eBay Inc. (NASDAQ:EBAY) is a well-established player in the e-commerce space and also has a first-mover advantage. To maintain its dominance, eBay has introduced several measures to fuel growth in its Marketplaces business.

eBay has been giving more data to its marketplace sellers. These data include price guidance, restocking guidance and more insight into inventory such as demand signals for the right products, price and timing. Additionally, eBay continues to increase user engagement and satisfaction by driving traffic to its top-rated sellers. As a result, same-store sales at these retailers continue to grow at a healthy rate. The company expanded the use of social channels, which is significantly increasing traffic growth.

Also, Raymond James’ analyst Aaron Kessler remains encouraged by the company’s growth in its marketplace business. He believes that platform changes, product innovation and promoted listings will help in driving the Marketplace business in 2018. Consequently, the analyst has upgraded its rating based on the company’s growth in its marketplace business.

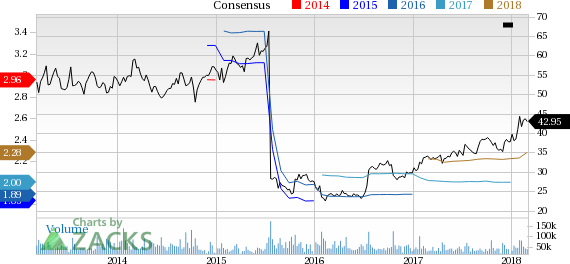

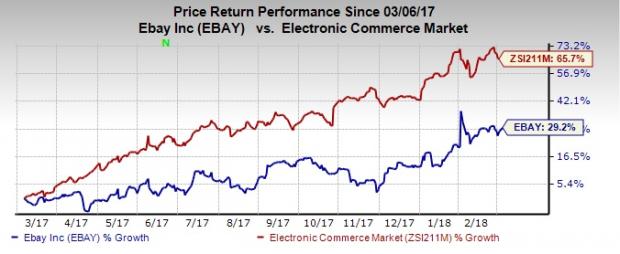

Following the upgrade, eBay’s shares were up 1.61% to $42.95. In a year’s time, the stock has gained 29.2% underperforming its industry’s growth of 65.7%.

He believes that gross merchandise volume (GMV) growth will continue to accelerate this year driven by enhancements to the buyer experience. In the recently reported fourth quarter, Marketplace GMV grew 9% year over year on a reported basis and 6% on an FX-Neutral basis.Total GMV of $24.4 million grew 10% from the prior-year quarter on a reported and 7% on a Fx-neutral basis.

The analyst believes that the company's Promoted Listings product will be accretive to earnings in 2018. In the last reported quarter, nearly 160,000 sellers used promoted listings to advertise more than 100 million items. That accounted for 50% of sequential revenue growth in the fourth quarter.

Bottom Line

eBay is one of the world's largest online trading communities with a powerful marketplace for sale of goods and services by individuals and small businesses. The company enables trade on a local, national and international basis with local sites in numerous markets in the United States and country-specific sites in the United Kingdom, Canada, Germany, Austria, France, Italy, Japan, Korea and Australia.

The company is making all efforts to improve its Marketplace business. It is currently re-platforming itself by building product catalogs on structured data, enhancing mobile platform, rolling out new browse-inspired shopping journeys and strengthening its brand. Last year, eBay partnered with Facebook (NASDAQ:FB) to boost its Marketplace business.

Also, the company accelerated its partnership deals to enhance its Marketplace. eBay partnered with Spring to offer a wide range of apparel and accessories through ebay.com. The company is anticipated to benefit from added selection of luxury brands. Moreover, the company is offering daily deals on Facebook’s Mobile Marketplace and getting access to the latter’s huge user base in return.

However, intensifying competition in the e-Commerce space as well as foreign exchange headwinds remain major concerns for the stock.

Zacks Rank and Stocks to Consider

eBay has a Zacks Rank #3 (Hold). A few better-ranked stocks in the technology sector are PetMed Express (NASDAQ:PETS) , Teradyne (NYSE:TER) and Brady Corporation (NYSE:BRC) . While PetMed and Teradyne sport a Zacks Rank #1 (Strong Buy), Brady Corporation carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for PetMed, Teradyne and Brady Corporation is projected to be 10%, 12% and 7.5%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Teradyne, Inc. (TER): Free Stock Analysis Report

Original post

Zacks Investment Research