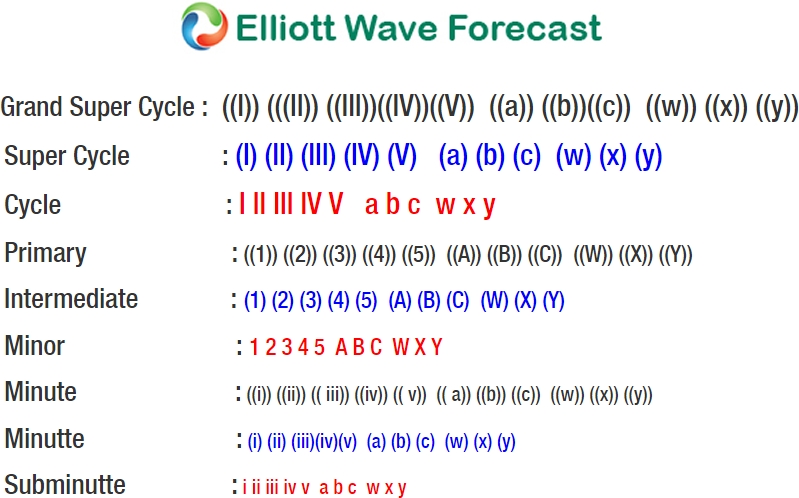

Short term Elliott Wave view in DAX suggests Primary wave ((B)) ended at 12434.7 on 3.16.2018. The decline from there is unfolding as a 5 waves impulse Elliott Wave structure. Down from 12434.7, Minor wave 1 ended at 12160, Minor wave 2 ended at 12375.5, Minor wave 3 ended at 11827, Minor wave 4 ended at 11987.50, and Minor wave 5 is proposed complete at 11706.50. The 5 waves move lower ended Intermediate wave (1) of a higher degree.

Intermediate wave (2) bounce is in progress to correct cycle from 3.16.2018 high as a zigzag Elliott Wave structure. A zigzag is a 5-3-5 structure and has a label of ABC. Potential target for Intermediate wave (2) is 12068.9 – 12261.06, which is the 50 – 76.4% retracement of the decline from 3.16.2018 high. As far as pivot at 3.16.2018 high (12434.7) stays intact during the bounce, expect Index to extend lower again afterwards. We don’t like buying the Index.

DAX 1 Hour Elliott Wave Chart