- ECB delivers what it promised but abandons forward guidance, euro climbs

- US banks pour $30 billion into troubled First Republic in rescue deal

- Stocks rise in relief rally, yields make unconvincing rebound, dollar slips

- But some caution today as triple witching looms

Banking crisis fears ease after another rescue

Equity markets globally were headed for painful losses for the week even as they scrambled to stage a relief rally on Friday. It’s been a challenge for investors to keep apace with the fast moving developments of the past week but there seems to be enough conviction for the time being that authorities have done all they can to avert a much bigger banking crisis from unfolding.

With the fallout of last week’s collapse of Silicon Valley Bank still reverberating across America’s regional banks, First Republic Bank (NYSE:FRC) was next to suffer a crisis of confidence from investors. In a coordinated response by the Fed, US Treasury and 11 Wall Street banks, the major US lenders have agreed to plug the hole in First Republic’s balance sheet by pumping $30 billion into it as deposits.

First Republic’s share price rallied from record lows on Thursday as details of the rescue package emerged.

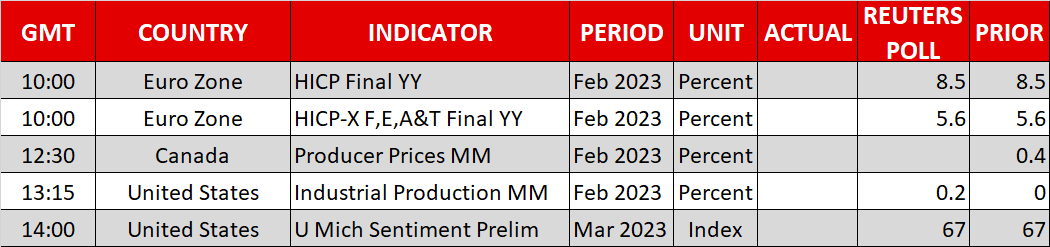

ECB raises rates but hints at pause

In Europe, the European Central Bank hiked its key lending rates by 50 basis points as had been widely telegraphed. There had been much speculation as to whether the ECB would go ahead with its planned rate increase amid the escalating fallout of the banking crisis. President Christine Lagarde did her best to portray confidence in the Eurozone banking system and the SNB’s move to shore up Credit Suisse clearly gave policymakers the nod to proceed with the March hike.

But what was more symbolic was the ECB’s decision to drop its forward guidance on future tightening. Prior to SVB’s collapse, there had been plenty of hints that there could be at least a couple more 50-bps hikes on the way. So the decision to become entirely data dependent suggests policymakers are ready to press the pause button if the situation doesn’t improve by the May meeting.

Tech stocks lead the rebound in equities

The combined policy responses in Europe and America lifted market spirits on Thursday and risk appetite is recovering further so far today.

European indices are posting decent gains after a rally on Wall Street overnight. The rebound in US stocks came alongside a bounce in Treasury yields. But yields of all bond durations remain well below their early March peaks in a boon for rate-sensitive tech stocks.

As financial stocks everywhere have been hammered, the Nasdaq has been an exception during this turmoil, gaining more than 5% since Monday. With the financial system under stress, investors are likely turning to the usual tech titans for their defensive strategies. Bitcoin has also been a big beneficiary from the slump in yields.

Triple witching and banking liquidity concerns

But US futures are fast losing steam, pointing to some caution on triple witching day. It is estimated that $2.7 trillion of options are due to expire today. The quarterly expiration of contracts for stock options, index futures and index options tend to spark some volatility whenever all three fall on the same day. If coincided with some new unwelcome headlines about the banking sector, there could be mayhem.

Despite some optimism returning to the markets, there are lingering worries about banks’ health as they have borrowed record amounts from the Fed this week. US banks have tapped into both the Fed’s lender-of-last resort facility as well as its Bank Term Lending Program launched in the aftermath of the SVB episode.

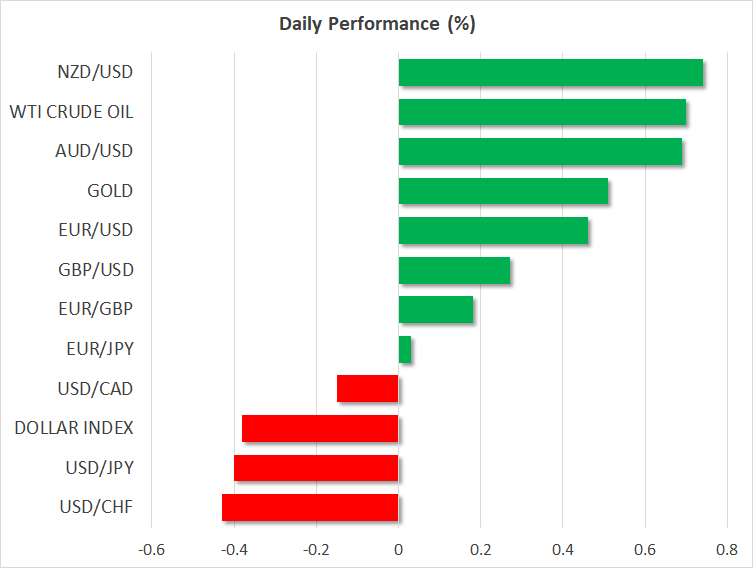

Dollar knocked by unwinding of Fed bets, euro not out of the woods

Subsequently, there is growing speculation that the Fed will repeat next week what the ECB has done this week – raise as expected, then pause. The expectations that the Fed is nearing the end of its tightening cycle have battered the US dollar, which has received only limited support from safe-haven flows.

Both the euro and Swiss franc have recovered somewhat from the Credit Suisse-induced panic. Credit Suisse is under pressure to merge with rival UBS, but both banks are reluctant to go down that path, so the saga is far from over.

Hence, traditional safe-havens like gold remain elevated, with the precious metal advancing today despite the risk-on mood.