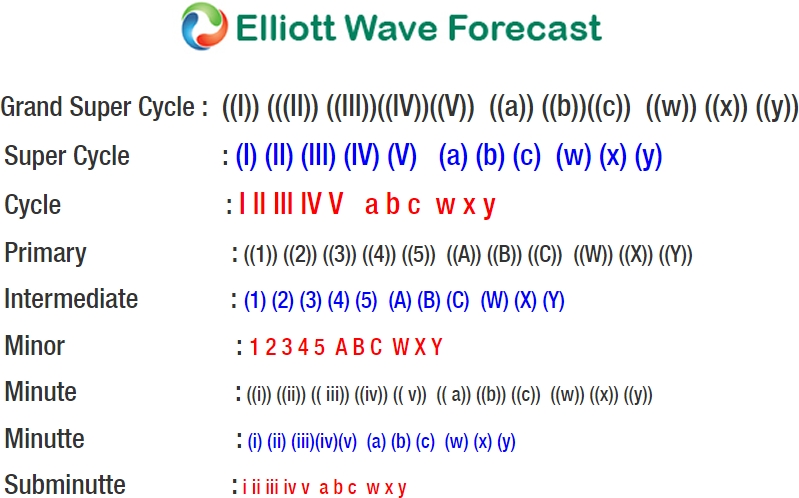

Gold Short Term Elliott Wave view suggests that the decline to 1306.96 ended Intermediate wave (X). The rally from there is unfolding in 5 waves impulse Elliott Wave structure. Minutte wave (i) ended at 1337, Minutte wave (ii) ended at 1317.27, Minutte wave (iii) ended at 1357.12, Minutte wave (iv) ended at 1348.30, and Minutte wave (v) ended at 1361.72.

The 5 waves rally also ended a higher degree Minute wave ((a)) of a zigzag Elliott Wave Structure. Minute wave ((b)) pullback is currently in progress to correct cycle from 2/8 low in 3, 7, or 11 swing. Minute wave ((b)) has reached 1323.39 – 1334.07 area where it could end. As far as pivot at 2/8 low (1306.96) stays intact, expect Gold to extend higher. We don’t like selling the yellow metal and expect buyers to appear at 1330.07 – 1334.15 area for a 3 waves bounce at least.

If pivot at 2/8 low (1306.96) fails, then Gold is doing a double correction in Intermediate wave (X). In this case, the yellow metal then can extend lower to 1289.48 – 1303.34 area where wave (X) can end and the rally resumes.

Gold 1 Hour Elliott Wave Chart