follow-through bull bar or will the Emini trade higher but close with a bear body or a long tail above.

- If May is a big bull bar closing near its high, it could potentially flip the market to Always In Long.

- May closed in the upper half of its range and was a follow-through bar.

- The bulls managed to create consecutive bull bars closing above the 20-month exponential moving average.

- Looking back, whenever this has happened (consecutive bull bars closing above the 20-month exponential moving average), it has often led to at least slightly higher prices.

- So far, the market has continued higher in early June.

- The move up since March is also in a tight bull channel.

- The bulls want another strong leg up from a double bottom bull flag (Dec 22 and Mar 13), completing the wedge pattern with the first 2 legs being December 13 and February 2 highs. The third leg up is currently underway.

- The next target for the bulls is the August 2022 high.

- They will need to create a strong breakout above the February 2 high with follow-through buying to convince traders that the bull trend could be resuming.

- The bears see the move down from January 2022 as a broad bear channel, with the August 2022 high as the last major lower high.

- They want a failed breakout above the February high.

- If the Emini trades higher, they want a reversal down from a double-top bear flag with the August high.

- The problem with the bear’s case is that they have not been able to create sustained follow-through selling since September 2022.

- They will need to create consecutive bear bars closing near their lows to convince traders that they are still in control.

- Since May’s candlestick was a bull doji closing in its upper half, it is a weaker buy signal bar for June.

- However, because the move up since March is in a tight bull channel, odds slightly favor the market to be in the sideways to up phase in the first part of June.

- Traders will see if the bulls can create another follow-through bull bar or will the Emini trade higher but close with a bear body or a long tail above.

- If June is a big bull bar closing near its high and above August’s high, it will increase the odds of a retest near the all-time high.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

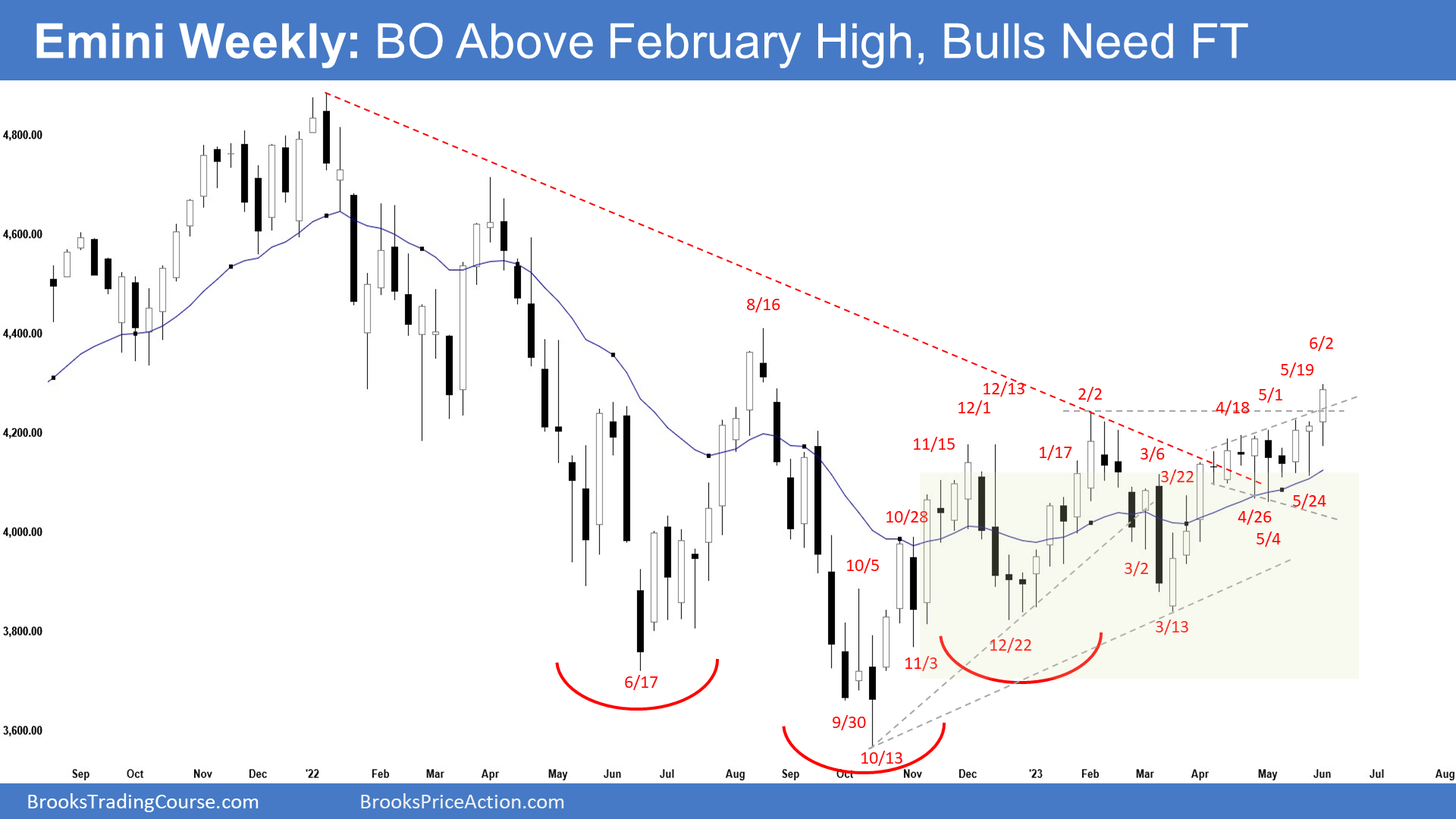

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bull bar closing near its high with a long tail below.

- Last week, we said that odds continue to favor the market to still be in the sideways to up phase until the bears can create credible selling pressure.

- This week broke far above the February high.

- The bulls want another strong leg up completing the wedge pattern with the first two legs being December 13 and February 2. The third leg up is currently underway.

- They hope that the recent 6-week tight trading range formed a bull flag around the trading range high.

- They want another leg up from a double bottom bull flag (May 4 and May 24) and a breakout far above February 2 high followed by a measured move up using the height of the 5-month trading range which will take them to the March 2022 high area.

- The next target for the bulls is the August 2022 high.

- The bulls need to create follow-through buying following this week’s close above the February 2 high.

- The bears want a reversal down from a wedge pattern (Dec 13, Feb 2, and June 2) and a double top with the August high.

- They hope that the 6-week tight trading range is the final flag of the move up and want a reversal back into the middle of the 6-month trading range.

- The problem with the bear’s case is that they have not been able to create credible selling pressure since the March low.

- They will need to create strong bear bars with follow-through selling to convince traders that a deeper pullback could be underway.

- At the very least, the bears will need a strong reversal bar or a micro double top before they would be willing to sell more aggressively.

- Since this week was a bull bar closing near its high, it is a buy signal bar for next week. It is not a strong sell signal bar.

- The market may gap up on Monday. Small gaps usually close early.

- For now, odds continue to favor the market to still be in the sideways to up phase until the bears can create credible selling pressure (consecutive big bear bars closing near their lows).

- Traders will see if the bulls can create follow-through buying or will the Emini trade slightly higher but close with a long tail above or a bear body.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.